Posts by Michelle McGrath

Advocacy Update: In Support of Harvest Dates

The American Cider Association (ACA) recently sent a letter to the TTB voicing the ACA’s support of a specific proposed labeling rule included in Notice 176, published in late 2018.

NOTICE 176

The notice contained proposed rules for modernizing wine (including cider), spirits and malt beverages labeling and advertising regulations. The ACA, many regional cider guilds and dozens of our members submitted comments on the notice during the official comment period. The comments included support for many but not all of the proposed rules.

Some positive change has resulted from those comments. We are hopeful our letter will usher further TTB announcements in favor of our official comments first made in 2019. This letter is our third mention of our support of harvest dates since our official comments posted.

OUR LETTER

The ACA’s recent letter to the TTB reiterated our support for the Notice 176 proposal to allow the use of harvest dates on qualifying wines and ciders. Harvest dates would create an important opportunity to distinguish a maker’s cider from season to season. Read our letter for further details of the proposal and our reasons for supporting it.

THE VOICE OF THE INDUSTRY

Our members’ support allows the ACA to amplify the voice of cider and to develop relationships with the TTB and others for the benefit of our industry. Through the collective power of our members, we have a stronger voice for cider when it matters. Our recent letter in support of harvest dates is one example of our commitment to advancing the needs of all cider producers, big or small.

We are grateful for the TTB for seeking the input of industry members regarding the proposed rules in Notice 176, and we eagerly await further announcements regarding the creation of harvest dates.

Exploring Geographic Indicators for Cider

Dear ACA Members,

For the last year and a half, the American Cider Association has been working closely with our partners at the New York Cider Association and key stakeholders in the wine industry and government to explore how harvest-driven ciders over 7% ABV might benefit from a system of geographic indicators. We all know the impact of place and time on a cider can be profound, yet because of the legal structure of American Viticultural Area (AVAs), certain appellations are prohibited on ciders requiring a certificate of label approval from the TTB.

State and county appellations are available to qualifying ciders but place names that may or may not overlap with an AVA are usually a ticket for a COLA rejection.

This is understandably frustrating to cideries whose ciders are influenced by the climate, soil and topography of their geographic location.

Our approach to exploring appellation in cider is to be thorough and cautious. The language outlining the legal structure for AVA is complicated and adopting the same structure for cider would have profound, and in my opinion, potentially negative effects on the cider industry. So the solution will need to be specific to cider, as cider deserves.

ACA and NYCA are working on this project together because our members’ voices on the need for a geographic indicator beyond county and place are crystal clear. It’s important to know this work is very complex. This is a long term project requiring legal experts, financial resources and perhaps Congressional action. It also requires the continued input of members like you.

We want to hear from you. We’ve put together this brief survey to begin learning more about your needs on indicating the geography of your cider as part of Phase 1 of this project. ACA is giving away a free hoodie to two lucky survey takers! We know this time of year is busy for you so we will keep the survey running through this calendar year. If you are interested in being more involved in this work, you can let us know in the survey. We look forward to hearing from you.

Sincerely,

Michelle McGrath

Executive Director

American Cider Association

P.S. I know that wine and cider labeling regulations are confusing. Geographic indicators complicate things even more. I’m excited to share that the ACA is rolling out a member resource library later this month. The library will house compliance information for our members among many other tools and resources. We will add new tools to it every quarter. Stay tuned for the official launch!

Quarter 2: A Year After The Great Stockpile

Included in your benefits as an active member of the American Cider Association are quarterly market trend reports that break cider out into regions, packaging type, flavor, draft and more. Today we are releasing the Quarter 2 data provided through our partnership with Nielsen. Year over year comparisons for the second quarter of 2021 are not very helpful for most CPGs, because what were consumers doing in April, May and June of 2020? Stockpiling goods. Cider was no exception—according to Nielsen, retail sales of the total cider category were up 13.8% for Q2 of 2020 and regional cider brands were up a shocking 40%. So what can we say about Q2 of 2021 with the knowledge that Q2 2020 deserves an asterisk?

In Nielsen-measured retail channels:

- Regional brands of cider became the majority of cider’s market share in Q4 of 2020. That pattern persists in Q2 of 2021. These brands were only 25% of the market as recently as 2017.

- Regional cider brands are up 34.5% compared to Q2 of 2019. They are down slightly at -3.5% when compared to Q2 of 2020 which actually highlights what cider is best at: share preservation.

- Comparing YOY, regional cider brands are still positive for the trailing 52 weeks and will likely enjoy traditional Q3 seasonal growth.

- 6 packs of cans are the packaging type of choice for the moment.

- Flavors that are up for regional brands when compared to Q2 2019 include apple, pineapple, cherry, berry and sours, but the “other” flavor category is up 42% when compared to Q2 2019.

The data included in the Q2 packet compares to 2020. Keep that in mind when drawing your own conclusions. My conclusion is that cider is sustaining a big portion of the growth it saw in 2020 to preserve its share of the market. With regional cider brands comprising the majority of cider’s market share, we may start to see overall share growth in the context of the beverage alcohol segment.

Retailers who are taking cider off the shelf right now are missing a huge opportunity. Fall cider sets are a big winner—”From summer to fall of 2020, cider’s share of the beer category grew from 4.3 percent to 5.2 percent” (Drizly). I wonder what the increase is for regional cider? Probably much greater.

There is a lot of discussion of “nostalgic” flavors at the moment. This may be a chance for cider to push apple-driven products as we see brands like Seattle Cider and Bold Rock doing.

As far as the return of on-premise? When on-premise came back on board last spring, all “beer” segments experienced growth. We learned from our webinar last month that cider had the greatest YOY growth of all the “beer” sub-segments (*Q2 volume share Nielsen 12w 2021). National cider brands lead the growth, with a 751% increase for drafts sales for Q2 YOY. Apple-driven ciders experienced the most growth of all the flavor segments.

Cider won’t quit.

For more information on regional, packaging and flavor trends, get the Q2 data package included in your membership.

BONUS: For a fun analysis of GLINTCAP winners in the fruit cider category, check out this blog from Old Orchard.

ACA Comments on Competition

The Department of the Treasury issued a “Request for Information (RFI) to solicit input regarding the current market structure and conditions of competition in the American markets for …[alcohol producers], including an assessment of any threats to competition and barriers to new entrants.” This RFI was in response to an Executive Order (EO) by President Biden issued on July 9, 2021. The EO focuses broadly on consolidation, but a specific section on beverage alcohol was included in the EO. That section addressed patterns of consolidation and unnecessary trade practice regulations in “wine, beer and spirits markets…that impede market access for smaller and independent brewers, winemakers, and distilleries.” On August 18, 2021, the ACA submitted comments addressing a range of challenges our member cideries face in these areas including wholesaler consolidation, tied-house laws, packaging supply, standards of fill, carbonation taxes, geographic indicators, harvest dates and more. You can read our public comment letter here.

The American Cider Association voices the policy and regulatory needs of cideries in Washington D.C. One of our principal strategic goals is that common sense policies and regulations at the national level support the continued growth and sustainability of the US cider industry. As a big tent organization, we work hard to ensure that all of our members benefit from our advocacy. We are excited to see small producers especially highlighted by the EO. We celebrate this opportunity to address competition and trade practices in the beverage alcohol market and we thank our members for supporting this effort.

You can read all the submitted comments on the EO on the TTB’s comment docket.

For questions or comments, please contact our executive director, Michelle McGrath, at Michelle@ciderassociation.org. To support the ACA’s advocacy work, consider joining as a member today.

CCP Level 1 Test Prep Is Going On Demand!

SPONSORS: Thank you to our 2021 CCP presenting sponsor, Petainer, and to our summer training sponsor, Arryved!

We are thrilled to announce that our introductory level Certified Cider Professional program is growing! Starting June 1, we’re launching a new Level 1 certification bundle.

Pricing

The Level 1 bundle is $99 for non-ACA members, $75 for members. The bundle includes:

- Detailed, updated study guide

- On-demand online training webinar (1.5 hours)

- Level 1 exam (2 attempts)

Presale

Between now and June 1st we are offering a 10% off pre-sale price. This special intro price is just $89 for ACA Non-Members and $68 for Members.

Test & Test Prep

The training and exam cover cider-specific facts in these key areas: (1) Apples, the orchard & history (2) Cider making (3) Evaluation (4) Families & Flavor (5) Keeping & serving (6) Food & cider. The closed-book exam has 60 multiple choice questions. The training materials include an updated, detailed study guide and a 1.5 hour webinar. Careful review of the study guide and webinar should prepare you to pass the exam!

Who Should Become a CCP?

First and foremost, if you sell cider, this program is for you. If you write about alcohol or food, this program is for you. If you just really love drinking cider, this program is for you. Maybe you run a beer-focused bottle shop with a cider section and want to learn more about cider? Maybe you hope to prove to your community’s cider drinkers that your shop knows its fermented apples? Maybe you are a sommelier or beverage director and want to be able to chat more about cider with customers? Maybe you are a distributor that wants to better understand the diversity and range of the cider category?

We target the front line of cider sales as our primary audience for CCP, but anybody is welcome to take the test. There is no pre-requisite for the Level 1 exam.

Meet Our New Team Member

We are also excited to announce that Jennie Dorsey has joined ACA as our parttime Cider Education Outreach Manager. Tuesday was her first day, but if you have questions about CCP, please do connect with Jennie!

Join the Education Committee

ACA is actively recruiting applicants interested in joining our volunteer committees, including our Education committee. This committee identifies target audiences for ACA’s cider education programs such as CCP, reviews & helps create ACA educational content, brainstorms strategic new educational programming, steers development of the third level of CCP. Applications are due May 26. Learn more about serving and how to apply here.

Visit our website today to reserve your Level 1 CCP Presale bundle!

Email Your Rep About Supporting the Fairness for Craft Beverages Act

Craft beverage producers who rely on direct to consumer sales were some of the hardest economically hit businesses in the Covid-19 pandemic. The year-end Covid-relief package allowed certain businesses (under NAICS code 72) to apply for 3.5 times their average monthly payroll on second draw PPP loans, but many cideries with prominent tasting rooms were excluded from the expanded relief. The Fairness for Craft Beverage Producers Act will ensure that cideries, wineries, meaderies, distilleries and breweries can receive the expanded funding. This would include businesses that fall under NAICS 3121 series and derive at least 35% of gross annual revenue during either calendar year 2019 or 2020 from in-person sales of products.

The American Cider Association is dedicated to advocating for the fair treatment of America’s cider industry. Will you join us in reaching out to your member of Congress about supporting this bill?

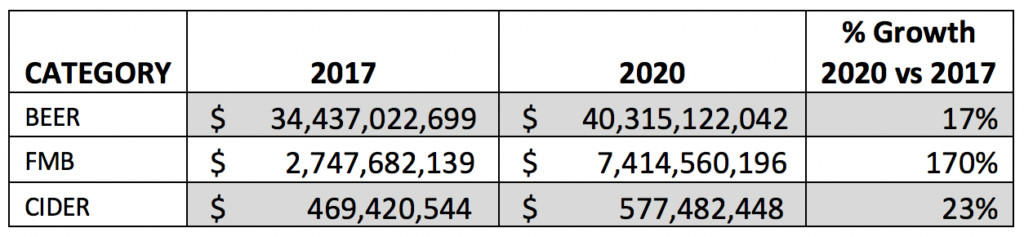

CIDER’S RESILIENCE STOOD TRUE THROUGH 2020

At the end of 2019, I argued that cider’s resilience through the “Summer of Hard Seltzer” was the real headline. I could not have possibly known that cider’s resilience through 2020 would swamp that achievement. 2020 challenged and changed alcohol beverage sales in the US with a rapid pace, and the cider industry was absolutely not immune. It goes without saying many of the forced changes were negative. On premise sales took a massive hit (-51.5% in Nielsen-measure on premise channels). It’s hard to argue that widespread closures of tasting rooms and restaurant accounts, ubiquitous employee layoffs, and anecdotal reduced supply purchases from local orchards were positive changes for the industry as a whole. However, it is true that some cider companies benefited from the market’s increased focus on retail due to the structure of their business models. It is meaningful to all cidermakers that in 2020 the cider category grew more than beer in the Nielsen-measured retail channels. What were some of the other positive outcomes?

We saw online sales for cider dramatically increase—for some producers, their 2020 online sales were as much as three times their 2019 sales. We know that local cidery customers rose to the challenge to order cider for curbside pickup and delivery, turning the previous conclusion that cider consumers are “explorers” with less brand loyalty on its head at the local level. Many of these changes required legislative emergency actions at the state level. Although there is a real fear that there will be push back against these changes long term, it is going to be hard to move the policies back to pre-Covid times. Convenience is King.

We also saw the category embrace rapid innovation and quickly adapt to new market conditions. This nimbleness allowed cider to hold onto its shares of the market. This happened despite growing perceived competition from flavored malt beverages and with completely different market conditions than what we saw in 2019.

As part of your American Cider Association membership benefits, we provide complimentary quarterly market trend reports which we commission Nielsen to produce. We look at the Quarter 4 reports to get an idea of how cider performed in chain retails and restaurants across the country for 2020. The reports break down trends by region, packaging and flavor.

Here are some of the major takeaways from cider’s off-premise performance in Nielsen-measured channels for Q4 of 2020:

- For the first time ever, sales of national cider brands (defined as those owned by larger beverage corporations) ceded their majority hold of the category’s shares. Regional brands accounted for 27% of cider’s dollar share in Q4 of 2017 and 51% of cider’s dollar share in 2020.

- Regional cider brands grew 33% in Quarter 4 of 2020 to help achieve this.

- Not surprisingly, canned cider sales grew 19%, with 6-packs, 4-packs, and single cans contributing the most to that growth.

- The top three performing cider-regions from a total-cider perspective were the Northwest ($ +27%), the East ($ +12%) and the Midwest ($ +8%).

- Regional cider dollars increased YOY for the quarter in all regions.

What about 2020 as a whole? Here are some key points for cider’s off premise performance in Nielsen-measured channels for all of 2020:

- Off premise cider grew at +9.4% for the total category in 2020.

- Regional brands grew 33.4% in off premise channels in 2020.

- Cider, as reported by Nielsen, maintains its dollar share percentage as 1.2%. The category has hovered near this number for the last several years. To preserve those shares, cider has had to grow at a rate that keeps up with changes in the market, including the rise in flavored malt beverage sales.

The conclusion I draw from the data we’re gathering through our partnership with Nielsen is (1) Cider is still growing and (2) In 2021, we may see cider’s dollar share of the off premise beer market exceed 1.2%. This is in part a response to regional brands dominating the cider category for the first time and their long, unwavering history of double-digit growth.

Dive into flavor trends and more with the Members-Only Q4 Nielsen report here.

Download the Q4 Cider Trends Report

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

2021 ACA Board Election Results

The American Cider Association announced the results of its 2021 Board of Director Elections live from CiderCon 2021 today. The ACA membership elected Brooke Glover, Soham Bhatt and Ryan Burk. Burk and Glover are board veterans and Bhatt is excited to be serving on the board for the first time.

The Board also selected its 2021 officers. They are:

Outgoing President Paul Vander Heide will remain on the board and looks forward to working closely with the new officers.

Sam Fitz of ANXO Cider in Washington DC, board member as a Cidery-At-Large, did not run for re-election in 2021. Sam has been a very engaged and contributive board member and looks forward to staying engaged with the association as a member in the next year.

Eleanor Leger shares her excitement to be serving as the 2021 Board Presdient:

I am honored to be newly elected as Board President of the American Cider Association. We have a fantastic new strategic plan with initiatives to strengthen understanding and support in the trade, make innovation and compliance easier, to support cider makers of all sizes and models, and to specifically reach out to Black, Indigenous and People of Color to let them know we welcome them as makers, customers, influencers, trade buyers and suppliers. As we go forward, I pledge to you that as Board President, my email door is always open, that I will work with my fellow Board members and Michelle to strengthen our organization and the value it delivers to you, our members, and that we will do our work in a way that brings us together in our common goal to build a great industry for everyone. – Eleanor Leger, 2021 ACA Board President

For media inquiry about these election results, please contact Michelle McGrath: michelle [at] ciderassociation [dot] org.

CiderCon® 2021 Trade Show Word Hunt Game!

Our virtual trade show is 🔥! And to make it sizzle a little bit more, we’ve created a fun word hunt game and a chance for YOU to win awesome prizes.

How to Play: Visit the trade show during the LIVE scheduled hours and ask the vendor for their magic word. Collect the words to complete a phrase. Think you have the phrase solved? Submit your guesses here. Make sure you have collected the magic words from at least these booths before you submit your answer: FruitSmart, Ekos, Fermentis, Fintech, Voran, Juicing Systems, CINA and Cider Culture. All booths have a word—visit them all for our best chance at winning.

The phrase is 4 sentences long, comprised of 44 words. There is a bonus prize for the first person to submit the right answer: a CiderCon hoodie! All correct guesses will be entered into a raffle for 4 nights hotel and 1 conference registration for CiderCon 2022 in Richmond, Virginia.

Submit your words and make your guess here! Game closes at 10:45 AT PST on Friday. Winners are announced during the grand toast. GOOD LUCK!

Hint: Apple Mythology