Labels

Exploring Geographic Indicators for Cider

Dear ACA Members,

For the last year and a half, the American Cider Association has been working closely with our partners at the New York Cider Association and key stakeholders in the wine industry and government to explore how harvest-driven ciders over 7% ABV might benefit from a system of geographic indicators. We all know the impact of place and time on a cider can be profound, yet because of the legal structure of American Viticultural Area (AVAs), certain appellations are prohibited on ciders requiring a certificate of label approval from the TTB.

State and county appellations are available to qualifying ciders but place names that may or may not overlap with an AVA are usually a ticket for a COLA rejection.

This is understandably frustrating to cideries whose ciders are influenced by the climate, soil and topography of their geographic location.

Our approach to exploring appellation in cider is to be thorough and cautious. The language outlining the legal structure for AVA is complicated and adopting the same structure for cider would have profound, and in my opinion, potentially negative effects on the cider industry. So the solution will need to be specific to cider, as cider deserves.

ACA and NYCA are working on this project together because our members’ voices on the need for a geographic indicator beyond county and place are crystal clear. It’s important to know this work is very complex. This is a long term project requiring legal experts, financial resources and perhaps Congressional action. It also requires the continued input of members like you.

We want to hear from you. We’ve put together this brief survey to begin learning more about your needs on indicating the geography of your cider as part of Phase 1 of this project. ACA is giving away a free hoodie to two lucky survey takers! We know this time of year is busy for you so we will keep the survey running through this calendar year. If you are interested in being more involved in this work, you can let us know in the survey. We look forward to hearing from you.

Sincerely,

Michelle McGrath

Executive Director

American Cider Association

P.S. I know that wine and cider labeling regulations are confusing. Geographic indicators complicate things even more. I’m excited to share that the ACA is rolling out a member resource library later this month. The library will house compliance information for our members among many other tools and resources. We will add new tools to it every quarter. Stay tuned for the official launch!

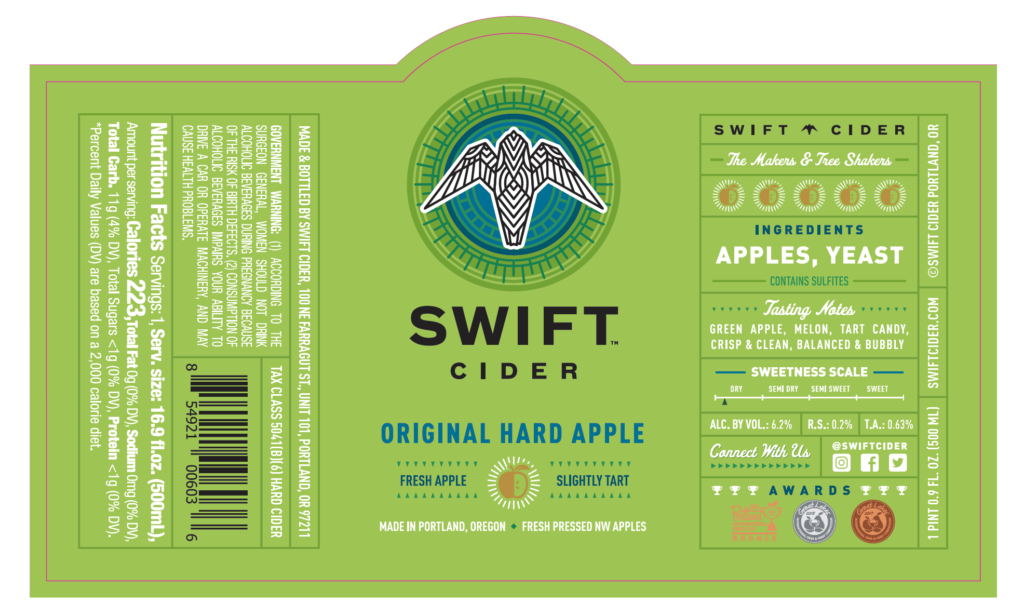

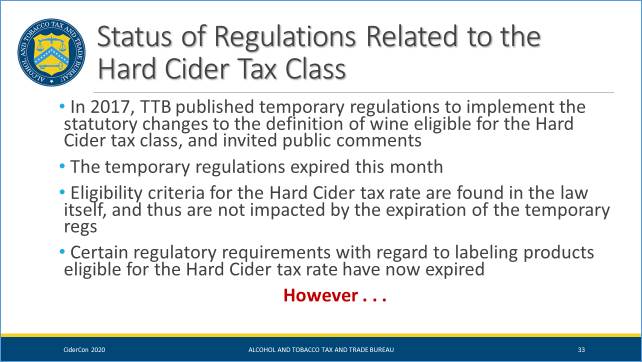

Tax Class Code Update

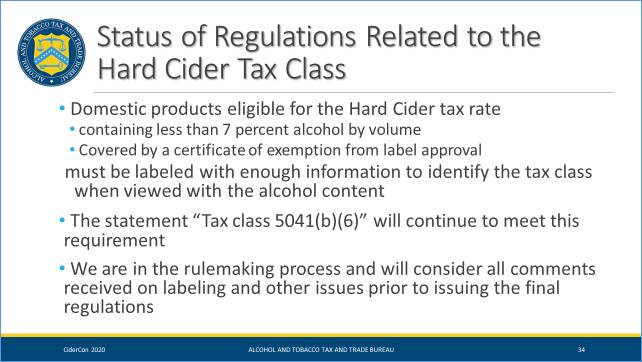

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears. Until very recently, the TTB was requiring a tax class code on all products eligible for the hard cider tax rate. These requirements were part of temporary rules that were put in place in reaction to the expansion of the product types eligible for the reduced rate. They mandated that the code “Tax class 5041(b)(6)” be on the packaging of hard cider tax rate product. These rules have now expired–the reduced tax rate remains.

For now, the TTB is not mandating the use of the statement “Tax class 5041(b)(6).” Nevertheless, the regulations do say that all wines (including cider and fruit cider, all ABVs) must be labeled with enough information for TTB to identify the correct tax class.

“Using ‘Tax class 5041(b)(6)’ will meet that requirement, so no one has to change their label unless they choose to,” said Susan Evans, TTB Director, Office of Industry and State Outreach in an email to the Association.

In the absence of the statement of the Tax class 5041(b)(6), the label must provide enough information for the TTB to know that the product is under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contains no other fruit than apples or pears.

We anticipate that the code requirement will return when the permanent rules are released, and will keep our members informed of such news.

Is your label compliant?

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears.

As of January 1, 2019, the TTB is requiring all cider (not just cider >7% ABV) that qualifies for the cider tax rate to be labeled with this statement: Tax class 5041(b)(6). The requirement starts when the product is removed from bonded premises. If your product was labeled and removed from bonded premises before the start of this year, it is not required to have the tax class statement.

If your cider was labeled in 2018 but wasn’t removed from bonded premises until 2019, the cider tax class statement must be present on the label. The TTB will allow a sticker with the statement to be applied to the label to be in compliance. Read more in TTB’s Industry Circular 2017-2.