TTB

BREAKING! TTB Publishes Ruling Approving New Volumes for Cider, Wine & Mead

Rule Making is Giant Victory for ACA in Fight More Parity for Cider Category

Portland, OR — The ACA is excited to share that the TTB announced today the addition of 13 new standards of fill for wine (including cider and mead), among them 473 ml (16 oz) and 569 ml (19.2 oz). The rule is set to be published in the Federal Register on January 10 and will be effective at that time. The American Cider Association is claiming the new standards as a major victory for the cider category and the Association, as pushing for more parity with beer and wine have been priorities in the Association’s strategic efforts to lift the cider category.

The newly approved standards now available to cider, wine & mead are:

- 473 ml (16 oz)

- 569 ml (19.2 oz)

- 180 ml

- 300 ml

- 330 ml

- 360 ml

- 550 ml

- 600 ml

- 620 ml

- 700 ml

- 720 ml

- 1.8 liter

- 2.25 liter

What This Means for Cider

The TTB regulates approved packaging volumes for wine, cider, mead and spirits. This authority was granted in the Federal Alcohol Administration (FAA) Act in 1935 at the time prohibition was repealed. As cider and mead are both subclasses of wine, the standards of fill for cider are contained in the TTB regulations covering labeling and advertising for wine (27 CFR part 4).

Previously, 16 oz and 19.2 oz can sizes were only an option for cider, wine, and mead under 7% ABV. Higher ABV cider (and wine and mead) could be labeled and distributed for in-state sales only if combined with a TTB-approved certificate of label (COLA) exemption. That was a challenging and limited solution for the cider industry.

“The COLA-exemption route was a band-aid. It proved that there is demand for higher ABV cider in these packaging volumes, but it wasn’t opening the market in a meaningful way. These new packaging volumes will be a game changer for regional cider in 2025,” said Jeff Parrish, Co-owner of Portland Cider Company and Committee Chair of ACA’s Government Affairs Committee.

An Opportunity for the US Cider Industry

Large format cans in convenience channels have been a critical source of growth for craft beverages since the COVID pandemic. Likewise, “imperial” ciders (cider over 6.9% ABV) have been a source of growth for cider in chain retailers, but imperial ciders in 16 oz and 19.2 oz cans were illegal.

“Now we will see single-serve regional cider succeeding in more convenience-oriented craft beverage spaces. That’s a big win for cider,” said ACA’s former longtime CEO Michelle McGrath who led the industry-wide efforts to lobby for the additional standards of fill until the end of December.

ACA board member Shannon Edgar of Stormalong Cider is excited about what the changes mean for a cidery like his. “We take a ‘hands off’ approach letting the cider ferment with less intervention. Some of these apples naturally ferment to ABV’s over 7% due to the higher sugar content. It’s great to be able to package these ciders in their natural state, in our container of choice that our customers are accustomed to,” Edgar said.

“Packaging is no panacea, but I’ve seen switching formats be a winning move for both larger regional cideries and smaller local cideries. Partnerships can help ease the cost of transition,” said McGrath.

A Track Record of Success for the ACA

The ACA first successfully lobbied for the addition of 355 ml (12 oz) cans for cider, wine, and mead in 2020. The change allowed regional cider to take advantage of ABV and packaging trends, and it made it easier for orchard-based cideries to incorporate cans, too. The adoption of 12 oz. packaging increased sales for the cider category. In 2024, regional cider was one of the only beverage alcohol categories to grow in both sales and volume. The ACA began pushing for 473 ml (16 oz) and 569 ml (19.2 oz) volumes to be added to approved wine standards of fill in 2022. Since the ACA’s original petition, they have continued to organize grassroots outreach and to lobby the TTB to adopt the changes. The TTB’s announcement today proves that the ACA and its members can collaborate to successfully pursue parity with other beverage categories.

###

To request an interview, please email ACA’s Board President, Christine Walter: christine@baumanscider.com.

The ACA is a 501(C)6 not-for-profit organization who is working to build and protect a sustainable and diverse cider industry in the United States through targeted education, advocacy, and a welcoming, thriving cider community.

TTB Reopening Comment Period on Proposed Standards of Fill

The TTB has opened a comment period on proposed additions to the standards of fill (Notice 210A) — including additions to the approved packaging sizes for wine, cider and mead over 6.9% ABV. The comment period will close on Oct 9, 2024 and the ACA is encouraging cideries and cider enthusiasts to submit comments in support of 16 oz (475 mL) and 19.2 oz (570 mL) packaging volumes for cider, mead and wine over 6.9% ABV. Comments can be submitted through the TTB’s website: SUBMIT COMMENTS HERE.

The ACA supports these additional standards of fill for cider because:

- Not having these common beverage alcohol packaging sizes cuts cider out of innovation opportunities driven by consumer demand.

- Lack of these packaging volumes puts cider at a disadvantage compared to beer and beyond-beer products taxed like beer, such as flavored-malt-beverages, who have access to these packaging volumes.

- Cider is an agricultural product made from apples. Apples will ferment to a higher ABV naturally depending on the weather that harvest season. Warmer temperatures equate to higher sugar levels resulting in higher alcohol levels. Making packaging decisions after fermentation is not a viable business model.

The American Cider Association is a staunch advocate for fair access to additional packaging sizes for cider, mead and wine over 6.9% ABV. In 2020, the TTB approved 355 ml (12 oz), 255 ml, and 200 ml packaging sizes in part as a response to ACA and ACA member petitions. In 2022, we petitioned for 16 oz (475 mL) and 19.2 oz cans (570 mL) for cider, mead and wine over 6.9% ABV and we have been advocating for their addition to permitted standards of fill ever since. In response to our inquiries, the TTB included 16 oz (475 mL) and 19.2 oz (570 mL) packaging volumes in their proposed rule. The summary of our comments can be found in Notice 210A.

Please join us in supporting the addition of 16 oz (475 mL) and 19.2 oz (570 mL) packaging volumes for cider, mead and wine. Be sure to submit your comments before October 9.

Advocacy Update: In Support of Harvest Dates

The American Cider Association (ACA) recently sent a letter to the TTB voicing the ACA’s support of a specific proposed labeling rule included in Notice 176, published in late 2018.

NOTICE 176

The notice contained proposed rules for modernizing wine (including cider), spirits and malt beverages labeling and advertising regulations. The ACA, many regional cider guilds and dozens of our members submitted comments on the notice during the official comment period. The comments included support for many but not all of the proposed rules.

Some positive change has resulted from those comments. We are hopeful our letter will usher further TTB announcements in favor of our official comments first made in 2019. This letter is our third mention of our support of harvest dates since our official comments posted.

OUR LETTER

The ACA’s recent letter to the TTB reiterated our support for the Notice 176 proposal to allow the use of harvest dates on qualifying wines and ciders. Harvest dates would create an important opportunity to distinguish a maker’s cider from season to season. Read our letter for further details of the proposal and our reasons for supporting it.

THE VOICE OF THE INDUSTRY

Our members’ support allows the ACA to amplify the voice of cider and to develop relationships with the TTB and others for the benefit of our industry. Through the collective power of our members, we have a stronger voice for cider when it matters. Our recent letter in support of harvest dates is one example of our commitment to advancing the needs of all cider producers, big or small.

We are grateful for the TTB for seeking the input of industry members regarding the proposed rules in Notice 176, and we eagerly await further announcements regarding the creation of harvest dates.

BREAKING NEWS: TTB Approves Additional Wine Standards of Fill

In a special edition newsletter sent to subscribers on December 28, 2020, the TTB announced new rules regarding standards of fill. The additional volumes approved for wine are:

- 355 ml (12 oz)

- 250 ml

- 200 ml

As all ciders are regulated as wine by the TTB, the above sizes are now being added as approved for cider. This means ciders above 7% will be able to be packaged in a 12 oz can or bottle for the first time. Previously, a state exemption was required to package ciders over 7% ABV in 355 ml packaging.

“These new container sizes will provide bottlers with flexibility by allowing the use of the added container sizes, and will facilitate the movement of goods in domestic and international commerce, while also providing consumers broader purchasing options,” the TTB writes in their newsletter.

The TTB newsletter included a final draft of the rule. The rule includes several mentions of submitted commentary from cidermakers and the American Cider Association (ACA) (formerly United States Association of Cider Makers).

An excerpt: “These producers note that, in the production of cider, apples often naturally ferment to an alcohol by volume (abv) level just above 7.4%, so producers often take steps to lower the abv below 7% so that the standards of fill regulations will not apply, enabling them to use 355 milliliter containers. They state that sugar levels in apples vary widely depending on climate and other factors, making final alcohol levels difficult to predict. They argue that being able to use the 355 milliliter container size will eliminate this uncertainty.”

“The ACA government affairs committee worked to make this happen,” said Michelle McGrath, executive director of ACA. “Additionally, so many of our members came together to provide comments. Our united voices made the difference.”

“ACA believes that this will help apple-focused cidermakers and others with packaging flexibility and compliance,” McGrath added.

The addition of 200 ml containers is also a win for US ice cider producers. “This will help our ice cider business, where 200ml has been a traditional ice wine bottle size outside the US for decades, and we have not had access to that format,” said ice cider producer and ACA board member, Eleanor Leger.

“There are many styles of cider, and packaging flexibility will allow us to deliver the right cider to the customer in the right package. We are excited that we can finally put ciders produced with heirloom and tannic varieties in a more accessible format for customers,” Leger added.

The American Cider Association is grateful to the TTB for providing a platform for industry and public comment. “We are very pleased that the TTB continues to work with industry to evaluate regulation and its relevance to current market conditions,” ACA board President Paul Vander Heide said. “Broadening standards of fill gives our members increased flexibility to serve their customers.”

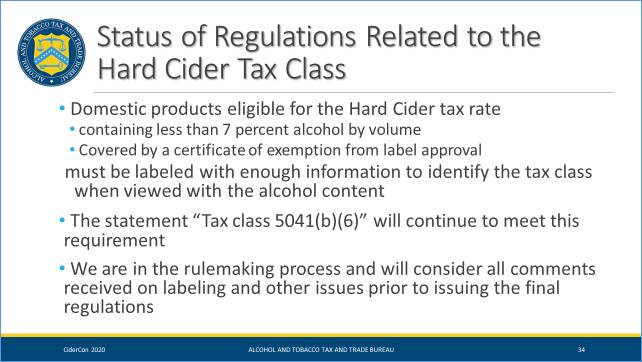

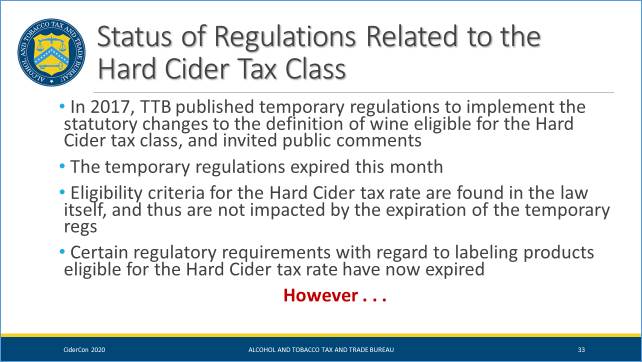

Tax Class Code Update

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears. Until very recently, the TTB was requiring a tax class code on all products eligible for the hard cider tax rate. These requirements were part of temporary rules that were put in place in reaction to the expansion of the product types eligible for the reduced rate. They mandated that the code “Tax class 5041(b)(6)” be on the packaging of hard cider tax rate product. These rules have now expired–the reduced tax rate remains.

For now, the TTB is not mandating the use of the statement “Tax class 5041(b)(6).” Nevertheless, the regulations do say that all wines (including cider and fruit cider, all ABVs) must be labeled with enough information for TTB to identify the correct tax class.

“Using ‘Tax class 5041(b)(6)’ will meet that requirement, so no one has to change their label unless they choose to,” said Susan Evans, TTB Director, Office of Industry and State Outreach in an email to the Association.

In the absence of the statement of the Tax class 5041(b)(6), the label must provide enough information for the TTB to know that the product is under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contains no other fruit than apples or pears.

We anticipate that the code requirement will return when the permanent rules are released, and will keep our members informed of such news.

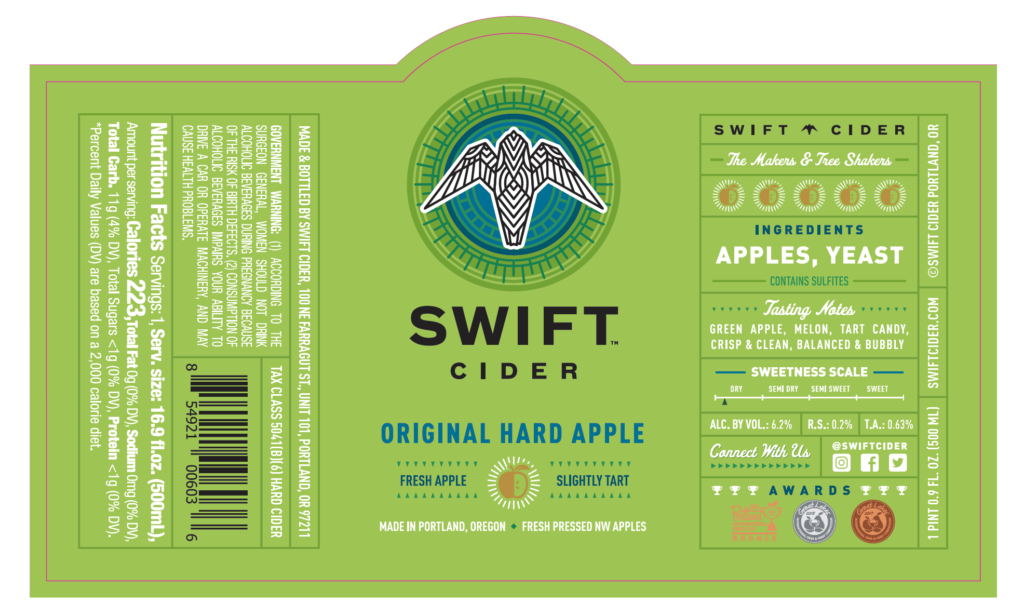

Is your label compliant?

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears.

As of January 1, 2019, the TTB is requiring all cider (not just cider >7% ABV) that qualifies for the cider tax rate to be labeled with this statement: Tax class 5041(b)(6). The requirement starts when the product is removed from bonded premises. If your product was labeled and removed from bonded premises before the start of this year, it is not required to have the tax class statement.

If your cider was labeled in 2018 but wasn’t removed from bonded premises until 2019, the cider tax class statement must be present on the label. The TTB will allow a sticker with the statement to be applied to the label to be in compliance. Read more in TTB’s Industry Circular 2017-2.