CIDER’S RESILIENCE STOOD TRUE THROUGH 2020

At the end of 2019, I argued that cider’s resilience through the “Summer of Hard Seltzer” was the real headline. I could not have possibly known that cider’s resilience through 2020 would swamp that achievement. 2020 challenged and changed alcohol beverage sales in the US with a rapid pace, and the cider industry was absolutely not immune. It goes without saying many of the forced changes were negative. On premise sales took a massive hit (-51.5% in Nielsen-measure on premise channels). It’s hard to argue that widespread closures of tasting rooms and restaurant accounts, ubiquitous employee layoffs, and anecdotal reduced supply purchases from local orchards were positive changes for the industry as a whole. However, it is true that some cider companies benefited from the market’s increased focus on retail due to the structure of their business models. It is meaningful to all cidermakers that in 2020 the cider category grew more than beer in the Nielsen-measured retail channels. What were some of the other positive outcomes?

We saw online sales for cider dramatically increase—for some producers, their 2020 online sales were as much as three times their 2019 sales. We know that local cidery customers rose to the challenge to order cider for curbside pickup and delivery, turning the previous conclusion that cider consumers are “explorers” with less brand loyalty on its head at the local level. Many of these changes required legislative emergency actions at the state level. Although there is a real fear that there will be push back against these changes long term, it is going to be hard to move the policies back to pre-Covid times. Convenience is King.

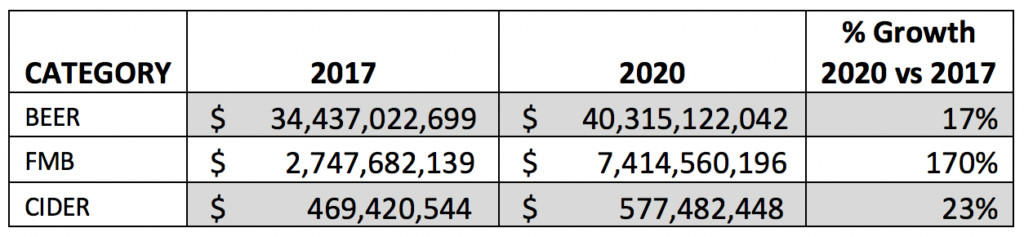

We also saw the category embrace rapid innovation and quickly adapt to new market conditions. This nimbleness allowed cider to hold onto its shares of the market. This happened despite growing perceived competition from flavored malt beverages and with completely different market conditions than what we saw in 2019.

As part of your American Cider Association membership benefits, we provide complimentary quarterly market trend reports which we commission Nielsen to produce. We look at the Quarter 4 reports to get an idea of how cider performed in chain retails and restaurants across the country for 2020. The reports break down trends by region, packaging and flavor.

Here are some of the major takeaways from cider’s off-premise performance in Nielsen-measured channels for Q4 of 2020:

- For the first time ever, sales of national cider brands (defined as those owned by larger beverage corporations) ceded their majority hold of the category’s shares. Regional brands accounted for 27% of cider’s dollar share in Q4 of 2017 and 51% of cider’s dollar share in 2020.

- Regional cider brands grew 33% in Quarter 4 of 2020 to help achieve this.

- Not surprisingly, canned cider sales grew 19%, with 6-packs, 4-packs, and single cans contributing the most to that growth.

- The top three performing cider-regions from a total-cider perspective were the Northwest ($ +27%), the East ($ +12%) and the Midwest ($ +8%).

- Regional cider dollars increased YOY for the quarter in all regions.

What about 2020 as a whole? Here are some key points for cider’s off premise performance in Nielsen-measured channels for all of 2020:

- Off premise cider grew at +9.4% for the total category in 2020.

- Regional brands grew 33.4% in off premise channels in 2020.

- Cider, as reported by Nielsen, maintains its dollar share percentage as 1.2%. The category has hovered near this number for the last several years. To preserve those shares, cider has had to grow at a rate that keeps up with changes in the market, including the rise in flavored malt beverage sales.

The conclusion I draw from the data we’re gathering through our partnership with Nielsen is (1) Cider is still growing and (2) In 2021, we may see cider’s dollar share of the off premise beer market exceed 1.2%. This is in part a response to regional brands dominating the cider category for the first time and their long, unwavering history of double-digit growth.

Dive into flavor trends and more with the Members-Only Q4 Nielsen report here.