Trends

Sightlines: Cross-Category Insights You Can Use June 2025

Each month, consumer insights platform Sightlines will share one quick hit you can use to make confident decisions. Remember, ACA members get 50% off a Sightlines subscription. Find the discount code in the Resource Hub.

Going Fizz-Free is Gaining New Audiences—and Cider Can Meet the Need

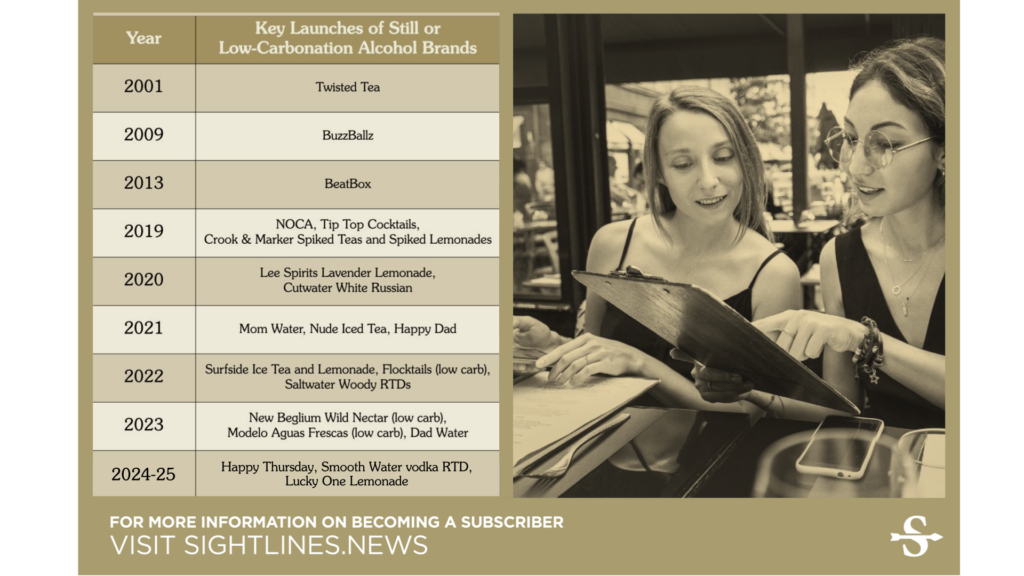

When drinkers reach for a packaged beverage, it’s most likely carbonated, with at least half of Americans drinking a carbonated soft drink daily. But that’s been changing, and in recent years, a growing number of beverage alcohol brands have explicitly asserted themselves as fizz-free alternatives: Brands like MolsonCoors’ Happy Thursday Spiked Refresher and Surfside Surfside Iced Tea + Vodka have made their lack of bubbles a core selling point, while NOCA Beverages (short for “no carbonation”) has made it an entire brand ethos. And one of the country’s largest RTD brands—Twisted Tea—has long won with drinkers who feel that a lack of bubbles allows them to enjoy multiple servings more easily. Carbonation can lead to feelings of bloating and fullness for some drinkers, and new, fizz-free brands help those people enjoy the pace and freedom of a lighter beverage.

Still cider is nothing new, but it’s traditionally put into a higher-end wine context and struggles to gain traction in more casual settings. But among young consumers reaching for canned cocktails and malt beverages, there’s rising interest in non-carbonated drinks, showing how different categories are working against different expectations. Beverages with lower or no carbonation also often have the advantage of not needing as much flavor to meet consumer desires (carbonation can sometimes dissipate flavor impact) and opens up serving opportunities, such as pouring over ice.

As you consider the positioning of your product—whether a traditional cider, modern craft, a flavor-driven RTD brand, or non-alc alternative to beer or wine, etc.—how you think about carbonation could be as important as “dry” or “gluten-free” or apple varietal for the consumer you’re seeking—perhaps even more so.

New On Premise Data for ACA Members!

Nationally Cider is up 3.3% in On Premise channels for the 52 week period ending April 23, 2023.

That’s right! On Premise data is back! We have renewed our partnership with CGA by NIQ OPM to bring our members helpful insights about On Premise cider trends. Drill down by Chain or Independent establishments, by 6 major urban markets, by national/regional brands, and by draft/package. Compare current trends to data from the last couple years to see growth and opportunities.

You must be an active ACA member to view this data. Not a member? Join now! Need to renew your membership. Renew here!

Nielsen 2021 Data Insights Webinar

Nielsen 2021 Data Insights Webinar – April 27, 2022 at 11:00am Pacific

Join the ACA and Nielsen for a review of 2021 Off-Premise cider trends with Nielsen. Nielsen VP Jon Berg will share sales trends by packaging, flavor, style and region. We will also look at the insights provided by our newest report with Nielsen, a comparative consumer panel study. We’ll identify cider’s strengths and areas for growth regarding consumer demographics, and we’ll compare it to wine, beer, FMBs and cocktails.

About the Speaker

You must be an active ACA member to attend this webinar. You can join or renew your membership here.

Harvest Driven Cider Segment Survey Report Webinar

Join us March 1, 2022 at 12:00pm Pacific for analyses of the harvest driven cider segment of the cider industry. Harvest driven cider makers are defined as those for whom 75% of their annual cider production is are pressed once per year at or close to the date of harvest and are aged for a minimum of three months prior to packaging. Because this segment of the cider industry is often smaller producers who don’t sell in markets captured by Nielsen data or retail data scanner providers like IRI, the American Cider Association decided to launch an annual harvest driven cider survey. This inaugural survey was undertaken by Michael Uhrich of Seventh Point Analytic Consulting. He has taken a deep dive into the data to suss out the current status of the harvest driven cider segment and will present these results with us in this webinar.

This webinar is for ACA members only. You can log in, join, or renew your membership here.

Registration closes February 28, 2022 at 1:00pm Pacific. Information to join via Zoom will be sent after registration closes on February 28, 2022.

Webinar: BeerBoard’s Hard Cider Trends

BeerBoard’s Hard Cider Trends Webinar February 22, 2022

Join Dillon Card and Jim Randall from BeerBoard for the newest on-premise insights for cider with national and regional breakdowns, including competitive style and product performance data. This webinar will take place Tuesday, February 22, 2022 at 12:00pm Pacific on Zoom. Zoom link will be provided the day before the webinar.

This webinar is for active ACA members only. Join now or renew your membership!

Q3 Trends Available for Download

Q3 reports are available for download as part of your ACA membership benefits. Regional cider brand sales were up 11% for year over year comparisons of Nielsen-measured off-premise channels for the 52-week period ending with Q3. Total cider category sales for the 52-week period ending with Q3 were up 2% compared to 2019 and down 4% when compared to 2020 for Nielsen-measured off-premise channels. In on-premise channels, cider’s rebound for the 12-week period of Q3 compared to the same period for 2020 exceeded beer’s rebound for both draft and packaged sales. For more details on how the category is performing including regional and packaging analysis, download our members-only Nielsen reports after logging into our website.

Quarter 2: A Year After The Great Stockpile

Included in your benefits as an active member of the American Cider Association are quarterly market trend reports that break cider out into regions, packaging type, flavor, draft and more. Today we are releasing the Quarter 2 data provided through our partnership with Nielsen. Year over year comparisons for the second quarter of 2021 are not very helpful for most CPGs, because what were consumers doing in April, May and June of 2020? Stockpiling goods. Cider was no exception—according to Nielsen, retail sales of the total cider category were up 13.8% for Q2 of 2020 and regional cider brands were up a shocking 40%. So what can we say about Q2 of 2021 with the knowledge that Q2 2020 deserves an asterisk?

In Nielsen-measured retail channels:

- Regional brands of cider became the majority of cider’s market share in Q4 of 2020. That pattern persists in Q2 of 2021. These brands were only 25% of the market as recently as 2017.

- Regional cider brands are up 34.5% compared to Q2 of 2019. They are down slightly at -3.5% when compared to Q2 of 2020 which actually highlights what cider is best at: share preservation.

- Comparing YOY, regional cider brands are still positive for the trailing 52 weeks and will likely enjoy traditional Q3 seasonal growth.

- 6 packs of cans are the packaging type of choice for the moment.

- Flavors that are up for regional brands when compared to Q2 2019 include apple, pineapple, cherry, berry and sours, but the “other” flavor category is up 42% when compared to Q2 2019.

The data included in the Q2 packet compares to 2020. Keep that in mind when drawing your own conclusions. My conclusion is that cider is sustaining a big portion of the growth it saw in 2020 to preserve its share of the market. With regional cider brands comprising the majority of cider’s market share, we may start to see overall share growth in the context of the beverage alcohol segment.

Retailers who are taking cider off the shelf right now are missing a huge opportunity. Fall cider sets are a big winner—”From summer to fall of 2020, cider’s share of the beer category grew from 4.3 percent to 5.2 percent” (Drizly). I wonder what the increase is for regional cider? Probably much greater.

There is a lot of discussion of “nostalgic” flavors at the moment. This may be a chance for cider to push apple-driven products as we see brands like Seattle Cider and Bold Rock doing.

As far as the return of on-premise? When on-premise came back on board last spring, all “beer” segments experienced growth. We learned from our webinar last month that cider had the greatest YOY growth of all the “beer” sub-segments (*Q2 volume share Nielsen 12w 2021). National cider brands lead the growth, with a 751% increase for drafts sales for Q2 YOY. Apple-driven ciders experienced the most growth of all the flavor segments.

Cider won’t quit.

For more information on regional, packaging and flavor trends, get the Q2 data package included in your membership.

BONUS: For a fun analysis of GLINTCAP winners in the fruit cider category, check out this blog from Old Orchard.

Download Nielsen 2021 Quarter 2 Reports

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

New ACA Member Benefit!

The American Cider Association is excited to announce a new partnership with Good Beer Hunting to bring you premium content from their Sightlines+ insights newsletter. Each week, their team combines data, analysis, and real-world experiences from across alcoholic beverage to help break down trends across categories that can help your business make decisions for the future. All ACA voting members will receive a 50% off a year membership to some of the best insights in the industry from writers like Bryan Roth and Kate Bernot. Login to your ACA account to find the code for your 50% discount.

Interested in learning a bit more about Sightlines? Check out these recent articles:

CIDER’S RESILIENCE STOOD TRUE THROUGH 2020

At the end of 2019, I argued that cider’s resilience through the “Summer of Hard Seltzer” was the real headline. I could not have possibly known that cider’s resilience through 2020 would swamp that achievement. 2020 challenged and changed alcohol beverage sales in the US with a rapid pace, and the cider industry was absolutely not immune. It goes without saying many of the forced changes were negative. On premise sales took a massive hit (-51.5% in Nielsen-measure on premise channels). It’s hard to argue that widespread closures of tasting rooms and restaurant accounts, ubiquitous employee layoffs, and anecdotal reduced supply purchases from local orchards were positive changes for the industry as a whole. However, it is true that some cider companies benefited from the market’s increased focus on retail due to the structure of their business models. It is meaningful to all cidermakers that in 2020 the cider category grew more than beer in the Nielsen-measured retail channels. What were some of the other positive outcomes?

We saw online sales for cider dramatically increase—for some producers, their 2020 online sales were as much as three times their 2019 sales. We know that local cidery customers rose to the challenge to order cider for curbside pickup and delivery, turning the previous conclusion that cider consumers are “explorers” with less brand loyalty on its head at the local level. Many of these changes required legislative emergency actions at the state level. Although there is a real fear that there will be push back against these changes long term, it is going to be hard to move the policies back to pre-Covid times. Convenience is King.

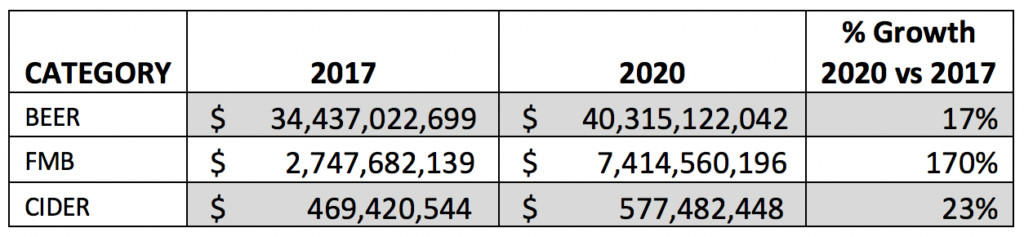

We also saw the category embrace rapid innovation and quickly adapt to new market conditions. This nimbleness allowed cider to hold onto its shares of the market. This happened despite growing perceived competition from flavored malt beverages and with completely different market conditions than what we saw in 2019.

As part of your American Cider Association membership benefits, we provide complimentary quarterly market trend reports which we commission Nielsen to produce. We look at the Quarter 4 reports to get an idea of how cider performed in chain retails and restaurants across the country for 2020. The reports break down trends by region, packaging and flavor.

Here are some of the major takeaways from cider’s off-premise performance in Nielsen-measured channels for Q4 of 2020:

- For the first time ever, sales of national cider brands (defined as those owned by larger beverage corporations) ceded their majority hold of the category’s shares. Regional brands accounted for 27% of cider’s dollar share in Q4 of 2017 and 51% of cider’s dollar share in 2020.

- Regional cider brands grew 33% in Quarter 4 of 2020 to help achieve this.

- Not surprisingly, canned cider sales grew 19%, with 6-packs, 4-packs, and single cans contributing the most to that growth.

- The top three performing cider-regions from a total-cider perspective were the Northwest ($ +27%), the East ($ +12%) and the Midwest ($ +8%).

- Regional cider dollars increased YOY for the quarter in all regions.

What about 2020 as a whole? Here are some key points for cider’s off premise performance in Nielsen-measured channels for all of 2020:

- Off premise cider grew at +9.4% for the total category in 2020.

- Regional brands grew 33.4% in off premise channels in 2020.

- Cider, as reported by Nielsen, maintains its dollar share percentage as 1.2%. The category has hovered near this number for the last several years. To preserve those shares, cider has had to grow at a rate that keeps up with changes in the market, including the rise in flavored malt beverage sales.

The conclusion I draw from the data we’re gathering through our partnership with Nielsen is (1) Cider is still growing and (2) In 2021, we may see cider’s dollar share of the off premise beer market exceed 1.2%. This is in part a response to regional brands dominating the cider category for the first time and their long, unwavering history of double-digit growth.

Dive into flavor trends and more with the Members-Only Q4 Nielsen report here.