Trends

Now Available: Q3 Nielsen Reports

Complimentary custom, quarterly market trend reports are part of your American Cider Association membership. To access these reports at any time, sign into our login page. The landing page is full of helpful tools like our custom Nielsen reports and more.

Just looking to download Quarter 3? Log in and click here.

Q3 Highlights:

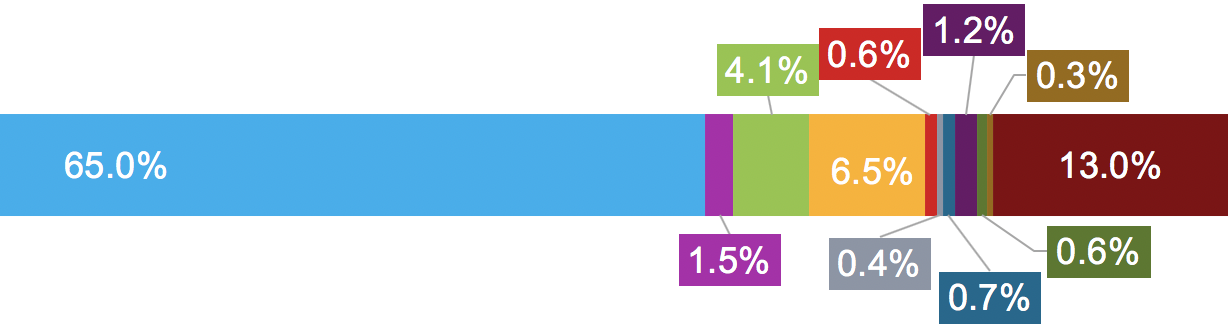

- The impact of the pandemic is stark. On-premise cider sales declined an estimated 40% when comparing 52-week periods and nearly 70% when comparing 12-week periods for the previous year.

- Total cider was up 10% for Q3 in off-premise channels measured by Nielsen. This does not make up for the massive pandemic-induced on-premise declines.

- Regional brands drove off-premise growth–up 34% vs national brand declines of 6%.

- Both on- and off-premise cider sales for regional brands are expected to eclipse national brand sales in Q4.

Find more insights by region, packaging and ingredients in our custom reports.

Q2 Nielsen Reports Ready For Download

One of the perks of combining our buying power as an association is that we can share valuable insights from Nielsen with you, our members.

You can now download our custom Q2 reports. In this data packet you will be able to access:

- Off-Premise Micro-Reports broken down for packaging type, flavor, and region–14 states and 6 regional outlooks. Available in both a 12-week and a 52-week outlook.

- Off-Premise Macro-Reports for Beer, FMBs and Cider. Available in both a 12-week and a 52-week outlook.

- On-Premise Reports for 6 metro markets.

- Nielsen PPT slide decks with charts, data visualization and insights on the cider category’s recent performance in both On- and Off-Premise.

- Bonus this quarter: Hard Seltzer off-premise report.

Here is an excerpt from a recent Nielsen survey about current overall consumer sentiment:

CONSUMER SENTIMENT REPORT SUMMARY BY NIELSEN

“Here are some high-level findings from a Nielsen survey of 18K+ consumers, fielded July 1-8, 2020.

- Since June, we have started to see some consistent trends not only for off premise alcohol, but also across many consumer good categories. That comes to life in consumer sentiment as well. 60% of households expect their routines to remain altered for at least the next 4 months

- Nielsen has shared insights in the past in several forms about how premiumization within off premise alcohol isn’t slowing down, and has in fact accelerated during COVID weeks. However, when it comes to total consumer goods, we are starting to see more cautious consumer sentiment in relation to spending. Approximately 4 in 10 (42%) of households say they are watching what they spend as a result of COVID.

- The homebody economy continues. When asked what % of time households eat meals or snacks at home versus outside of home, 39% of households said they ate 100% of their meals and snacks at home. An equal amount (39%) said they ate outside of their home only 10% of the time. As a comparison, when asked what their habits were prior to COVID, only 12% said they ate all of their meals at home.

- When asked what their plans are for the coming months, close to 1 in 3 households (28%) said they plan to eat all of their meals at home. That of course was lower for younger consumers age 21-34, and much higher for consumers age 65+.

- What about consumer plans if economic conditions get worse (recession and/or inflation)? When asked about things they would do to save money when shopping for beer or wine, 39% said they won’t change how they shop for it. However, nearly ¼ said they would buy less. That’s a slightly different story for households with lower income (<$30K), which said they would be more likely to stop buying it all together.”

8/25/20 Webinar Recording: State of Direct to Consumer-the Wine Perspective

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.