Posts Tagged ‘Taxes’

Cider Tax News

UPDATE: On 12/27/20 President Trump signed the bill making the reform included in the CBMTRA permanent.

On Monday night, Congress took the important step to pass permanent Federal excise tax credits for the nation’s cideries, meaderies, wineries, breweries, and distilleries. The tax reform measures for alcohol producers were originally introduced on a two-year basis in 2017 and renewed for one year late in 2019. The renewal was set to expire on December 31, 2020, but thanks to the inclusion of the Craft Beverage Modernization and Tax Reform Act (CBMTRA) in the most recent COVID relief bill, the excise tax credits are now permanent. The transition from temporary tax bill to permanence was relatively rapid thanks to enormous bipartisan popularity in both the Senate and House of Representatives as well as unprecedented collaboration of cider, wine, beer, spirits, and mead.

The bill removes prior barriers to growth by increasing the defining production threshold of a small cidery or winery and maintaining tiered tax credits as cideries grow and meet those thresholds.

“Many cideries feared exceeding the original small producer threshold. The permanent passage of the CBMTRA removes that fear,” said Michelle McGrath, executive director of the American Cider Association (ACA).

CBMTRA had many Congressional champions that ensured its success including the Senate co-sponsors Senate Finance Ranking Member Senator Wyden (D-OR) and Senator Roy Blunt (R-MO), House co-sponsors Representative Kind (D-WI) and Representative Kelly (R-PA), House Ways and Means Committee Chair Representative Neal (D-MA), House Ways and Means Ranking Member Kevin Brady (R-TX), Senate Majority Leader Mitch McConnell (R-KY), Senate Minority Leader Charles Schumer (D-NY), Senate Finance Chair Charles Grassley (R-IA), House Speaker Nancy Pelosi (D-CA), and House Minority Leader Kevin McCarthy (R-CA).

“America’s cidermakers can take a deep breath knowing that not only will their Federal excise taxes not go up on January 1, but the annual cycle of uncertainty regarding those taxes will stay behind with 2020,” said Brooke Glover, vice president of the American Cider Association.

“These tax credits were passed relatively recently, but many new cideries have never known any other way. I’m grateful they aren’t facing a tax increase come January 1. This can provide a bit of much needed confidence to do business in 2021,” said McGrath.

ACA played a supportive role in the craft beverage coalition that lobbied to make the credits permanent.

“Our members have worked hard to host members of Congress at their cideries, visit their offices in DC and participate in collaborative days of action. I was really proud of ACA’s membership,” McGrath said. “We are also extremely grateful to our colleagues in wine, beer, spirits and mead for including us in the beverage coalition.”

The American Cider Association encourages its members to make sure they are taking advantage of these tax credits and to let the ACA know how they are investing the savings. The Association will be rolling out educational resources to explain the nuances of how the CBMTRA benefits cider businesses in the coming weeks.

“Thank you to our members for renewing your membership year after year. Your small annual investment in the ACA has added up to much bigger permanent tax savings for you,” added McGrath. “Cider has a seat at the table. We have increasing numbers of Congressional champions. Our association is working.”

The bill now heads to President Trump for his signature and he is anticipated to sign. In a time when it is desperately needed, the CBMTRA supports jobs, farms and craft manufacturing.

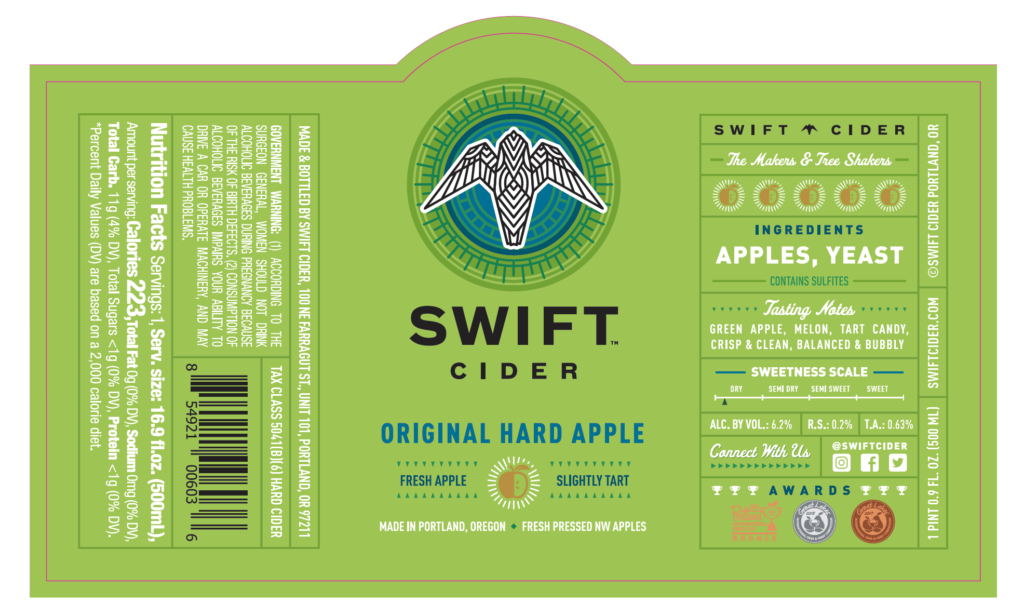

Is your label compliant?

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears.

As of January 1, 2019, the TTB is requiring all cider (not just cider >7% ABV) that qualifies for the cider tax rate to be labeled with this statement: Tax class 5041(b)(6). The requirement starts when the product is removed from bonded premises. If your product was labeled and removed from bonded premises before the start of this year, it is not required to have the tax class statement.

If your cider was labeled in 2018 but wasn’t removed from bonded premises until 2019, the cider tax class statement must be present on the label. The TTB will allow a sticker with the statement to be applied to the label to be in compliance. Read more in TTB’s Industry Circular 2017-2.