Cider Taxes

📣 ACTION ALERT: Renew the Craft Beverage Modernization and Tax Reform Act

Cideries like yours are facing the harsh economic realities of a global pandemic. Congress needs to be proactive in supporting small businesses like yours right now, but they also need to protect you from further economic harm. In a normal year, raising Federal Excise Taxes could significantly damage our industry’s viability. In 2021, raising taxes could force hundreds of cideries to permanently close their doors. Join us in urging Congress to act urgently and make the Craft Beverage Modernization and Tax Reform Act permanent NOW.

This will impact all segments of the cider industry. It’s critical we work together in reaching out to lawmakers today or come January 1, your Federal Excise Taxes may go up significantly.

Please reach out to Congress today and tell them your business needs a break: Make the Craft Beverage Modernization and Tax Reform Act permanent!

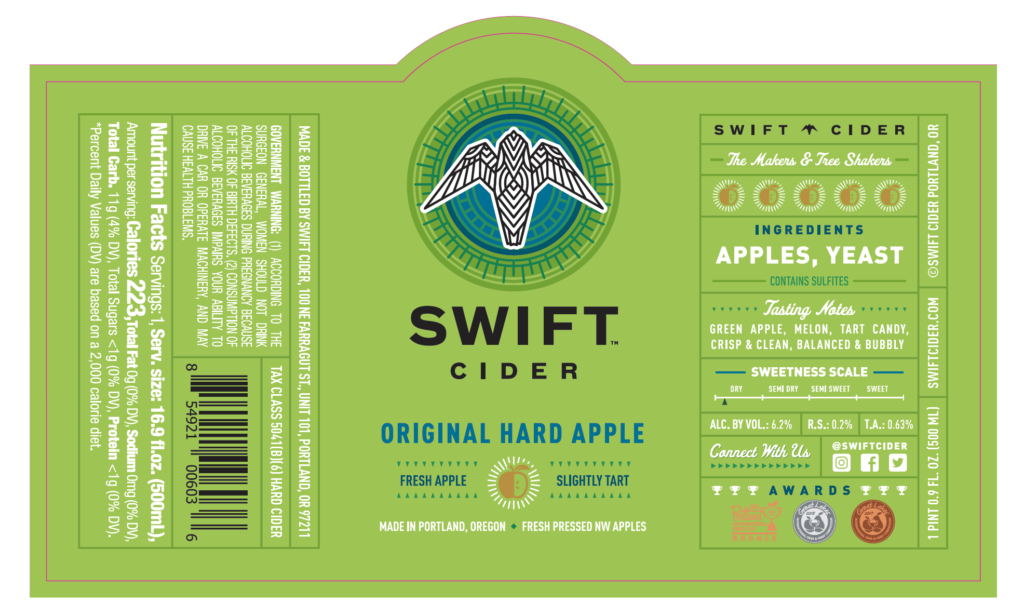

Is your label compliant?

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears.

As of January 1, 2019, the TTB is requiring all cider (not just cider >7% ABV) that qualifies for the cider tax rate to be labeled with this statement: Tax class 5041(b)(6). The requirement starts when the product is removed from bonded premises. If your product was labeled and removed from bonded premises before the start of this year, it is not required to have the tax class statement.

If your cider was labeled in 2018 but wasn’t removed from bonded premises until 2019, the cider tax class statement must be present on the label. The TTB will allow a sticker with the statement to be applied to the label to be in compliance. Read more in TTB’s Industry Circular 2017-2.

Cider Tax News

Federal alcohol excise tax reform is included in the recently passed Tax Cuts and Jobs Act. Beer, wine, spirits and cider all benefit. What’s in it for cider? The threshold for which a cider maker receives the “Small Producer Tax Credit” has been significantly broadened. Previously, you could only receive this tax credit on the first 100,000 gallons produced and only if you made less than 250,000 gallons a year. But a new credit structure has been developed for both the hard cider tax rate and the wine tax rate (which is the rate fruit cider currently falls under). The following language is from Wine America. If your cider does not qualify for the hard cider tax rate, this structure applies to your product.

“The bill will save all wineries, regardless of size, significant money through an excise tax credit mechanism which reduces the effective rate. For example, while the federal excise tax on table wine will remain unchanged at $1.07 per gallon, there will be a new tax credit of $1.00 on the first 30,000 gallons produced, making the effective tax rate $0.07 (seven cents) per gallon. The tax credit on the next 100,000 gallons produced is $0.90, and between 130,000 and 750,000 gallons produced the tax credit will be $0.535.”

For hard cider, the bill will save cideries money through a similar excise tax credit mechanism. While the federal excise tax on hard cider will remain unchanged at $0.226 per gallon, there will be a new tax credit of $0.062 on the first 30,000 gallons produced, making the effective tax rate $0.164 per gallon. The tax credit on the next 100,000 gallons produced is $0.056, and between 130,000 and 750,000 gallons produced the tax credit will be $0.033.”

This reform was passed on a temporary basis. It will expire on December 31, 2019. American Cider Association is looking at ways to increase our presence in the coalition working to make this permanent and to represent the interests of cider in this process moving forward.

Once the President signs this current version into law, it becomes effective on January 1. That does not give the TTB time to create the regulatory process to implement this law. Cideries will likely receive retroactive tax credits after the regulations are created.

For more information about this law, please visit Wine America’s site, or contact Michelle McGrath at michelle@ciderassociation.org.