Market Data

Harvest Driven Cider Segment Survey Report Webinar

Join us March 1, 2022 at 12:00pm Pacific for analyses of the harvest driven cider segment of the cider industry. Harvest driven cider makers are defined as those for whom 75% of their annual cider production is are pressed once per year at or close to the date of harvest and are aged for a minimum of three months prior to packaging. Because this segment of the cider industry is often smaller producers who don’t sell in markets captured by Nielsen data or retail data scanner providers like IRI, the American Cider Association decided to launch an annual harvest driven cider survey. This inaugural survey was undertaken by Michael Uhrich of Seventh Point Analytic Consulting. He has taken a deep dive into the data to suss out the current status of the harvest driven cider segment and will present these results with us in this webinar.

This webinar is for ACA members only. You can log in, join, or renew your membership here.

Registration closes February 28, 2022 at 1:00pm Pacific. Information to join via Zoom will be sent after registration closes on February 28, 2022.

Webinar: BeerBoard’s Hard Cider Trends

BeerBoard’s Hard Cider Trends Webinar February 22, 2022

Join Dillon Card and Jim Randall from BeerBoard for the newest on-premise insights for cider with national and regional breakdowns, including competitive style and product performance data. This webinar will take place Tuesday, February 22, 2022 at 12:00pm Pacific on Zoom. Zoom link will be provided the day before the webinar.

This webinar is for active ACA members only. Join now or renew your membership!

Q3 Trends Available for Download

Q3 reports are available for download as part of your ACA membership benefits. Regional cider brand sales were up 11% for year over year comparisons of Nielsen-measured off-premise channels for the 52-week period ending with Q3. Total cider category sales for the 52-week period ending with Q3 were up 2% compared to 2019 and down 4% when compared to 2020 for Nielsen-measured off-premise channels. In on-premise channels, cider’s rebound for the 12-week period of Q3 compared to the same period for 2020 exceeded beer’s rebound for both draft and packaged sales. For more details on how the category is performing including regional and packaging analysis, download our members-only Nielsen reports after logging into our website.

Quarter 2: A Year After The Great Stockpile

Included in your benefits as an active member of the American Cider Association are quarterly market trend reports that break cider out into regions, packaging type, flavor, draft and more. Today we are releasing the Quarter 2 data provided through our partnership with Nielsen. Year over year comparisons for the second quarter of 2021 are not very helpful for most CPGs, because what were consumers doing in April, May and June of 2020? Stockpiling goods. Cider was no exception—according to Nielsen, retail sales of the total cider category were up 13.8% for Q2 of 2020 and regional cider brands were up a shocking 40%. So what can we say about Q2 of 2021 with the knowledge that Q2 2020 deserves an asterisk?

In Nielsen-measured retail channels:

- Regional brands of cider became the majority of cider’s market share in Q4 of 2020. That pattern persists in Q2 of 2021. These brands were only 25% of the market as recently as 2017.

- Regional cider brands are up 34.5% compared to Q2 of 2019. They are down slightly at -3.5% when compared to Q2 of 2020 which actually highlights what cider is best at: share preservation.

- Comparing YOY, regional cider brands are still positive for the trailing 52 weeks and will likely enjoy traditional Q3 seasonal growth.

- 6 packs of cans are the packaging type of choice for the moment.

- Flavors that are up for regional brands when compared to Q2 2019 include apple, pineapple, cherry, berry and sours, but the “other” flavor category is up 42% when compared to Q2 2019.

The data included in the Q2 packet compares to 2020. Keep that in mind when drawing your own conclusions. My conclusion is that cider is sustaining a big portion of the growth it saw in 2020 to preserve its share of the market. With regional cider brands comprising the majority of cider’s market share, we may start to see overall share growth in the context of the beverage alcohol segment.

Retailers who are taking cider off the shelf right now are missing a huge opportunity. Fall cider sets are a big winner—”From summer to fall of 2020, cider’s share of the beer category grew from 4.3 percent to 5.2 percent” (Drizly). I wonder what the increase is for regional cider? Probably much greater.

There is a lot of discussion of “nostalgic” flavors at the moment. This may be a chance for cider to push apple-driven products as we see brands like Seattle Cider and Bold Rock doing.

As far as the return of on-premise? When on-premise came back on board last spring, all “beer” segments experienced growth. We learned from our webinar last month that cider had the greatest YOY growth of all the “beer” sub-segments (*Q2 volume share Nielsen 12w 2021). National cider brands lead the growth, with a 751% increase for drafts sales for Q2 YOY. Apple-driven ciders experienced the most growth of all the flavor segments.

Cider won’t quit.

For more information on regional, packaging and flavor trends, get the Q2 data package included in your membership.

BONUS: For a fun analysis of GLINTCAP winners in the fruit cider category, check out this blog from Old Orchard.

Download Nielsen 2021 Quarter 2 Reports

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

New ACA Member Benefit!

The American Cider Association is excited to announce a new partnership with Good Beer Hunting to bring you premium content from their Sightlines+ insights newsletter. Each week, their team combines data, analysis, and real-world experiences from across alcoholic beverage to help break down trends across categories that can help your business make decisions for the future. All ACA voting members will receive a 50% off a year membership to some of the best insights in the industry from writers like Bryan Roth and Kate Bernot. Login to your ACA account to find the code for your 50% discount.

Interested in learning a bit more about Sightlines? Check out these recent articles:

CIDER’S RESILIENCE STOOD TRUE THROUGH 2020

At the end of 2019, I argued that cider’s resilience through the “Summer of Hard Seltzer” was the real headline. I could not have possibly known that cider’s resilience through 2020 would swamp that achievement. 2020 challenged and changed alcohol beverage sales in the US with a rapid pace, and the cider industry was absolutely not immune. It goes without saying many of the forced changes were negative. On premise sales took a massive hit (-51.5% in Nielsen-measure on premise channels). It’s hard to argue that widespread closures of tasting rooms and restaurant accounts, ubiquitous employee layoffs, and anecdotal reduced supply purchases from local orchards were positive changes for the industry as a whole. However, it is true that some cider companies benefited from the market’s increased focus on retail due to the structure of their business models. It is meaningful to all cidermakers that in 2020 the cider category grew more than beer in the Nielsen-measured retail channels. What were some of the other positive outcomes?

We saw online sales for cider dramatically increase—for some producers, their 2020 online sales were as much as three times their 2019 sales. We know that local cidery customers rose to the challenge to order cider for curbside pickup and delivery, turning the previous conclusion that cider consumers are “explorers” with less brand loyalty on its head at the local level. Many of these changes required legislative emergency actions at the state level. Although there is a real fear that there will be push back against these changes long term, it is going to be hard to move the policies back to pre-Covid times. Convenience is King.

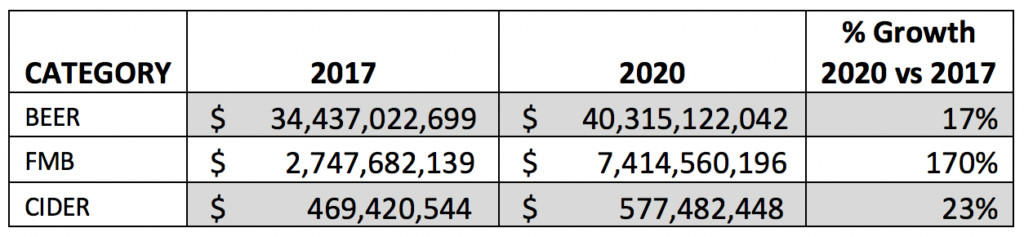

We also saw the category embrace rapid innovation and quickly adapt to new market conditions. This nimbleness allowed cider to hold onto its shares of the market. This happened despite growing perceived competition from flavored malt beverages and with completely different market conditions than what we saw in 2019.

As part of your American Cider Association membership benefits, we provide complimentary quarterly market trend reports which we commission Nielsen to produce. We look at the Quarter 4 reports to get an idea of how cider performed in chain retails and restaurants across the country for 2020. The reports break down trends by region, packaging and flavor.

Here are some of the major takeaways from cider’s off-premise performance in Nielsen-measured channels for Q4 of 2020:

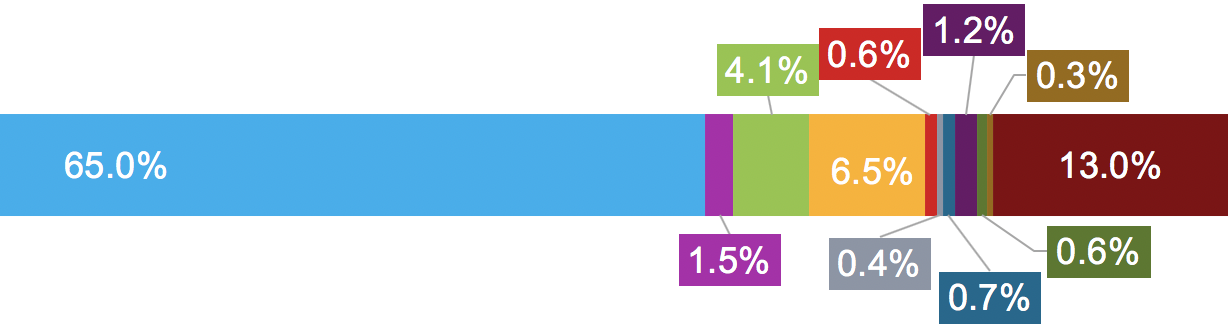

- For the first time ever, sales of national cider brands (defined as those owned by larger beverage corporations) ceded their majority hold of the category’s shares. Regional brands accounted for 27% of cider’s dollar share in Q4 of 2017 and 51% of cider’s dollar share in 2020.

- Regional cider brands grew 33% in Quarter 4 of 2020 to help achieve this.

- Not surprisingly, canned cider sales grew 19%, with 6-packs, 4-packs, and single cans contributing the most to that growth.

- The top three performing cider-regions from a total-cider perspective were the Northwest ($ +27%), the East ($ +12%) and the Midwest ($ +8%).

- Regional cider dollars increased YOY for the quarter in all regions.

What about 2020 as a whole? Here are some key points for cider’s off premise performance in Nielsen-measured channels for all of 2020:

- Off premise cider grew at +9.4% for the total category in 2020.

- Regional brands grew 33.4% in off premise channels in 2020.

- Cider, as reported by Nielsen, maintains its dollar share percentage as 1.2%. The category has hovered near this number for the last several years. To preserve those shares, cider has had to grow at a rate that keeps up with changes in the market, including the rise in flavored malt beverage sales.

The conclusion I draw from the data we’re gathering through our partnership with Nielsen is (1) Cider is still growing and (2) In 2021, we may see cider’s dollar share of the off premise beer market exceed 1.2%. This is in part a response to regional brands dominating the cider category for the first time and their long, unwavering history of double-digit growth.

Dive into flavor trends and more with the Members-Only Q4 Nielsen report here.

Now Available: Q3 Nielsen Reports

Complimentary custom, quarterly market trend reports are part of your American Cider Association membership. To access these reports at any time, sign into our login page. The landing page is full of helpful tools like our custom Nielsen reports and more.

Just looking to download Quarter 3? Log in and click here.

Q3 Highlights:

- The impact of the pandemic is stark. On-premise cider sales declined an estimated 40% when comparing 52-week periods and nearly 70% when comparing 12-week periods for the previous year.

- Total cider was up 10% for Q3 in off-premise channels measured by Nielsen. This does not make up for the massive pandemic-induced on-premise declines.

- Regional brands drove off-premise growth–up 34% vs national brand declines of 6%.

- Both on- and off-premise cider sales for regional brands are expected to eclipse national brand sales in Q4.

Find more insights by region, packaging and ingredients in our custom reports.

Q2 Nielsen Reports Ready For Download

One of the perks of combining our buying power as an association is that we can share valuable insights from Nielsen with you, our members.

You can now download our custom Q2 reports. In this data packet you will be able to access:

- Off-Premise Micro-Reports broken down for packaging type, flavor, and region–14 states and 6 regional outlooks. Available in both a 12-week and a 52-week outlook.

- Off-Premise Macro-Reports for Beer, FMBs and Cider. Available in both a 12-week and a 52-week outlook.

- On-Premise Reports for 6 metro markets.

- Nielsen PPT slide decks with charts, data visualization and insights on the cider category’s recent performance in both On- and Off-Premise.

- Bonus this quarter: Hard Seltzer off-premise report.

Here is an excerpt from a recent Nielsen survey about current overall consumer sentiment:

CONSUMER SENTIMENT REPORT SUMMARY BY NIELSEN

“Here are some high-level findings from a Nielsen survey of 18K+ consumers, fielded July 1-8, 2020.

- Since June, we have started to see some consistent trends not only for off premise alcohol, but also across many consumer good categories. That comes to life in consumer sentiment as well. 60% of households expect their routines to remain altered for at least the next 4 months

- Nielsen has shared insights in the past in several forms about how premiumization within off premise alcohol isn’t slowing down, and has in fact accelerated during COVID weeks. However, when it comes to total consumer goods, we are starting to see more cautious consumer sentiment in relation to spending. Approximately 4 in 10 (42%) of households say they are watching what they spend as a result of COVID.

- The homebody economy continues. When asked what % of time households eat meals or snacks at home versus outside of home, 39% of households said they ate 100% of their meals and snacks at home. An equal amount (39%) said they ate outside of their home only 10% of the time. As a comparison, when asked what their habits were prior to COVID, only 12% said they ate all of their meals at home.

- When asked what their plans are for the coming months, close to 1 in 3 households (28%) said they plan to eat all of their meals at home. That of course was lower for younger consumers age 21-34, and much higher for consumers age 65+.

- What about consumer plans if economic conditions get worse (recession and/or inflation)? When asked about things they would do to save money when shopping for beer or wine, 39% said they won’t change how they shop for it. However, nearly ¼ said they would buy less. That’s a slightly different story for households with lower income (<$30K), which said they would be more likely to stop buying it all together.”

Q2 2020 Nielsen Reports for Our Members

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.