Download the Q4 Cider Trends Report

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

Exploring Diversity of Cider Profiles Through the Selection of New Yeast Strains

by Etienne Dorignac –Technical Manager, Fruit Fermentation

#SponsoredContent by Fermentis

Introduction

Although the global cider market has been constantly growing over the past 15 years, , the growth rate has progressively slowed down in the last 5 years. In fact, we see from the last data published (AICV) that the significant increase of consumption observed between 2005 and 2015, from 13.5 million hectoliters (MhL) to 24 MhLs, mainly driven by new regions such as North America, Australasia and Africa versus older markets such as West Europe and Latin America, progressively flattened out to reach about 26 MhLs in 2019. In addition, the distribution between regions has not been changing much in recent years… In this context, cidermakers are facing competition challenges and need to find new ways to boost their market by standing apart from each other. Among the main diversification tools they have in hands, the choice of the raw materials and the recipe; but also the selection of the yeast strain and the conditions applied to carry out the fermentation can drastically affect cider organoleptic profiles. In this way, Fermentis R&D selected 4 new yeast strains dedicated to ciders whose characterization will be presented in this article.

Evaluation of different yeast strains through different types of cidermaking

- Cider?

What could be considered as a “cider” is actually very variable depending on the countries and the substrates: 100% apples, types of apples, addition of other fruits such as pears, usage of juice, concentrates or external sugars. In addition, the number of recipes can hugely differ, what makes a standard study almost impossible.

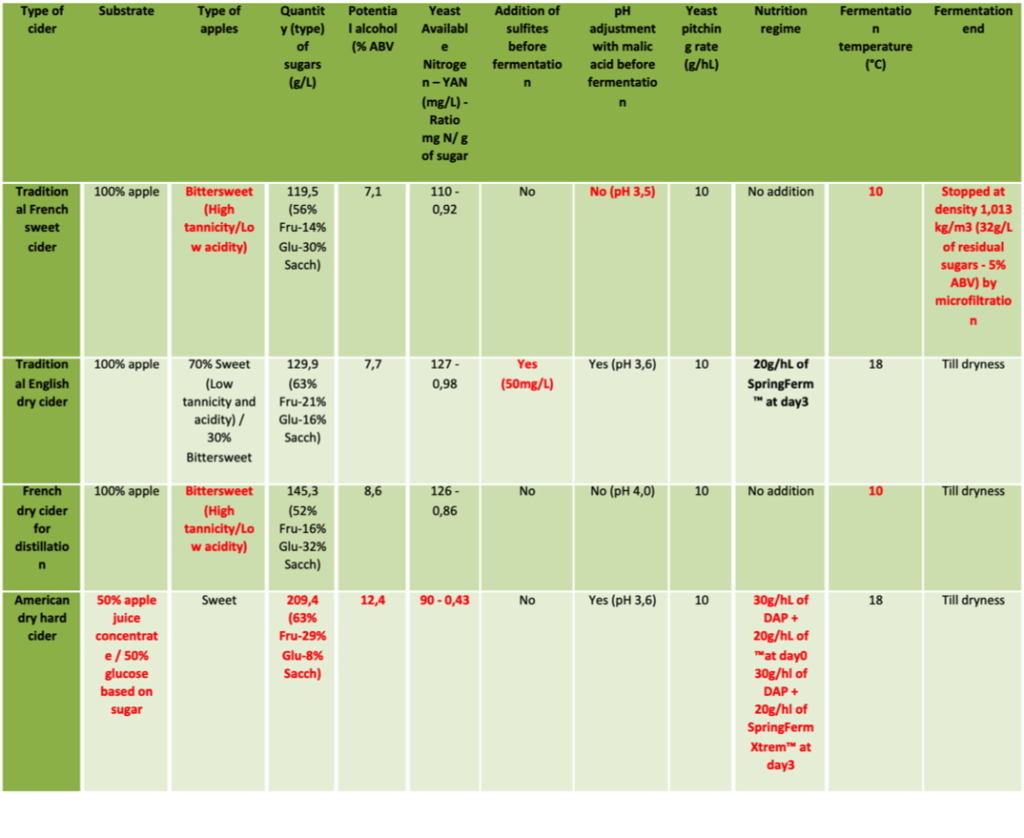

As a consequence, the characterization was based on 4 major recipes that could embrace the main problematics faced by cidermakers around the world: types of apples used, source and quantity of sugars, completion or voluntary stop of fermentation (to eventually leave some residual sugars) and fermentation temperature.

The different recipes are detailed in Table 1.

All fermentations have been carried out at the experimental cellar of the Institut Français des Productions Cidricoles (IFPC), French research institute specialized in cidermaking; in 15L glass vessels, with a standardized oxygen rate addition (1.5mg/L) and under inert atmosphere (N2).

2. Strain characterization

It is easily understandable that, from the traditional French sweet cider to the American hard dry cider, most of the fermentation conditions are becoming increasingly difficult even though nutrition and temperature were adjusted. It was then interesting to try different yeast strains through all these recipes in order to select the most diverse and interesting ones. From more than 20 strains evaluated, we’ll highlight the main results for 4 of them (SafCider™ AB-1, SafCider™ TF-6, SafCider™ AS-2 and SafCider™ AC-4) , more specifically as it relates to their robustness; and their analytical and aromatic profiles.

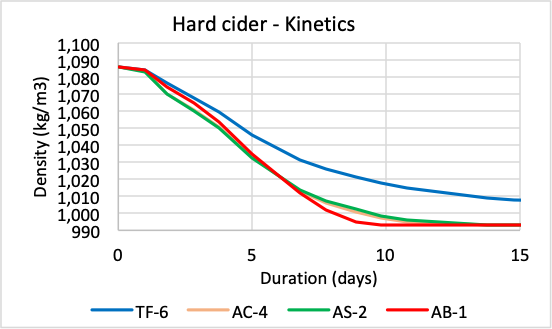

a. Robustness

To assess the robustness of the strains towards difficult fermentation conditions, i.e. high sugar concentration (and content in the most difficult to assimilate fermentable sugars, i.e. fructose), low pH, nutrient deficiency, low temperature… Figure 1 shows the kinetics as well as the remaining sugars at the end of the fermentation in the hard cider. The strain SafCider™ TF-6 clearly stands apart from the other strains as it was not able to finish the fermentation and typically left ~25 g/L of sugars, among which fructose was a major part. This feature was observed in most of all matrices, as TF-6 was only able to finish the fermentation till dryness in the English cider (high YAN, low tannicity, then less inhibition and more O2 availability, high temperature), highlighting the bigger needs of this particular strain and the fact that the selection can be crucial depending on the cidermaker target. A higher sensitivity to high concentration of SO2 (50 mg/L maximum) is as well to be noticed for this strain.

b. Analytical Profile

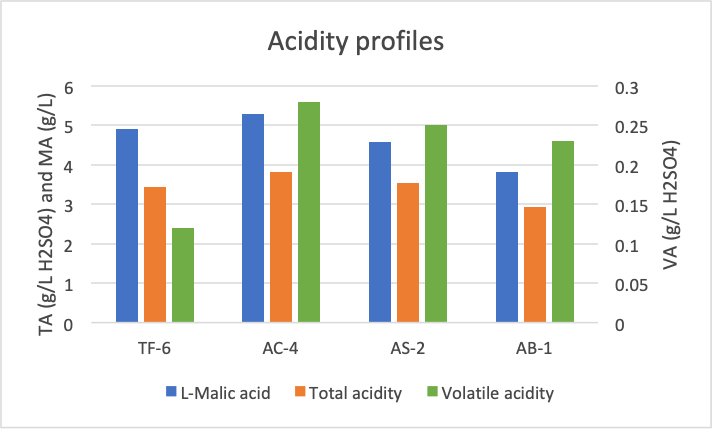

All basic analytical parameters at the end of the fermentation have been determined. Among the most interesting ones, the acidity profile is of particular interest as it reflects the metabolic behavior of the strain that could have a real impact on the organoleptic profile. Figure 2 shows the acidity profiles of strains in the English cider recipe. Most significant with SafCider™ AB-1 and maybe not as much with the other strains, we could see that some strains are able to consume the major organic acid present in apples, i.e. the malic acid, in significant amount through the malo-ethanolic pathway; and thus decreasing the total acidity and its feeling. To the contrary, some strains, such as SafCider™ AC-4, are preserving this acidity and maintain a crispy feeling (observed but not shown here). Moreover, the ability of strains to produce acetic acid during fermentation from the glycolysis pathway can also affect the aromatic profile, degrading its quality at too high concentration (vinegar flavors). For this attribute, all strains were selected for their low production with always the SafCider™ TF-6 being a “clean” strain towards deviations like SO2 and acetaldehyde production as well.

c. Aromatic Profile

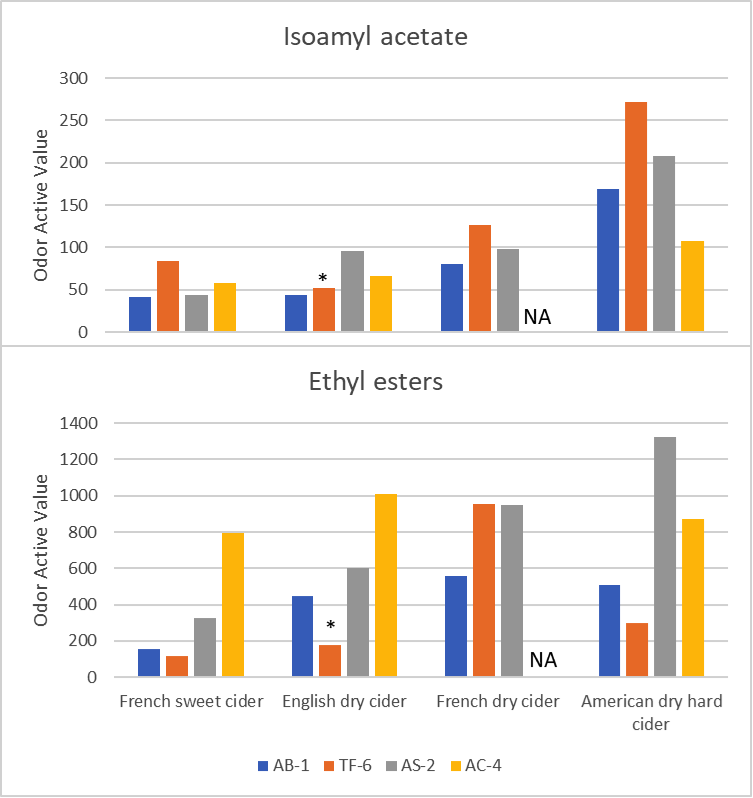

In addition to higher alcohols, two major types of aromatic compounds are produced by yeast strains during fermentation and have a significant impact on the aromatic profile of all beverages: (1) the acetate esters, whose most famous and abundant one is the isoamyl acetate with its distinctive banana and candy notes and which is recognized as an overall aroma enhancer; and (2) the ethyl esters, whose most abundant ones are the linear chain ethyl esters from 4 to 10 carbons (C4-butanoate, C6-hexanoate, C8-octanoate and C10-decanoate) and which confer more discrete but more complex floral and fruity characters. Huge differences in the release of these compounds can drastically affect the flavor perceptions of beverages, the same applying for ciders. In Figure 3, all matrices have been taken to compare the aromatic behavior of the strains in different conditions.

We noticed big differences between strains; and even if aromatic compounds concentrations were of course impacted by the recipe and more specifically the amount of sugars fermented (especially for isoamyl acetate whose acetate part is directly linked to the glycolysis pathway), we could extract common trends. Except for the English cider, SafCider™ TF-6 showed always higher production of isoamyl acetate than others. This will be illustrated in terms of flavor but also aromatic intensity in the last paragraph of this article. For the English cider only, SafCider™ TF-6 was indeed able to dry the sugars and not leave any residual sugars, suggesting a strong relationship between the stress generated at the end of the fermentation and the aroma produced. SafCider™ AC-4 showed particularly high but quite stable ethyl esters production (driven by ethyl octanoate – fruity/floral), hypothesizing a reliable complexity in the flavors. SafCider™ AB-1 and particularly SafCider™ AS-2 increased their ester production along with the difficulty of the recipe with SafCider™ AB-1 being on the low values, more respecting the raw material.

*: Sole recipe in which TF-6 was able to dry the sugars. NA = Non-Available.

Focus on French Traditional Sweet Cider – Strain Baseline

Relying on the expertise of IFPC and their trained taste panel specialized on French traditional sweet ciders, professional tastings have been carried out on French cider experiments, both stopped with around ~30 g/L of residual sugars (called “Brut” ciders in French). The specificity of this tasting was to assess first the global fruitiness of the ciders with two major descriptors: (1) “Fruity/Floral” corresponding to fresh fruit (apple, pear, banana…) feeling; and (2) “Cooked fruits” related to ripe or processed fruits (like compote), aromas that are not necessarily looked for but adding complexity to the final cider. After this evaluation, it was then asked to tasters to detail fresh and cooked fruit notes to identify the aromatic drivers for each strain and to evaluate off-flavors as well, such as phenolic and sulfury aromas. Finally, a simple evaluation of the basic tastes was done: Sweet, acid, bitter and astringent.

From these tastings, SafCider™ TF-6 (especially) and SafCider™ AS-2 were scored as the highest in fresh but also cooked fruits, whereas SafCider™ AC-4 was judged less expressive and predominantly oriented towards freshness; and SafCider™ AB-1 was more discrete (data not shown).

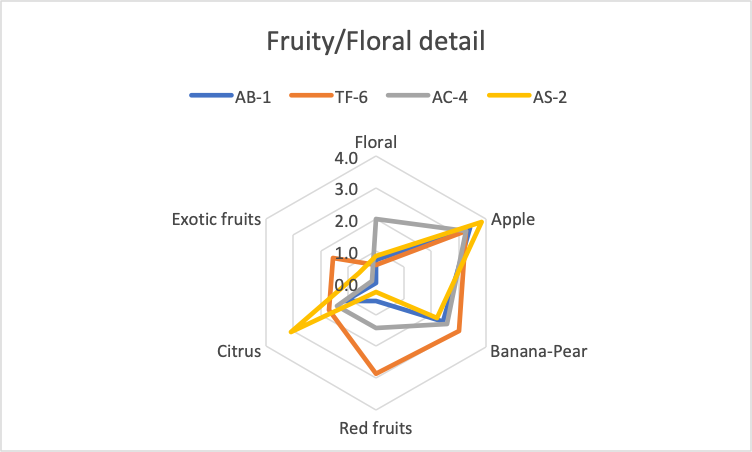

More interesting were the detailed fresh fruits perceived by tasters as shown in Figure 4. Obviously, sensory characterization of all ciders was driven by detection of apple notes, but SafCider™ TF-6 scored high for most of the fruits, especially banana-pear and red fruits. SafCider™ AS-2 and SafCider™ AC-4 respectively exhibited more citrus and floral notes, whereas SafCider™ AB-1 was mainly centered on apple.

Both these general and detailed notes are actually quite well related with the production of aromatic compounds highlighted in the previous paragraph; with higher production of isoamyl acetate by SafCider™ TF-6, offering thus more aromatic intensity but enhanced aromatic complexity towards the other fruits as well; followed by SafCider™ AS-2 and SafCider™ AC-4, the latter producing mainly ethyl esters such as ethyl octanoate; which could explain these red fruits and specifically floral notes. SafCider™ AB-1 was the less exuberant and expressing more the raw material thanks to its quite discrete aroma production.

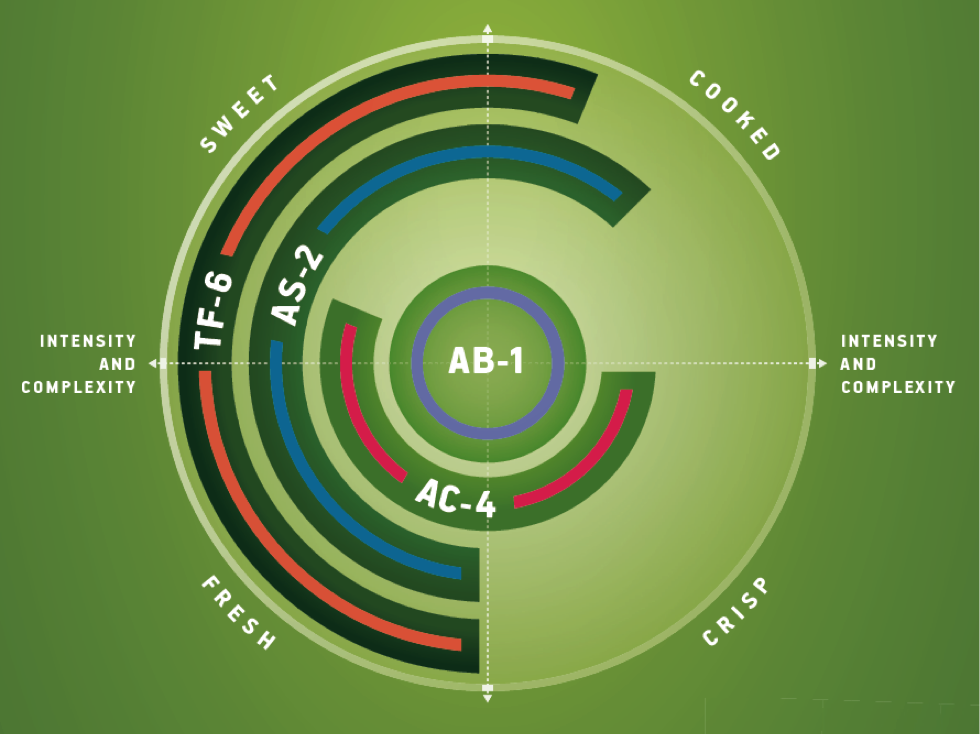

Together with mouthfeel attributes assessment (data not shown) confirming higher acidity feeling for SafCider™ AC-4 in line with its acidity maintenance and the sweetness feelings for SafCider™ TF-6 and SafCider™ AS-2 possibly linked to their high candy-like aromatic intensity and their higher remaining fructose level (higher sweetening power than glucose or saccharose), Fermentis suggested the map in Figure 5 to describe the impact of these 4 yeast strains and to serve as a baseline for cidermakers in their choices.

Conclusion

Yeast strains may have a huge impact on cider profiles, not only in terms of fermentation performances and analytics but for sure also from a sensory perception standpoint. As such, they can be considered as a powerful tool to diversify the cider offer in the market and cidermakers can play with them to achieve their final product target. For this purpose, Fermentis focused its research on the selection of valuable strains dedicated for ciders. SafCider™ AB-1 (Apple Balanced) will suit for all types of balanced ciders even under difficult fermentation conditions. SafCider™ AS-2 (Apple Sweet) will bring to sweet and dry ciders complex aromatic profile between fresh and cooked fruits and a rounder mouthfeel. SafCider™ AC-4 (Apple Crisp) will be applied for highly fresh and crisp sweet or dry ciders. SafCider™ TF-6 (Tutti Fruiti) will be dedicated to intensely fruity but rather sweet and round ciders!

ACA Annual Membership Meeting

ACA Annual Membership Meeting, March 3, 2021 – 11:00am Pacific Time

Please join the American Cider Association to review last year’s accomplishments, take a look at our new strategic plan, and weigh in on our future activities to support the cider industry.

You must be an Active ACA Member to particpate in the Annual Membership Meeting. You can become a member or update your membership here.

Let Ellen know when your membership is up to date and she will send you the Zoom link!

Four Insightful Webinars Coming Up Soon!

Brought to you by Ciderpros.com

Across stories of business owners’ ambitions and fears, Leadership Coach, Stephanie Hartman, found patterns of common pitfalls emerged at each phase of business maturity. For those who did not get help soon enough, the pitfalls ended their business—or the business survived at the cost of the owner’s health or relationships. Those who took necessary steps, restored balance in their lives and found renewed inspiration. In this presentation, Stephanie will share actionable tips to help you avoid the common pitfalls or escape them if you’re already there.

All CiderCon attendees will be emailed a link to the Zoom meeting prior to the date of the webinar. Didn’t attend CiderCon? ACA members can request a ticket by emailing Michelle.

Brought to you be Ekos

You started your cidery because you love making cider, but no one told you most of your days would be spent behind a computer or in meetings handling the less glamorous aspects of your business. You don’t need an MBA to run a successful cidery, but there are some business basics you need to master, including operations, sales, and accounting. In this webinar, Ekos will provide an overview of what you need to know in each area, advice for how technology can help you be more efficient, and tips for taking your business to the next level.

Certified Pommelier™ Guided Tasting March 4, 2021 – 3:30pm Pacific Time

Brought to you by Arryved

The Certified Pommelier™ exam is a rigorous test of a beverage professional’s cider knowledge, including one’s ability to taste and evaluate an apple-driven cider. This workshop is an opportunity for students to practice using the formulated evaluation schema used in the Certified Pommelier™ tasting exam. Workshop registrants will be sent a link to purchase the cider that the instructors will be evaluating. Purchasing cider is optional.

Instructors: Darlene Hayes & Tim Godfrey

CiderCon Encore: Driving Organizational Change with Stephanie Hartman March 11, 2021 – 9:30am Pacific Time

Brought to you by Ciderpros.com

For your facility move or new software to deliver on the promise of life being better, you’ll likely need some employees, customers or suppliers to stop doing something and start doing something else. In this presentation, Leadership Coach, Stephanie Hartman, will share a blend of academic theory and practical tools for addressing the tactical and emotional aspects of organizational change.

The link to the Zoom meeting will be sent to all CiderCon attendees prior to the date of the course. Didn’t attend CiderCon? ACA members can request a ticket by emailing Michelle.

CiderCon® 2021 Fact Sheet

While CiderCon® 2021 may have had a different feel due to the necessity of transitioning to a virtual platform, it was undoubtedly an unparalleled success!

- CiderCon® 2021 took place on the virtual platform Hopin from February 3-5, 2021. The schedule can be downloaded here. Instagram Highlights available here.

- 793 people attended the conference via their computers from around the world.

- 41 states and the District of Columbia were represented, with Oregon, New York, California, Colorado, Michigan, Virginia, and Washington having the most attendees.

- 18 countries were represented, with cider professionals from the US, Canada, Mexico, Thailand, Australia, New Zealand, Japan, Russia, South Korea, Finland, Norway, Denmark, Netherlands, Germany, United Kingdom, Ireland, France and Italy all in virtual attendance.

- 47 vendors took part in the virtual Trade Show, sponsored by Fruitsmart, with resounding success. Many provided live virtual demonstrations of their product offerings and interviewed cidermakers who were using their goods and services.

- Four keynote speakers graced the virtual main stage, sponsored by Fintech, over the course of the conference. They were:

- Anna Nadasdy of Fintech Infosource who opened the conference with a discussion of what consumer trends in 2021 might look like and how businesses can stay agile in a tumultuous climate.

- Justin Doggett of Kyoto Black Coffee who discussed the need for businesses to support one another during the pandemic and beyond and suggested innovative ways in which to do so.

- Michael Uhrich of Seventh Point Analytics Consulting who discussed, not only the importance of analytics to businesses, but practicable ways in which cider professionals can do assessments in house.

- Dr. J Nikol Jackson-Beckham founder of Crafted for All who closed out the main stage presentations with concrete ways in which businesses can create sustainable inclusion, equity, and justice strategies and put them into practice.

- The Cheers & Chat Networking sessions allowed attendees to be randomly matched with someone for a speed dating style virtual meetup. Hundreds of people took part in Cheers & Chat and new cider professional friends were quickly made.

- The American Cider Association once again partnered with the Cider Institute of North America to develop a range of in-depth, production oriented sessions for cidermakers. Every single session in the production track had more than 100 attendees and several topped 200 people. Sessions included co-fermentation in natural ciders, factors to consider when making sparkling cider, quince fermentation, improving the shelf life of canned ciders and strategies for creating a successful blend. The Cider Institute of North America trains cider makers through their educational programming in partnership with universities like Cornell.

- VIP packages purchased by attendees raised $1000 for the Cider Institute scholarship fund, whose goal is to offer tuition-free education to Black, Indiginous and People of Color covering the fundamental aspects of cider production through their online training.

- The Pomme Boots Society once again partnered with the ACA to provide unique content this year, including a session from Samantha Lee, co-founder of Hopewell Brewery, who shared how her progressive craft brewery flipped the script on traditional craft brewery business by putting people over profits. Pomme Boots Society is a volunteer run organization for women working in the cider industry. The Pomme Boots Society annual meeting featured Lee, and speakers from the Pink Boots Society, and had close to 200 people in attendance.

- Five legal and compliance sessions were also offered. Four of these sessions were led by employees from the TTB, the federal agency responsible for regulating cider taxes and labels. In addition, TTB employees hosted a virtual booth in the Trade Show that saw over 200 attendees stop by to discuss the finer points of legal regulations.

- The American Cider Associations annual board elections happen concurrently with CiderCon®. Newly elected board members were presented prior to the Grand Toast. Soham Bhatt of Artifact Cider was elected to his first term on the board in an At Large seat, Brooke Glover of Swilled Dog Hard Cider was re-elected as an At Large member, and Ryan Burk of Angry Orchard was re-elected as a Large Cidery member.

- In addition, new board officials were installed with Eleanor Leger of Eden Ciders taking the helm as president, Brooke Glover of Swilled Dog Hard Cider as vice-president, Marcus Robert of Tieton Cider as treasurer, and John Behrens of Farmhaus Cider as secretary.

CiderCon® 2022 is scheduled to take place in Richmond, Virginia from February 1-4, 2022.

2021 ACA Board Election Results

The American Cider Association announced the results of its 2021 Board of Director Elections live from CiderCon 2021 today. The ACA membership elected Brooke Glover, Soham Bhatt and Ryan Burk. Burk and Glover are board veterans and Bhatt is excited to be serving on the board for the first time.

The Board also selected its 2021 officers. They are:

Outgoing President Paul Vander Heide will remain on the board and looks forward to working closely with the new officers.

Sam Fitz of ANXO Cider in Washington DC, board member as a Cidery-At-Large, did not run for re-election in 2021. Sam has been a very engaged and contributive board member and looks forward to staying engaged with the association as a member in the next year.

Eleanor Leger shares her excitement to be serving as the 2021 Board Presdient:

I am honored to be newly elected as Board President of the American Cider Association. We have a fantastic new strategic plan with initiatives to strengthen understanding and support in the trade, make innovation and compliance easier, to support cider makers of all sizes and models, and to specifically reach out to Black, Indigenous and People of Color to let them know we welcome them as makers, customers, influencers, trade buyers and suppliers. As we go forward, I pledge to you that as Board President, my email door is always open, that I will work with my fellow Board members and Michelle to strengthen our organization and the value it delivers to you, our members, and that we will do our work in a way that brings us together in our common goal to build a great industry for everyone. – Eleanor Leger, 2021 ACA Board President

For media inquiry about these election results, please contact Michelle McGrath: michelle [at] ciderassociation [dot] org.

ICYMI: CiderCon® Starts Tomorrow!

CiderCon® is literally just around the corner! Virtual doors open at 8:00am tomorrow, Wednesday, February 3, 2021. Are you registered yet? If not, there is still time! Click the button above to be directed to our virtual platform, Hopin, where CiderCon is being held this year, and you can still buy your tickets. Trust us, you don’t want to miss out on all the amazing sessions we have offered this year, nor the super sweet virtual Trade Show! Plus, if you’re a registered attendee you will have access to the sessions long after CiderCon so you can check out sessions you missed at your leisure. Curious about just how awesome these sessions are: Read on for some recent highlights!

At Hopewell Brewing – one of Chicago’s rising brewery stars – success is not defined by bottom lines. Thanks to co-founder Samantha Lee, the brewery measures its performance against the way it treats its employees, and prioritizes being responsible community members and building a culture of good business practices. In this session, Lee shares how her progressive craft brewery flipped the script on traditional craft brewery business by putting people over profits. Plus, hear about how the brewery has maintained that sense of togetherness and hope during the pandemic — through activism, creative connection, and, of course, brewing damn good beer.

Cider producers are facing several issues which impact successful canned packaging, including overcoming reduced aromas due to formation of H2S which can negatively impact consumer opinion upon consumption. Join this session to hear about research from Cornell University using accelerated aging tests to predict corrosion and H2S formation during long-term storage of wine and cider in aluminum packaging. Producers will discuss preliminary results and observations from current trials with Enartis related to reducing the use of SO2 and removing copper-bound sulfides to increase shelf stability and minimize the appearance of sulfur off aromas in the can. The panel will discuss solutions and trends to be aware of and continue exploring.

While keeping our distance has become the norm in 2020, everyone who chooses to visit your taproom for on-premise consumption is accepting that some level of interaction will occur. Even during the shortest, COVID-era encounter, you have the ability to build connections with your guests. In this session, we will show the financial value of engaging at a high level and why it is vital even more so during a pandemic.

Why bother with home cidermaking if you are not going to experiment? This session will explore various ways in which cidermakers can experiment on a small-scale. Darlene and Dana will provide advice regarding experimental-control design that will enable you to more objectively evaluate the effect of your “treatment.” The presentation will include examples of successes as well as failures. If you are interested in experimenting with additions from native plants, we will provide tips for investigating previous uses by Native American tribes and emphasize the importance of doing your research to ensure you do not poison anyone. Finally, Dana will share her own experiences using California native plants such as Manzanita (“Little Apple” in Spanish), Elderberry, Toyon, and Pacific Madrone.

Consumers and commercial food buyers are increasingly interested in products with “sustainable” attributes — products that are local, natural, organic, or claim other social or environmental benefits. This session will review consumer and market research on the demand for sustainable products. We will consider some best practices for making sustainability claims and address the differences between first, second and third party claims. We will also discuss the pros and cons of third-party certification and the roles that certification can play improving operations and supporting the brand and product marketing.

This session will detail how cidermakers in the United States are presenting single variety ciders and ciders that specifically call out notable varieties in a blend. We will examine the feedback loop from producer to consumer and chart how this is changing the way producers market their products. We will talk about creating successful tasting notes and how to educate consumers on raw materials.

CiderCon® 2021 Trade Show Word Hunt Game!

Our virtual trade show is 🔥! And to make it sizzle a little bit more, we’ve created a fun word hunt game and a chance for YOU to win awesome prizes.

How to Play: Visit the trade show during the LIVE scheduled hours and ask the vendor for their magic word. Collect the words to complete a phrase. Think you have the phrase solved? Submit your guesses here. Make sure you have collected the magic words from at least these booths before you submit your answer: FruitSmart, Ekos, Fermentis, Fintech, Voran, Juicing Systems, CINA and Cider Culture. All booths have a word—visit them all for our best chance at winning.

The phrase is 4 sentences long, comprised of 44 words. There is a bonus prize for the first person to submit the right answer: a CiderCon hoodie! All correct guesses will be entered into a raffle for 4 nights hotel and 1 conference registration for CiderCon 2022 in Richmond, Virginia.

Submit your words and make your guess here! Game closes at 10:45 AT PST on Friday. Winners are announced during the grand toast. GOOD LUCK!

Hint: Apple Mythology

2021 ACA Board Candidates

As a 501C-6 non-profit membership-based trade association for the US hard cider industry, each year the American Cider Association holds elections for our board of directors. The board members play a critical role in governance and oversight as well as guiding strategic decisions. Our bylaws have established specific seats that include representation for regions and cidery size (gallons produced). Our succession plan rotates which seats are up for election each year to ensure a mixture of new perspective and institutional knowledge. This year there are 3 seats who are up for election—2 are “At Large” and the third is for Large Cidery (>1M g; voted for among ‘Large Cidery’ members only).

Our elections are electronic with a vote by email system. Each cidery gets 1 ballot. Ballots are sent to the Primary Contact email in our database. Members are encouraged to get team input on who your cidery is voting for.

Ballots will go out Wednesday morning and will close Friday morning. Only active ACA members will receive a ballot. As there are two seats available for the At Large Director category, members will have the chance to cast a vote for two candidates.

It is our pleasure to introduce to you the 2021 ACA Board Election Candidates. At Large Candidates: Brooke Glover, James Chuck, Soham Bhatt and Tyler Butcher. Large Cidery Candidate: Ryan Burk. Scroll down to get to know all of these candidates and what they hope to do on the board of the ACA.

>>At-Large Board Candidates

Brooke Glover – Swilled Dog Hard Cider (West Virginia) Watch Brooke’s Candidate Statement and read her words below:

“My name is Brooke Glover, and I am the co-founder of Swilled Dog Hard Cider, a small cidery out of West Virginia. I’ve had the privilege of serving on the Board of the ACA for the past three years, including as Vice-President for the last two, as well as chair of the Marketing Committee and as a member of the Gov’t Affairs Committee. It would be an honor to continue my service to the industry and to our members and I’d like to focus on three things should I be re-elected: 1. Regulatory affairs and lobbying for our industry. We’ve had some significant wins this year in this department and I’d like to continue advocating for our members and keep the momentum to help make regulations fair and logical. 2. Continuing to act as a representative for our smaller cideries. Smaller cideries need to continue to have a voice in the decisions that affect our approach to the industry’s growth. This includes helping to get data that can be used to make business decisions and gain shelf space. 3. Continued growth of the industry. To fulfill the ACA’s mission of having a successful and diverse industry, we need to work together and support each other. Bringing together all cidermakers in this goal needs to continue to be a focus for our organization. Thanks so much! I would love the privilege of continuing to serve you and I appreciate your vote.”

James Chuck – Empire Cider (New York) Watch James’s Candidate Statement and read his words below:

“I know how tough the cider business is. I’m running for an At Large Board position because I want to help you and your company survive COVID and thrive once it’s over. I co-founded the Empire Cider Company in New York State in 2013 to make great ciders from New York apples. We’ve had some successes and failures, won awards and helped others throughout the country do so, too. I’ve served on the Marketing committees of both the ACA and the New York Cider Association, and am a member of the NYCA’s Social Justice Committee. As an At Large member I’d apply my background in hard cider company management, strategy consulting, social entrepreneurship, economic development and digital marketing to: 1) Help us all grow the US cider category by 50% to $2 billion with gains in every region and state; 2) Protect and increase cider shelf-space in off-premise accounts; 3) Support cider’s return to on-premise accounts so that sales and margins post-COVID are better than pre-COVID; and 4) Create tools and templates to help small and medium sized cideries achieve lasting profitability. Additionally, I would support Michelle’s work advocating to ensure an inclusive and successful US cider industry in which you can achieve healthy living-wages and sustainable economic viability in order to continue your passion of cider-making, environmental and land stewardship, and job preservation and creation in your community.

I’m committed to contribution and I’d be grateful for your vote and the opportunity to serve you as an At Large member on the Board of the American Cider Association. Thank you very much.”

Soham Bhatt – Artifact Cider (Massachussetts) Watch Soham’s Candidate Statement and read his words below:

“This past July during an otherwise hilarious monologue on Jimmy Kimmel Live! comedian Iliza Shlesinger did a bit on hard seltzer brands. She joked, “the hard seltzer race, too many contenders!…we saw this gold rush with the flavored water game and hard cider game”. [cringe]. While it might be true that hard seltzer is getting saturated, I know for a fact that “the hard cider game” is anything but a gold rush. Having started my cidery with my best friend and our paltry pooled life savings, it was dispiriting to think that the mainstream understanding of this beverage had been reduced to a flash-in-the-pan, forgettable fad drink. Even after untold fits, starts, and the motivation pulverizing life of small business, I’m still optimistic about the promise of cider. I’m optimistic about the diversity of approaches we have in the United States and how we can collaborate with our peers across the globe. I’m excited about everything from exploring terroir in cider to the coolest co-ferment on the block. But I think that on the most fundamental level, it’s still a broadly and tragically misunderstood beverage. So my goal, if honored with the opportunity to serve on the board of the ACA, is a simple and focused one. I’d like to contribute and expand the work currently being done to figure out new and novel ways to educate the trade and our drinkers about cider, our different approaches, the value of diversity in those approaches, and why cider is not a fad. Despite our differences, there are a number of things that all cider producers can agree on and industry materials should reflect it. Perhaps someday as a result of these efforts, Iliza will know the difference between the ‘gold rush’ she referenced and the Gold Rush we care about.”

Tyler Butcher – Kekionga Cider Company (Indiana) Watch Tyler’s Candidate Statment and read his words below:

“Hello all. I am the co-founder of Kekionga Craft Company, which opened in July of 2017. We are a farm winery that is located within a historic apple mill, dating back to the late 1920’s. Cider is our primary focus, as we can and bottle for distribution in the 10-county area of northeast Indiana. I recently joined our company full time to manage all the business operations. I have 10+ years of experience in the accounting and finance industry. I have worked for companies with revenues that range from 12 mil up to 6 billion. Currently, I hold the position of treasurer for the Northeast Indiana Beer Trail. I am hoping that my passion for small business and the alcohol industry, combined with my financial background, would be a great fit for the American Cider Association.”

>> Large Cidery Board Candidate

Ryan Burk – Angry Orchard (New York) Watch Ryan’s Candidate Statement and read his word’s below.

“Hey, American Cider Association! Ryan Burk here from Angry Orchard. I am asking for your vote for my third term on the ACA board. I’m really excited to continue my work on the board, and to contribute at a high level to the cider industry at large. I definitely appreciate being able to be a bridge between CINA, that’s the Cider Institute of North America, and the American Cider Association Board. Education in the cellar is something that I’m personally interested in and invested in, not just for myself but for other cidermakers. Certainly education as relates to the CCP and the Certified Pommelier program, connecting with our friends in the bars, at the wholesaler, etc, provides an opportunity to elevate their own education and become experts in cider. We can continue to develop a shared language about what cider is. All of these things are really interesting to me, and I think are our greatest opportunities as we move forward with our dynamic and growing industry.

I think that I can share a local‑here in New York‑national, and global perspective, with the board, and with the industry, and I’m happy to continue to get that opportunity. Cheers and happy CiderCon!”

CiderCon 2021: Sustainability Leadership Action Group

This CiderCon session will take place Thursday, February 4, Noon to 1PM PST.

This facilitated Leadership Action Group breakout session begins the process of exploring the practices and metrics that are – or could be— the call signs of a sustainable cider enterprise and industry. This interactive session kicks off with a brief orientation on sustainability and measurement with sustainability strategy and reporting expert Lisa Spicka of Maracuja Solutions. With this background as reference, participants will share sustainability successes and challenges with peers. Finally, the group will work through a series of discussions to identify how sustainability might be leveraged to elevate the performance and reputation of the cider industry and its businesses, with a focus on the metrics that might be measured to help tell the story. You won’t want to miss being a part of this Thought Leadership initiative!

Pre-Registration Requested: To enhance session outcomes, we request that participants pre-register via this Google Form by February 2nd. The Form (@ 5-10 minutes to complete) includes simple background questions. However, you won’t be turned away if you “show up” the day of the session!