Archive for November 2025

ACA Welcomes Three New Certified Pommeliers™ Following Exam in Virginia

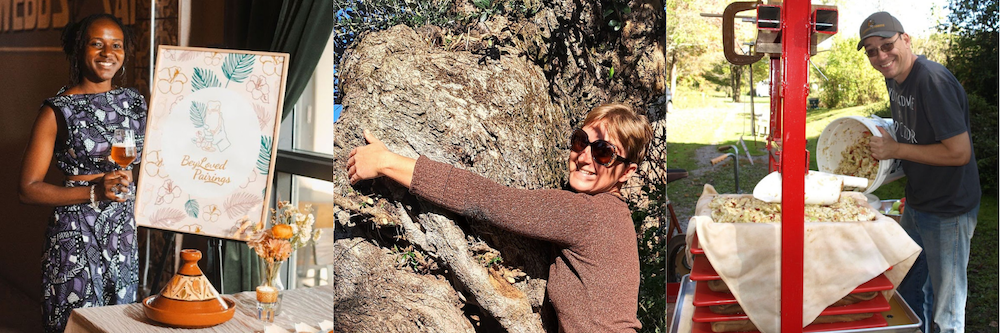

The American Cider Association (ACA) is pleased to announce that three individuals have achieved the rank of Certified Pommelier™ following an exam held in Charlottesville, Virginia on October 6. The newly minted Certified Pommeliers™ are Brittany Kordick of Kordick Family Farm, Joanne Mumbey of BeyLoved Pairings LLC and award winning amateur cidermaker Brad Winans.

Joanne Mumbey, Brittany Kordick, and Brad Winans

“We are so proud to welcome these new Certified Pommeliers™ to our vibrant community of experts elevating the appreciation and understanding of cider,” says ACA Director of Education and Program Development Jennie Dorsey. “Each new member brings with them the stories of orchards, the craftsmanship of cidermakers, and the passion of enthusiasts that makes our community thrive. We are very excited to see what the future holds and the new heights that our community can reach together.”

The ACA originally launched its Certified Cider Professional™ (CCP) program to equip industry leaders with the expertise to navigate cider’s rich diversity with confidence. As cider’s popularity continues to grow, the program is gaining popularity with food and beverage professionals wanting to set themselves apart from their peers with exceptional skills, deep knowledge, and a commitment to hospitality.

“We know that top dining experiences are built on knowledgeable, confident service, and cider deserves to be part of that conversation,” says ACA CEO Monica Cohen. “Our Certified Cider Professional™ program ensures that food and beverage professionals have the expertise to showcase cider’s full potential. With cider pairings, we know the dining experience for guests is elevated.”

More about the Certified Cider Professional™ Program and Upcoming Opportunities

The Certified Cider Professional™ program is designed to educate those on the front-line of cider sales, making it the world’s most comprehensive and in-depth cider appreciation program for food and beverage professionals worldwide.

The CCP program begins with a Level 1 Certified Cider Guide™ (CCG) designation to help industry professionals develop a fundamental understanding of cider. The Level 2 Certified Pommelier™ (CP) designation takes it a step further by encouraging cider professionals to think critically and showcase a higher level of understanding of the elements of cider.

The ACA is dedicated to ensuring that all information tested on the exam is made accessible to anyone who desires to learn. To that end, the ACA released a textbook in March of 2023 to help candidates prepare to take the exam with just one comprehensive resource. The second edition of the textbook was released in March of 2024 to present a more global view of the cider industry as well as including new sections covering important emerging sectors such as low and no-alcohol products. The textbook is available for purchase through Kindle Direct Publishing. Additionally, the ACA offers sensory analysis practice webinars and a Facebook study group continuously updated with resources for exam candidates. Interested candidates can find links to all Certified Pommelier™ resources on the ACA website.

For those interested in attaining their Certified Pommelier™ designation there is an upcoming exam at CiderCon® 2026 in Providence, Rhode Island on February 3. Registration for the exam is on the ACA website. While exam takers do not have to be registered for CiderCon® 2026 to take the exam, it is highly recommended as a way to connect with the larger cider community.

Contact the ACA’s Director of Education Jennie Dorsey for more information about global cider education and access to Certified Cider Professional™ programming near you. You can also learn more at https://ciderassociation.org/certification.

###

Cooking with Cider at Thanksgiving

If you’re looking to add a unique twist to your holiday menu this year, consider cooking with cider for Thanksgiving. This versatile ingredient can elevate both sweet and savory dishes and perfectly complements traditional flavors. Check out the recipes below to explore creative ways to incorporate cider into your Thanksgiving feast, ensuring your celebration is both memorable and mouthwatering. You can also download the recipes here so you can print them out and use them anytime!

Cider Brined Turkey

Prep Time: 20 minutes plus 12 to 24 hours brining

Cook Time: Varies by turkey size

Ingredients:

- 1 whole turkey, 12 to 16 pounds

- 2 quarts cider

- 2 quarts water

- 1 cup kosher salt

- 1 cup brown sugar

- 2 teaspoons black peppercorns

- 4 bay leaves

- 6 sprigs fresh thyme

- Peel of 1 orange

- 6 garlic cloves, smashed

Instructions:

- Heat 1 quart of water in a large pot. Add salt and sugar. Stir until dissolved.

- Remove from heat. Add remaining water and all aromatics. Add cider last so it stays cold.

- Chill the brine completely.

- Place the turkey in a large container. Pour the brine over the turkey, making sure it is fully submerged.

- Add more water if needed. Refrigerate for 12 to 24 hours.

- Remove turkey from the brine. Pat completely dry.

- Roast according to your preferred method.

- The turkey will cook slightly faster due to the brine, so check temperature early.

- Rest for at least 20 minutes before carving.

Cider Herb Gravy

Serves: About 2 cups

Prep and Cook Time: 15 minutes

Ingredients:

- 2 tablespoons turkey drippings or butter

- 2 tablespoons flour

- 1 cup cider

- 1 cup turkey or chicken stock

- 1 teaspoon chopped thyme

- 1 teaspoon chopped sage

- Salt and pepper to taste

Instructions:

- Place your roasting pan on medium heat or use a saucepan with drippings.

- Add flour and whisk into the fat to form a smooth roux. Cook for 2 minutes.

- Pour in the cider. Scrape up browned bits.

- Add stock. Simmer until thick.

- Stir in herbs, salt, and pepper.

- Serve warm.

Cider Braised Brussels Sprouts with Bacon

Serves: 6

Prep Time: 10 minutes. Cook Time: 20 minutes

Ingredients:

- 1 pound Brussels sprouts, halved

- 4 slices bacon, chopped

- 1 small onion, sliced

- 1 cup cider

- 1 teaspoon Dijon mustard

- Optional, 1 small apple thinly sliced

- Salt and pepper to taste

Instructions:

- Cook bacon in a large skillet until crisp. Remove and keep the fat in the pan.

- Add onion and Brussels sprouts. Sauté until lightly browned.

- Pour in cider. Add apple if using.

- Simmer uncovered until the liquid is reduced and glossy, about 10 minutes.

- Stir in Dijon. Add salt and pepper.

- Return bacon to the pan and serve.

Cider and Maple Glazed Carrots and Parsnips

Serves: 6

Prep Time: 10 minutes. Cook Time: 20 minutes

Ingredients:

- 2 pounds carrots and parsnips, sliced on a bias

- 1 cup cider

- 2 tablespoons butter

- 2 tablespoons maple syrup

- Salt and pepper to taste

Instructions:

- Place carrots, parsnips, and cider in a skillet. Bring to a simmer.

- Cook until carrots and parsnips are almost tender, about 10 minutes.

- Add butter and maple syrup.

- Continue cooking until the liquid reduces to a shiny glaze.

- Season with salt and pepper.

Sourdough Cider and Sage Stuffing

Serves: 8

Prep Time: 15 minutes plus apple soak. Cook Time: 40 minutes

Ingredients:

- 8 cups cubed sourdough bread

- 1 onion, diced

- 2 celery stalks, diced

- 4 tablespoons butter

- 2 apples, diced

- 1 cup cider

- 1 tablespoon chopped sage

- 1 cup stock

- Salt and pepper to taste

Instructions:

- Toss diced apples with cider. Let soak for 15 minutes, then drain and reserve cider.

- Sauté onion and celery in butter until soft.

- Combine bread, vegetables, apples, sage, and reserved cider.

- Add stock until the bread is moist but not soggy.

- Transfer to a baking dish. Bake at 350 F for 30 to 40 minutes until golden on top.

Cider Cranberry Sauce

Serves: 8

Prep Time: 5 minutes. Cook Time: 15 minutes

Ingredients:

- 12 ounces fresh cranberries

- 1 cup cider

- 1 cup sugar

- Zest of 1 orange

- 1 cinnamon stick

Instructions:

- Bring cider and sugar to a simmer.

- Add cranberries, orange zest, and cinnamon stick.

- Cook until berries burst and the sauce thickens.

- Remove cinnamon stick. Cool before serving.

Perry Pear Crisp

Serves: 6

Prep Time: 15 minutes. Cook Time: 35 minutes

Ingredients:

For the filling:

- 4 pears, sliced

- 2 tablespoons sugar

- 2 tablespoons butter

- ½ cup perry

- Pinch of cinnamon

For the topping:

- 1 cup oats

- ½ cup flour

- ½ cup brown sugar

- ½ cup cold butter, diced

- Pinch of salt

Instructions:

- Cook pears with butter, sugar, cinnamon, and perry until just tender.

- Transfer to a baking dish.

- Mix oats, flour, brown sugar, and salt. Cut in the butter until crumbly.

- Sprinkle over the pears.

- Bake at 350 F for 30 to 35 minutes until golden and bubbling.

- Serve with fresh whip cream or a scoop of vanilla ice cream.

ACA Now Accepting Nominations for 2026 Board of Directors

The ACA Board of Directors is comprised of passionate, active cidery owners – large and small – who are committed to shaping the future of the organization and the greater cider industry. If you’d like to be part of that and are ready to lend your voice, ideas, and leadership to this important work, now’s your chance!

The American Cider Association (ACA) has six seats open for election on our Board of Directors in 2026. The available positions are as follows:

- 1 Large Cidery Seat

- 1 Regional Chair – Mountain West

- 1 Regional Chair – Northwest

- 1 Regional Chair – Midwest

- 2 At-Large Seats

Our annual nomination window is now open, and we want to hear from you!

Election Details

Elections will be conducted electronically during CiderCon® 2026, taking place in Providence, Rhode Island, from February 3-5. All U.S. member cideries are eligible to vote, with each cidery having one vote. Primary cidery contacts will receive an email on February 3 inviting them to vote for board members.

While previous volunteer experience with the ACA is not mandatory, it is highly encouraged for those considering a run for office.

Application and Eligibility

Here are the specifics for those interested in applying:

- Eligibility: Positions are open to any active ACA member cidery in the U.S., regardless of size, excluding the Large Cidery Seat which must be filled by a cidery making 1,000,000+ gallons annually.

- Application Deadline: December 19, 2025.

- Candidacy Requirements: You must be a permanent employee of a bonded cidery producing cider in the U.S.

- Term Duration: Each term lasts for three years.

Please be aware that incumbents may be running for re-election. Applications will be reviewed on a rolling basis until the deadline, and qualified candidates will receive further instructions on the board election process.

Need More Information?

For any questions regarding board service, feel free to reach out to ACA CEO Monica Cohen at monica@ciderassociation.org to schedule a meeting.

To submit your nomination by the December 19 deadline, please complete the self-nomination form. We look forward to your contributions and are excited to see the future leaders of our industry step forward!

CiderCon® 2026 – You’ll Be Glad You Did It!

Some events are too good to miss…and CiderCon® is one of them.

Invest in your cidery by investing in your knowledge, your network, and a week that will change the way you think about cider. Sessions and speakers are in place and it’s going to be a good one!

CiderCon® is the gathering for everyone shaping the future of cider, from orchardists and makers to marketers, distributors, and enthusiasts. It’s where learning, tasting, and connection come together to spark ideas and strengthen our industry.

This year’s theme, Crafting Cider’s Future Together, celebrates the collaborative spirit that defines cider and the momentum driving us forward. The cider industry is at a powerful intersection of tradition and transformation and together, we’re building what comes next.

While official programming kicks off Wednesday and Thursday, February 4–5, the excitement starts much earlier!

Monday: Choose your own adventure from tours like Prohibition in Providence: A Drinking History Tour to Cider Tours through Connecticut and Rhode Island, or enjoy a flavorful Culinary Arts Museum Tour & Demonstration.

Tuesday: Dive into our TTB Bootcamp, or, if you’re launching or dreaming of your own cidery, don’t miss the brand-new From Vision to Viability: Startup Cider Business Bootcamp. Then grab your ticket to the always sold-out Cider Share, where ciders from around the world are poured and connections are made.

Wednesday: The official kickoff to CiderCon®! Hear updates from ACA Board President Christine Walter (Bauman Cider) and Monica Cohen, CEO of the American Cider Association. Guest speaker Alan Reed, CEO of Chicagoland Food and Beverage, will share insights on meeting today’s consumers where they are and industry friends Jim Bair, CEO ofU.S. Apple and Bart Watson CEO of the Brewers Association, will give us updates and insights from their vantage points.

Attendees will then enjoy a variety of information sessions throughout the day on Wednesday and Thursday from Cider Apples of the Future to Who Put the Band-Aid in the Barnyard? plus have an opportunity to attend a variety of different tasting sessions, ample time to explore our biggest-ever trade show, and the chance to pick up some cider swag and the latest book releases at the ACA Bookstore.

Wrap up the week with the Grand Toast and a new Cider Party the perfect way to celebrate what we’ve learned, shared, and envisioned together.

CiderCon® 2026 | February 2–6 | Providence, Rhode Island

CiderCon® 2026 | February 2–6 | Providence, Rhode Island

Learn. Connect. Celebrate. Craft cider’s future together.

The Shutdown’s Nearing an End. Now What?

After weeks of uncertainty, the federal government is (almost) finally back in business and that means the TTB and other key agencies are, too. For cideries, this is the moment to shake off the disruption, check in on delayed approvals, and get your product plans back on track.

The American Cider Association (ACA) has continued to stay in touch with Hill offices throughout the shutdown to make sure the voice of cider was still being heard. Now that things are moving again, offices are far less distracted and listening. Which means this is the time for cidermakers across the country to speak up and make sure Congress understands how federal policy impacts your business and your growers.

Here are a few steps to help you get back up to speed—and plug into the national cider conversation while it matters most:

Now is the Time to Use Your Voice

Lawmakers are turning their attention to appropriations before the end of the year, and now is when your voice has the most impact.

We’re calling on everyone in the cider community to join our Do Gooder campaign and send a quick message to your Congressional representative about the Bubble Bill—a key piece of legislation that supports small producers and the farmers they work with. It takes less than a minute – click the link, enter your address, press send.

Do Gooder Link to Email Your Reps

A personal note from a constituent cidermaker goes further than you might think. Even just a handful of messages can help move the needle and keep cider in the conversation on Capitol Hill. If you’re a cider lover rather than a cidermaker, your voice can help elevate the message from the cideries you love.

Check on Your TTB Filings

With the TTB reopening, the agency is now working through its backlog of label and formula approvals. If you have pending applications, log in and confirm their status.

If anything was returned or expired during the shutdown, resubmit as soon as possible and prioritize what’s most urgent for your production schedule.

Reassess Your Production and Release Schedule

A temporary freeze can throw even the best-laid plans off course. Take a fresh look at your seasonal releases, packaging timelines, and distributor communication. If your new ciders were caught in the delay, use this moment to reimagine your launch strategy. Perhaps pair a release with a taproom event or local collaboration to generate excitement?

Stay Visible in Your Community:

Your customers are always ready to support you. Host a cider release, organize a small tasting, or simply share what’s new at your cidery. Keeping your story front and center helps the public, and policymakers, understand the role cider plays in local economies and agriculture.

Who’s Ready for the End of Premiumization?

Each month consumer insights platform Sightlines will share one quick hit you can use to make confident decisions. Also, ACA members get 50% off a Sightlines subscription. Find the discount code in the Resource Hub.

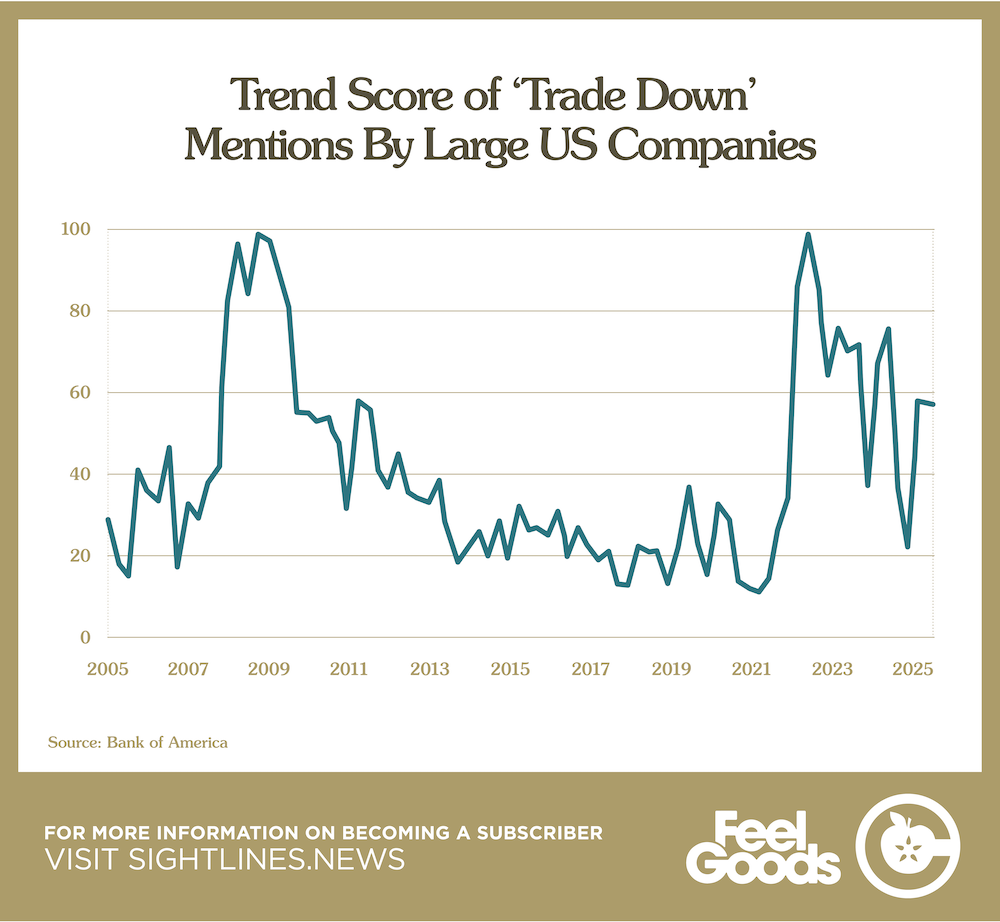

Consumer spending in the U.S. has, of late, been buoyed by the wealthiest Americans. Recent analysis of Federal Reserve data by Moody’s Analytics showed that the top 10% of earners in the U.S. (those whose households make $250,000 or more annually) accounted for 49% of total consumer spending in Q2 2025. That’s the highest level ever reported since such data collection began in 1989, and it’s well above the one-third of overall consumer spending that group represented in the early 1990s.

Well-off Americans have carried water for much of the economy, but they can’t do it forever—particularly not when it comes to alcohol. The discretionary spending power of the wealthy has for years been a driver of premiumization, but the tides may be turning. Those households, after all, only need to buy so much beer or wine or cider. Eventually, all but the most exclusive of luxury brands need “average” Americans to buy in, or need the wealthy to buy even more. But we are currently seeing the affluent slow their spending: Analysts at Jefferies and Moody’s have noted that affluent shoppers have pulled back on luxury spending and are showing an increased appetite for discounts and deals. As a result, mentions of “trading down” in conference calls by large U.S. consumer companies have ticked up in recent years, echoing spikes seen after the housing market crisis in 2008 and during the post-COVID inflationary period. Sales of private label staples are breaking records. Amazon Prime Day shoppers spent on staples, not big-ticket buys. Lower-cost retailers like Kohl’s, TJ Maxx, and Dollar Tree have seen stock prices rise this year as investors bet on shoppers continuing to hunt deals. Even Gen Z is taking advantage of early-bird specials and happy hours. Alcohol companies need to recognize that a broad trend toward premiumization is no longer a given. What will make up the slack when big spenders pull back?