Archive for September 2020

📣 ACTION ALERT: Renew the Craft Beverage Modernization and Tax Reform Act

Cideries like yours are facing the harsh economic realities of a global pandemic. Congress needs to be proactive in supporting small businesses like yours right now, but they also need to protect you from further economic harm. In a normal year, raising Federal Excise Taxes could significantly damage our industry’s viability. In 2021, raising taxes could force hundreds of cideries to permanently close their doors. Join us in urging Congress to act urgently and make the Craft Beverage Modernization and Tax Reform Act permanent NOW.

This will impact all segments of the cider industry. It’s critical we work together in reaching out to lawmakers today or come January 1, your Federal Excise Taxes may go up significantly.

Please reach out to Congress today and tell them your business needs a break: Make the Craft Beverage Modernization and Tax Reform Act permanent!

Two New ACA Member Benefits

We admire hustle, but we hope that your ACA membership makes cidery life a little bit easier. We have two new benefits we’re eager to tell you about, plus some exciting things to look forward to!

1. 15% Discount off of CiderPros.com Job & Marketplace Listings

We’re honored to be a founding partner in CiderPros.com–a new jobs site for the cider industry. We’re thrilled to extend a 15% discount off of the cost of job and marketplace listings to our members. You can find the coupon code on our members page here (logging in required first step to access). We will update the code from time to time.

2. Cider Press List 101

If you are just ramping up your cider specific media outreach efforts, we’ve got a starter list to get you going. You can access the list here under our Marketing Tools section (logging in required first step to access). Thank you to the ACA Marketing Committee for curating this list for our members!

Need a refresher on best practices for submitting press releases to media? Download this CiderCon 2019 Presentation from media professionals Erin James and Caitlin Braam.

+Benefits in the Pipeline:

We’re excited to launch on-demand training for our Certified Cider Professional program and cider compliance guidelines this fall. We’ll also have some new market insights available soon. Stay tuned!

>Renew Your Membership Today

Are your having a hard time navigating our website to renew your membership? Email us and we can send you a quick invoice with a link to pay with a credit card. We’ve been affected by the COVID pandemic and your renewal today can have a huge impact. We have a small thank you for those who renew early by a month or more.

Q2 Nielsen Reports Ready For Download

One of the perks of combining our buying power as an association is that we can share valuable insights from Nielsen with you, our members.

You can now download our custom Q2 reports. In this data packet you will be able to access:

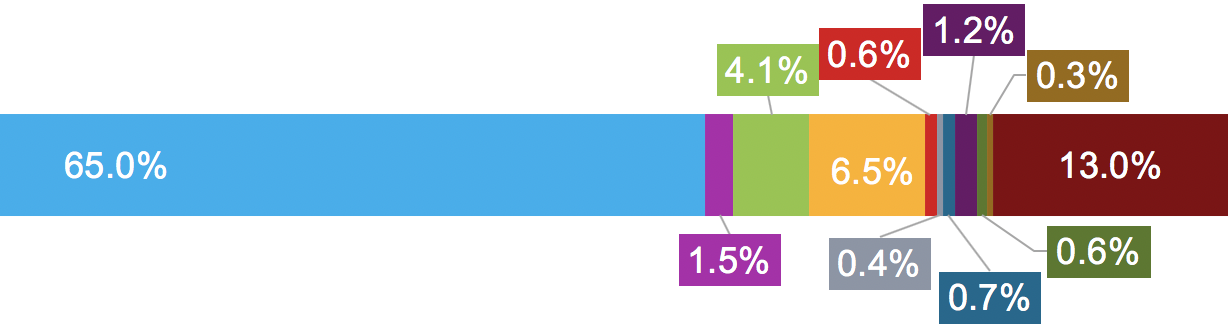

- Off-Premise Micro-Reports broken down for packaging type, flavor, and region–14 states and 6 regional outlooks. Available in both a 12-week and a 52-week outlook.

- Off-Premise Macro-Reports for Beer, FMBs and Cider. Available in both a 12-week and a 52-week outlook.

- On-Premise Reports for 6 metro markets.

- Nielsen PPT slide decks with charts, data visualization and insights on the cider category’s recent performance in both On- and Off-Premise.

- Bonus this quarter: Hard Seltzer off-premise report.

Here is an excerpt from a recent Nielsen survey about current overall consumer sentiment:

CONSUMER SENTIMENT REPORT SUMMARY BY NIELSEN

“Here are some high-level findings from a Nielsen survey of 18K+ consumers, fielded July 1-8, 2020.

- Since June, we have started to see some consistent trends not only for off premise alcohol, but also across many consumer good categories. That comes to life in consumer sentiment as well. 60% of households expect their routines to remain altered for at least the next 4 months

- Nielsen has shared insights in the past in several forms about how premiumization within off premise alcohol isn’t slowing down, and has in fact accelerated during COVID weeks. However, when it comes to total consumer goods, we are starting to see more cautious consumer sentiment in relation to spending. Approximately 4 in 10 (42%) of households say they are watching what they spend as a result of COVID.

- The homebody economy continues. When asked what % of time households eat meals or snacks at home versus outside of home, 39% of households said they ate 100% of their meals and snacks at home. An equal amount (39%) said they ate outside of their home only 10% of the time. As a comparison, when asked what their habits were prior to COVID, only 12% said they ate all of their meals at home.

- When asked what their plans are for the coming months, close to 1 in 3 households (28%) said they plan to eat all of their meals at home. That of course was lower for younger consumers age 21-34, and much higher for consumers age 65+.

- What about consumer plans if economic conditions get worse (recession and/or inflation)? When asked about things they would do to save money when shopping for beer or wine, 39% said they won’t change how they shop for it. However, nearly ¼ said they would buy less. That’s a slightly different story for households with lower income (<$30K), which said they would be more likely to stop buying it all together.”

Q2 2020 Nielsen Reports for Our Members

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.