Posts by Michelle McGrath

SBA Re-Opens EIDL For Ag Biz Only

When the SBA first started offering Economic Impact Disaster Loans (EIDL) with an associated cash-advance to help counter the impact of the Corona virus on small businesses, farm-based businesses were disqualified from applying. Farming advocates were hopeful that the USDA was going to provide financial relief to those businesses as prescribed by the CARES Act, but the roll-out of such relief remains to be seen.

SBA’s Corona-relief programs have faced enormous demand, and congress had to recently add more resources to the programs to keep them running (PPP & EIDL). The demand for the EIDL loans was so great that the SBA ran out of funds long before all the applications were assessed. When the CARES 2 Act, as it’s sometimes called, provided more funding for EIDL, the queue of unprocessed applications was so long the SBA decided to keep the application closed.

Recently, the SBA has decided to reopen applications but for agricultural businesses only. The Small Business Act defines agricultural enterprises as “businesses engaged in the production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries.” Eligible agricultural businesses must have 500 or fewer employees. There are two qualifying questions when applying for an EIDL. The first question asks what type and size of business you are applying for. “Applicant is an agricultural enterprise with not more than 500 employees” is one of the options.

Reopening of EIDL is good news for apple suppliers, orchards, farm-stand cideries and other agricultural enterprises in the cider industry.

The EIDL application for agricultural enterprises is available here.

ACTION ALERT: Low-interest loans are helpful, but much more is needed to support the cider community. Congress needs to be reminded that this industry is in dire need of support.

As one of our members recently shared: “Our sales are down 60%. I’ve had to furlough 92% of our staff….It’s a sink or swim in dangerous water situation, and our elected officials need to know.”

Read more about what the American Cider Association and Craft Beverage Coalition are asking for:

American Cider Association Virtual Listening Tour

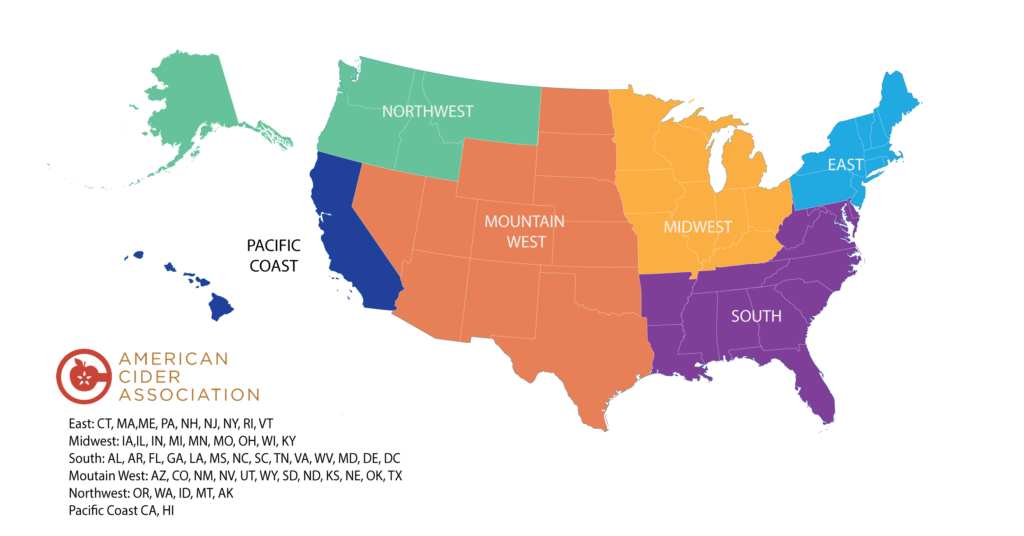

Virtual Listening Tour: May 12-15

We’re hitting the virtual road! Please join the board of the American Cider Association for a listening tour next month. What you can expect:

- Program & resource updates from Executive Director Michelle McGrath, including the legislative & compliance landscape for cider and COVID-19 pandemic updates

- Virtual Listening Session led by Michelle with your Regional Board Chair

- Informative Guest Speakers

We hope you’ll join us with your questions and comments on the national landscape for cider and the American Cider Association’s involvement. Please note that to keep this meeting productive, we are limiting the meeting to pre-registered participants and a password is required (received upon registration).

LINKS TO REGISTER CAN BE FOUND BELOW

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Eastern Region

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Midwest Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Southern Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Mountain West Region

–>Thursday, May 14: American Cider Association Virtual Listening Tour: Pacific Coast Region

–>Friday, May 15: American Cider Association Virtual Listening Tour: Northwest Region

P.S. Have questions you’d like to send in advance? We’d love to hear them! Let us know what you’re thinking.

Craft Beverage Coalition Calls for Day of Action 4/22

Urge Congress to Approve Economic Relief from COVID-19 for Craft Beverage Alcohol Producers

Members of the Craft Beverage Coalition representing the nation’s brewers, distillers, vintners, cidermakers and mead producers are hosting a “Call to Action” on Wednesday, April 22 to urge Congress to provide much needed economic support for the industry. As a result of “stay at home” orders issued by state officials, craft producers are struggling to stay afloat as they take innovative steps to keep the doors open, including curbside pickup and local delivery options as well as the production of hand sanitizers and disinfectant sprays. The CARES Act provided initial relief, but much more must be done. The coalition is asking Congress to provide more economic relief so that businesses can weather this crisis, return to normal operations once the crisis is over, and continue supporting jobs and state economies across the country while providing consumers with their favorite products to enjoy responsibly.

The Coalition is asking Congress to take the following actions:

- Suspend all federal excise tax obligations on domestic and imported alcohol products, effective January 1, 2020, through December 31, 2020 so producers can dedicate scarce resources to payroll and other operating costs.

- Enact a permanent extension of the Craft Beverage Modernization and Tax Reform Act (H.R. 1175/S. 362), which now has bipartisan support from 74 senators and 343 representatives and would provide certainty amidst economic instability.

- Approve additional funding to support no- and low-interest loan and grant programs administered by the Department of the Treasury and Small Business Administration, including the Paycheck Protection Program and Economic Injury Disaster Loans.

- Authorize the Department of the Treasury to create a Workforce Stabilization Fund for the hospitality and travel sectors that will allow distilleries, breweries, wineries, and cideries to keep workers employed, maintain operations, and meet financial obligations.

- Create temporary tax incentives that encourage consumers to return to on-premise dining and drinking establishments when public health officials determine it’s safe. Examples include reinstating the expanded business entertainment tax deduction and creating a new, temporary travel tax credit equal to 50% of any expense for meals, lodging, recreation, transportation, or entertainment while traveling away from home within the U.S.

- Encourage the Administration to work with our trading partners to simultaneously suspend tariffs on beer, wine, and distilled spirits products and our supply chain partners.

Join the Call to Action and help craft producers seek much needed economic relief.

5/9/20 Updates on SBA Resources

There’s a lot of information (and a lot of MISSING information) regarding stimulus funds currently. Here are a few new pieces of info to know:

+According to the SBA, lenders supporting PPP loans “must make the first disbursement of the loan no later than 10 calendar days after the loan is approved.” Read more

+The Treasury is expected to start dispersing stimulus checks by April 10 Read more

+The government is releasing informing guidelines on many of the SBA resources on what seems like a rolling basis. Although the good news is that “EIDL Loan advances will start to be distributed this week,” the SBA has released at least in some places that the advances are for “$1000 per employee up to $10,000 max.” This is different than what was previously said.

+Farmers do qualify for PPP loans, but as of today, they do not qualify for EIDL loans. We are advocating for farmers to qualify for EIDL loans and for specialty crop support in the USDA earmarked stimulus funds of the CARES ACt. To learn more about what resources are available to farm-based businesses, check out our webinar with Penn State Extension on Monday, April 13.

+Congress is struggling to find a path forward for a bipartisan proposal that would expand the Paycheck Protection Program (PPP). It is recognized by both parties that expanding the program is necessary.

TTB Postpones Excise Tax Due Dates

The TTB announced on March 31 that they will postpone excise tax filing and payment due dates for 90 days. The full announcement and details of their plan can be read in their newsletter.

The craft beverage coalition, which the American Cider Association is proud to support, asked for excise tax relief in a joint letter on March 19.

In the announcement, the TTB acknowledged that the alcohol industry is hurting due to the COVID-19 pandemic.

“The Alcohol and Tobacco Tax and Trade Bureau (TTB) recognizes that businesses that we regulate are being severely impacted by COVID-19. To assist these businesses during this period, we are postponing several filing and payment due dates for 90-days where the original due date falls on or after March 1, 2020, through July 1, 2020.”

The American Cider Association applauds the TTB for responding to the needs of the industry during this time.

Senate Passes the CARES Act

The US Senate just passed the CARES Act, or what is commonly known as the Phase III COVID-19 economic stimulus package. The bill includes many things (here is a good summary), but 3 things in particular will help the cider industry.

- It puts cash directly in the pockets of most Americans

- It extends unemployment and expands it to include sole proprietors and contractors

- It funds small business loans to cover payroll support, mortgage payments, insurance premiums and other debt obligations. Loans used for these qualified purposes may be forgiven

We are working around the clock to address the challenges you are facing due to the COVID-19 pandemic. Our goal is to remove barriers that will make it difficult for cideries to continue operating as normally as possible as soon as possible. We’ve been working with regulators and lobbying Congress to get you the relief that you need.

It’s believed that an additional stimulus package may come together in a couple months to address certain specific industry needs, hopefully including ours. We have champions and political power because we create manufacturing jobs and agriculture is core to our being. We are Main Street.

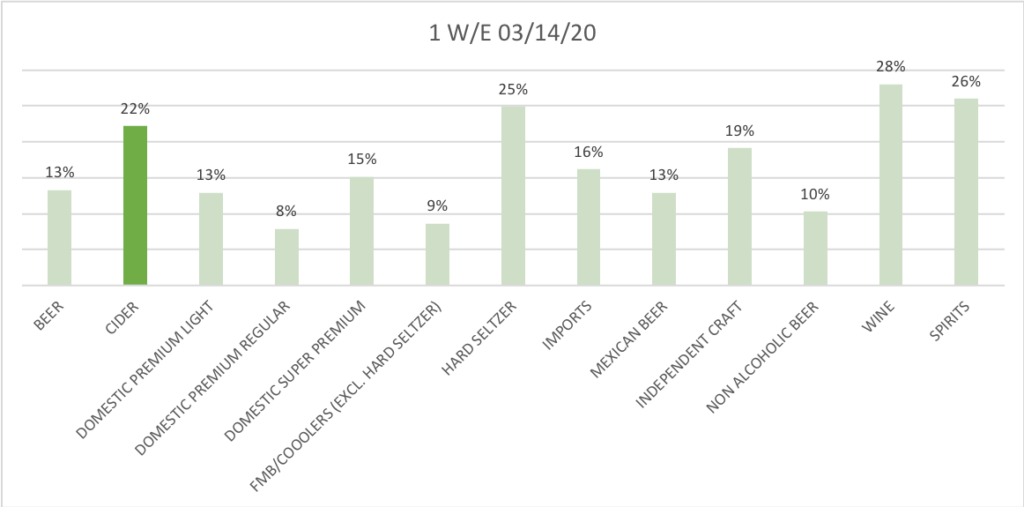

Americans Are Stocking Up on Cider

It’s no secret that shopping patterns have dramatically changed since it became clear that the Corona virus was here. The subject of endless memes, grocery shelves–especially the toilet paper section–are picked clean as people stock up for the long haul. According to Nielsen’s off-premise sales data, consumers are also stocking up on cider.

Off-premise sales in the channels measured by Nielsen show cider retail sales up 22% for the week ending on March 14 compared to the week ending on March 7. Other segments of beverage alcohol also saw increases.

Changing Retail Landscape

American Cider Association members across the country have seen sometimes dramatic changes in how their customers are buying cider. Offering local delivery has earned more dollars than previously average taproom earnings for many smaller cideries. It will be interesting to speak with online retailers to see how e-commerce shopping patterns change for cider in the coming weeks.

In an average year, on-premise sales account for roughly 60% of cider’s total sales according to Nielsen CGA (compared to 40% for beer as estimated by the Brewer’s Association). This 60/40 breakdown of on-/off-premise sales for cider doesn’t include cidery taproom or independent retailer sales. Still, it’s safe to say we will see a dramatic shift in on-premise’s dominance in cider’s marketshare in the coming weeks. Expect to see business model adaptions to continue and include curbside, delivery and online retail.

Craft Beverage Coalition Letter to Congressional Leadership Seeking Support in COVID-19 Relief Package

The American Cider Association joined trade groups for wine, spirits, beer and mead in requesting the following support for the beverage alcohol community during the Covid-19 Pandemic:

Expand Unemployment Insurance

Suspend Payroll taxes

Provide federal excise tax relief

Provide Robust no- and low-interest loan assistance

Create an industry stabilization fund

Maintain an open commercial border

Seek the suspension of tariffs on beverage alcohol and their suppliers

The association is pursuing additional efforts to support state level relief policies including ease of shipping. Cideries can help us identify opportunities for relief by taking our brief impact survey.

Covid Resources for Cideries

We are in unprecedented times. We know you are facing economic uncertainty. As your association, we are here to listen to your challenges, and get help on its way in whatever capacity we can. Here are a few things we’re doing to help.

Provide an informational hub specific to our industry’s needs: We’ve launched our Covid-19 resource page. We’ll be updating this daily to help you access useful information.

Connect you to your peers to share challenges and solutions:We have launched a Facebook group for peer to peer networking with fellow members. We will also be monitoring our website’s forum. If there was ever a time to need to connect, now is it. Members can click here to request to join the Facebook group.

Unify our voice for our specific needs: The beverage alcohol community, including the American Cider Association, is working hard to advocate for solutions to relieve the impact of closures and lost jobs. Cider is absolutely an economic driver and that’s a story that is easy to tell. The beverage alcohol community is having early conversations about delayed excise taxes and other paths to help all our members keep their doors open in the long run. How has Covid impacted your business? What form of relief would help during this difficult time? Please take our 7-question survey to help us craft the message of urgency and need to Congress and the TTB.

Look to the future: It’s hard to think about much else than this crazy situation right now. Nevertheless, the American Cider Association is working hard to find ways to help our industry weather this storm, including keeping our eye on the future of the industry. Our long-term goals to grow a diverse and successful industry haven’t changed, and we won’t lose sight of them even as we focus on short term support. We are planning to host virtual town halls for all of our regions in May. You can sign up now, forget about them for a few weeks, and then join us for updates on our next 3-year strategic plan, including our compliance camp project to provide members with comprehensive resources on topics like excise taxes, labeling, franchise law and licenses. These town halls are open to all cideries—regardless of your membership status. Stay tuned for official dates and registration links.

We’ll be back with more resources to support you on a rolling basis over the next few weeks. Thank you for being a member so we can harness this industry’s collective power to do what it needs to thrive. In the coming days, check on your cider industry peers and friends. We promise to do the same. Cider IS stronger together.

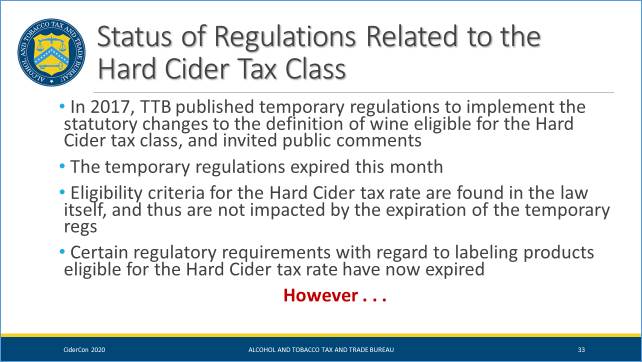

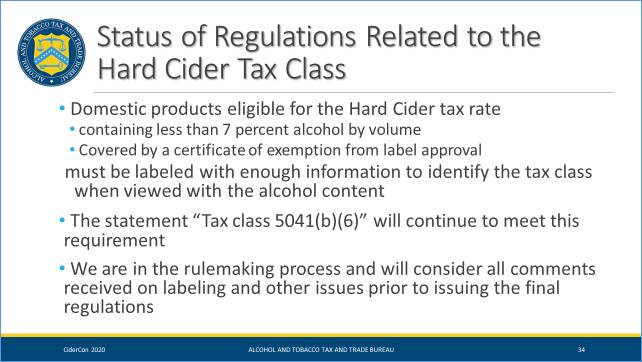

Tax Class Code Update

Since the enactment of the CIDER Act, the cider tax rate applies to products that are under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contain no other fruit than apples or pears. Until very recently, the TTB was requiring a tax class code on all products eligible for the hard cider tax rate. These requirements were part of temporary rules that were put in place in reaction to the expansion of the product types eligible for the reduced rate. They mandated that the code “Tax class 5041(b)(6)” be on the packaging of hard cider tax rate product. These rules have now expired–the reduced tax rate remains.

For now, the TTB is not mandating the use of the statement “Tax class 5041(b)(6).” Nevertheless, the regulations do say that all wines (including cider and fruit cider, all ABVs) must be labeled with enough information for TTB to identify the correct tax class.

“Using ‘Tax class 5041(b)(6)’ will meet that requirement, so no one has to change their label unless they choose to,” said Susan Evans, TTB Director, Office of Industry and State Outreach in an email to the Association.

In the absence of the statement of the Tax class 5041(b)(6), the label must provide enough information for the TTB to know that the product is under 8.5% ABV, under 0.64 gram of carbon dioxide per 100 milliliters and contains no other fruit than apples or pears.

We anticipate that the code requirement will return when the permanent rules are released, and will keep our members informed of such news.