Uncategorized

Now Available: Q3 Nielsen Reports – MEMBERS ONLY

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

Annual Membership Survey Time!

We are working to finish a new strategic plan for the American Cider Association, and it’s very important to us that we hear from America’s cideries. You can be a part of guiding our programming to grow and sustain a diverse and successful cider industry by completing our affiliate membership survey.

There are two versions of the survey. One version is for owners/managers and includes benchmarking questions specific to HR and production. That version has been emailed to the main points of contact listed for member accounts.

There is also a version of the survey meant to collect input from non-owners/managers. If you are in the cider industry at all (apple grower, bar tender, keg producer, cider blogger, you name it!), you can take our survey and provide useful feedback.

The survey is completely anonymous. We thank you in advance for sharing with us!

6/23/20 Webinar Recording: Intro to Managing Distributor Relationships

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

6/18/20 Recorded Webinar of PPP Loan Forgiveness Updates

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

Spring 2020 Apple Crop Conditions

Written by Greg Peck, Assistant Professor of Horticulture, Cornell University

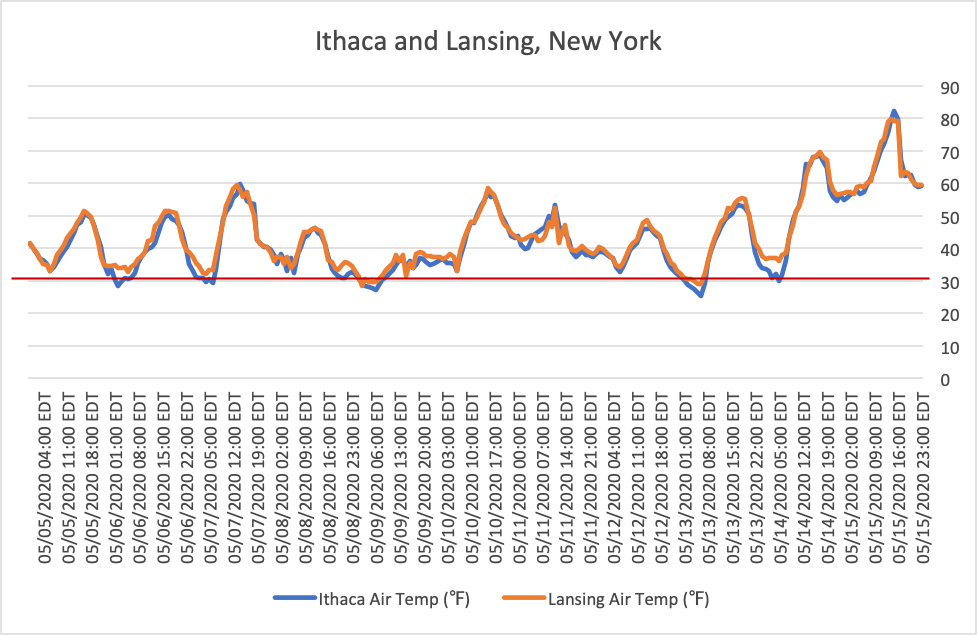

Gee whiz, 2020, you really have it in for us! In the midst of a global pandemic in mid-May apple growers throughout the Midwest and Eastern US endured several nights of potentially damaging cold temperatures. At our research farms in Ithaca and Lansing, NY we had below freezing temperatures on May 6, 7, 9, 13, and 14 (Figure 1).

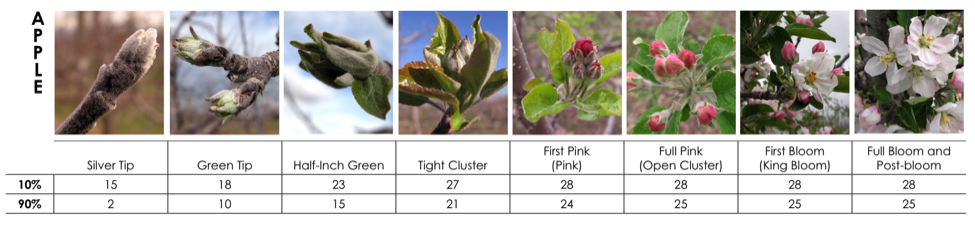

However, it’s important to note that because of the solute concentration in the flower bud cells, and the protective layers around the buds, the absolute cold temperatures typically need to be several degrees below freezing to cause damage (Figure 2). You will also notice that as the flowers develop from silver tip to petal fall, they become more susceptible to freeze damage.

The amount of damage that occurs is also very much so dependent upon the air movement, humidity, number of hours below the critical temperature, tree health, soil moisture, moisture on the bud surface, and if any frost control methods were used, such as wind machines, helicopters, overhead irrigation, or heat. A thorough discussion of frost control methods written by Michigan State University Extension Educator Amy Irish-Brown can be found at: https://www.canr.msu.edu/uploads/files/2013_NW_orchard_show/OrchardShow13Irish-Brown.pdf

Damage to the apple flowers can also vary. Typically, the king bloom (center flower in the cluster that usually becomes the largest apple at harvest) is several days more mature than the side blooms in the whorl. Thus, the king bloom is more likely to sustain damage. For culinary apple producers who sell wholesale, this can be a major problem since pricing is very much tied to fruit size. For cider producers, individual fruit size is less of an issue than tonnage per acre. Additionally, apples typically produce up to 95% more flowers than can reasonably be carried as fruit (not to mention that over-cropping leads to biennial bearing) some level of frost damage is tolerable. The threshold for how much damage is acceptable depends upon the initial flower bud load and yield expectations.

One other thing for the cider industry to remember is that many of the European cider cultivars tend to bloom later than culinary apple cultivars and crab apples. Local and regional apple industry reports tend to be more focused on culinary apples. So, how the freeze damage might affect your apple selling or purchasing this fall will depend upon the types of apples that are being used for cider.

So, how much damage occurred around the country this spring? I’ll give an update from New York and a few colleagues and growers in other regions have shared what they experienced, as well. (Note: I did some minor copy editing for clarity.)

New York (May 27): In the Finger Lakes region of NY, despite temperatures down to 26 ºF in our research farm (23 ºF at my house!) we probably only sustained 10-15% damage to the earlier blooming cultivars and much less to our research cider apple trees. Several growers I’ve spoken with report similar findings. We’re now at late pink to full bloom for most of our apple cultivars with excellent pollination conditions. I suspect we’ll start out the season with the potential for a full crop. The Lake Ontario region of NY has had variable damage from none to greater than 80% of the flowers being damaged. Typically, growers who are closer to the Lake will have less frost damage because the cold water in the Lake delays flowering by several days or more. Reports from the Hudson River Valley are also variable, but more growers in that region appear to have sustained damage than those in the Finger Lakes or Lake Ontario region. Update (June 18): After surviving several frosts and a hail storm, the particularly warm temperatures during bloom have led to several cider apple growers in the Finger Lakes reporting that they have fire blight infections. For our conventionally managed research orchards, we applied streptomycin four times (we use predictive models to determine the need to use this antibiotic), but we were still not able to prevent infections. I think most of the infections were from a late afternoon shower on June 6. We had sprayed strep on June 4 after hail went through the Ithaca research orchard and with just a handful of flowers not open at that application, I thought we would be okay. Big mistake. Most of the infections started in flowers on one-year old wood, including on the central leader. We’re cutting out as much as we can, but I may need to rip out my Dabinett trees and start over. The Medaille d’Or and “Geneva” Tremlet’s Bitter trees also had a large number of fire blight strikes. There was a moderate amount of fire blight on Ellis Bitter, Harry Master’s Jersey, and Yarlington Mill. Porter’s Perfection only had a couple-few strikes, likely due to the fact that it blooms about a week earlier than the other English cider cultivars. Despite all of these issues, if we can stay ahead of the fireblight infections we should have a decent crop overall.

Renae Moran, University of Maine (May 14): “We are at the beginning of pink on Macs, and still at tight cluster for Honeycrisp. I have not checked apple buds yet, but I don’t think it got colder than 30 ºF in most places. Peaches that survived the winter are mostly still alive, but most orchards had 50% or more bud death by April. Peaches are just starting to bloom. Sweet cherries in a frost pocket are dead. The ocean effect delays bloom in Maine, and most growers have orchards at high elevation which also delays bloom. Poor soils are the compromise for escaping frost in most years.” Update (June 16): “I have not checked statewide, but in southern Maine, we had freezing temperatures around June 1, at the petal fall stage. Obvious injury to fruitlets was reported by two growers in the Newport area. In my orchard, I am seeing heavy fruit drop which is probably due to this freeze, and some due to normal thinning. I am also seeing about 10% of the apples with frost rings. Other growers are reporting the heavy fruit drop, as well.”

Terry Bradshaw, University of Vermont, Burlington, VT (May 14): “We’re actually looking pretty good here on the freeze front, although I need to check on a few folks in the southern part of the state. I’m still at early pink on most stuff, tight cluster on some. On cider varieties, a bit of half-inch-green, even. Lows haven’t been that low: 31.8 ºF on May 9th in Shoreham, 28.4 ºF in Essex where buds are tighter than ours.”

Liz Garofalo, UMass Extension Fruit Program, Belchertown, MA (May 27): “There were a few sites in MA where we dipped (on May 10, at 3am one site hit 30.7 ºF, warmed and then dropped back down to 31.7 ºF from 5-6am) below freezing for an hour or two. But, with cider varieties being largely behind others in terms of bud development, they have escaped bloom damage, and the worst that we are seeing are some crinkly leaves from prolonged cool temperatures. Of course, we are now knee deep in fireblight weather with varieties like Stoke Red just barely at pink in one location. For reference, the pink date for that particular variety and location was May 19. All of our apples look like they are setting a good crop, weather has improved, and bees are buzzing.” Update (June 16): “Nearly 75% of Massachusetts is currently experiencing “abnormally dry” weather conditions. In Belchertown at the UMass Cold Spring Research Orchard, we are down 5.38 inches from the yearly average precipitation accumulation. Tree stress caused by water deficits increases the likelihood of opportunistic pathogens and insects that would not normally pose a problem in the orchard- things like black stem borer and phomopsis. High density plantings, especially new and newly established plantings, should be receiving regular irrigation to ensure healthy trees and a healthy crop. We are not yet seeing fireblight strikes. Given the late blooming nature of some of our cider varieties, however, there is still time for strikes to show up in MA.”

Megan Muehlbauer, Rutgers University, Pittstown, NJ (May 26): “New Jersey growers have seen vast differences in frost damage to culinary apples across the state this spring, with crop losses ranging from 0 to 100%. In some instances, several feet of difference in elevation at single farms resulted in complete crop loss. At the Snyder Research Farm in Pittstown, NJ the lowest temperature recorded over the past 30 days was 31 °F. Thus, it seems the late blooming hard cider apple varieties have been spared (a few of which were still in full bloom/petal fall) as of May 25.” Update (June 18): “As of mid-June the hard cider apple crop in New Jersey is looking beautiful. It seems that they have all bloomed just late enough to avoid the most brutal of the spring frosts (Mid-April was particularly disastrous for many other crops). The fruit set looks excellent, thus far there looks to be barely any damage. I haven’t seen or heard of any particularly bad fire blight incidents either, although we have been vigilant with preventative sprays at both our research site and in discussion with growers.”

Diane Flynt, Foggy Ridge Cider, Dugspur, VA (May 13): “Spring was mostly kind here in Southwest VA—cool, with little frost damage in last weekend’s sub 28 ºF temperatures for two nights running. Wind was a big issue during bloom, with 18 to 20 mph wind most days (and nights) so spraying was a challenge. But it looks like we have decent fruit set and I hope for a good harvest. Last year I had 40 cidermakers ask to purchase our fruit, and was able to sell to only 4. All my current customers say they want to purchase again—I pass this along as a counter to anxiety growers may be facing about selling cider fruit this year. We are TINY but I do think this demand is an indication of continued interest in high quality cider apples. I hope we don’t see contraction in planting cider apples in response to the challenges cidermakers are facing in selling. Virginia Wine has done an outstanding job in communicating with the industry since isolation began in VA, and I think most of the cidermakers that were doing a decent job before the virus will come out OK.”

Tom Kon, North Carolina State University, Mills River, NC (May 26): “Southeastern apple growers (NC, SC, and GA) observed at least four frost/freeze events during spring of 2020. The polar vortex occurred when fruit was ~18 mm in diameter, but temperatures dropped slightly below freezing at most sites. While most growers avoided catastrophic losses, some blocks/sites are exhibiting sub-lethal cold injury (frost rings, russet, seed damage etc.).”

Nikki Rothwell, Michigan State University, Traverse City, MI (May 26): “We do have some damage in apples in Michigan. I think the areas in the south have more than us here in the north. It has also been pretty variety dependent. Red Delicious, which I know is not used for cider, has more damage than other varieties. However, we had great pollination weather, so I think many growers will have a decent crop. We just need to get through this fire blight weather. We are in bloom with Epiphytic Infection Potential (EIPs) in the 200-300!”

Chris Gottschalk, Michigan State University, East Lansing, MI (May 26): “On May 9th, mid-Michigan sustained temperatures of 25 ºF for two to three hours overnight. As a result, many of our early flowering cider cultivars in the Great Lakes Cider Apple Collection sustained freeze damage. Estimates ranged from 0% loss to >50% loss. For example, Chestnut crab (early blooming) was at first pink and lost >50% of its flowers to the cold. Whereas Cimitiere, a very late blooming cultivar, was at 1/2 inch green and did not suffer any damage. In general, most of our cultivars lost the king blossom but will still produce a sizable crop load this year.” Update (June 17): “The frost that Michigan experienced in early May has decreased crop load levels, for both cider and fresh market types. At the Great Lakes Cider Apple Collection, our Chestnut Crab (an early-blooming cultivar) was severely affected by the frost and has an extremely small crop load. In contrast, Vista Bella (another early-blooming cultivar) was unaffected by the frost and is supporting a high crop load. Our fresh-market industry is reporting similar results with crop load levels being very cultivar dependent. Our late-blooming cultivars, Dabinett and Cimitiere, both were unaffected by the frost and will produce a large crop this year. Many of our other accessions, that bloom at similar times to the fresh-market types, such as Sweet Alford, Yellow Newtown, Esopus Spitzenburg, Gravenstein, and Winesap all have light crop loads.”

Doug Hill, Deep Roots Orchard, Watervliet, MI (June 17): “Early bloom varieties in our orchard Redfield, Granniwinkle and Grimes Golden were negatively effected by the freeze in May. Temps dropped into the low 20’s (22-25) for several hours. Below freezing for 5-6 hours. I am happy to report that other varieties of later bloom were less affected. Browns Apple, Cox Orange Pippin, Spitzenburg, Dabinet, Harrison, Kingston Black (spotty), porters perfection. I noticed some spotty dead blooms on some of the trees but overall we feel lucky about our outcome. Trees were planted in 2017.”

Katie Nash Suding, University of Colorado, Boulder, CO (June 16): “In the Front Range of Colorado we had a late April snow storm which damaged many flowers and so we are expecting generally low fruit set.”

Brant Clark, 63rd Street Farm Orchards, Boulder County, CO (June 18): “The late cold weather, which coincided with the bulk of blossom season, more or less wiped out production for this year. We have one tree with one apple, a Golder Russet on Antonovka rootstock. Our guess is that the tree is not well (leaves more yellow than green) and so bloomed late, thereby missing the freezing event. Additionally, an earlier cold snap and major snow, measured 51cm/20″+, damaged the new leaves on early trees. Leaves which were below the snow survived with little or no damage, leaves above the snow were killed. Most of our trees are on mid and late season rootstock, so suffered little, if any, damage.”

Brady Jacobson, Mt. Hood Organic Farms, Hood River, OR (June 16): “I know the Midwest and East had severe cold weather that might have reduced the crop. We, on the other hand had great weather for bloom and set a big crop in Hood River, OR. Problem is it hailed a few nights ago, so we will have a lot more processing apples for sale this year.”

Carol Miles, Northwestern Washington Research and Extension Center, Mt. Vernon, WA (June 16): “Here in western WA we have not been negatively impacted by temperature. We have had a bit of rain though this past month, and this has led to slightly cooler temperatures, thus fruit development may be a little slow at this time in this region.”

Karen Lewis, Washington State University, Moses Lake, WA (June 17): “The apple crop looks fine in Eastern WA – we have a few pockets of frost damage but overall, if it all sticks and we manage our crop load, then we are on track. It has been a cool, wet and windy spring. Only a few warm days in May. Temperatures are on the way up this week and into next week ( 90’s). Somewhat steep increase but trees /fruit aren’t stressed.”

Jake Mann, Five Mile Orchards, Watsonville, CA (June 18): “We had two amazing seasons here in 2018 and 2019 with excellent growing conditions across the year: sufficient chilling hours and good rains, a gorgeous bloom with no frost or major precipitation during pollination, followed by a mellow summer growing season into harvest with enough folks around to pick the fruit when it was ready. 2020’s crop is looking promising, even considering this should be an alternate bearing year. Precipitation was lower this winter, but chilling hours were once again sufficient. Weather was clear and warm during bloom. Nice fruit set. Intermittent spring rains necessitated some scab control sprays, and we’ve seen outbreaks of aphis and skin worm (moths) in May and June, but have been able to keep them under control. If you wanted to say there was a pattern developing over the past three years, it’s that we’re seeing dryer winters, later accumulation of chilling, with more precipitation in spring rather than winter. The Newtown Pippin crop (our main cider apple here) looks solid, not as bountiful as last year for some blocks, but still feeling optimistic. It’s looking like a big year for our Red Delicious (not the most sought after cider fruit, true) and a worthwhile crop is growing in our other dessert fruit sections. The test blocks and grafts we have for Kingston Black, Wickson, Nehou, and some other cider-specific varieties show promise for adapting these in greater quantity to our region. The orchards didn’t get the memo about Covid… our small crew remained busy though the spring and have been able to work at a safe social distance from each other. We remain optimistic that our fruit will find it’s home in the markets this fall.”

JUNE WEBINARS

We are working to bring our members relevant virtual content during this time. Our webinars are free if viewed live, and they are always accessible to our active members as recordings on our member page after logging in with your account.

JUNE 18: New Developments in PPP Loan Forgiveness

Speakers: Richard Lyons, Partner and Co-Chair of Wendel Rosen’s Food and Beverage practice and Kirk Faris, CPA and Tax Senior Manager at Moss Adams

SUMMARY: This webinar will go over the PPP loan, and in particular the new laws and updates that came into effect over the past few weeks, as well as related topics:

–Determining and maximizing PPP loan forgiveness, including what expenditures “count”, applicable period and employee considerations

–Minimizing and deferring expenses, whether you received a PPP loan or not: tax credits, raising capital, SBA loans, etc.

–Other financial and business considerations

JUNE 23: An Introduction to Managing Distributor Relationships

Speaker: Julie Rhodes, business coach and owner of Not Your Hobby Marketing Solutions

SUMMARY: This webinar will most benefit new cideries, those expanding their distributor partnerships for the first time, and brands that would like to improve their relationship with their current wholesale partners. A distribution contract is a partnership, which should be mutually beneficial for both parties. In this webinar we will explore 6 actionable ways that you can be a proactive supplier partner with your wholesaler, so that you can improve the profitability of your relationship. By the end of this webinar, you should walk away with an understanding of how to effectively partner with your distributor to grow your cider brand, increase sales and brand awareness, and foster a mutually beneficial business relationship for long term growth.

Have a webinar topic suggestion? Reach out.

Congress Passes PPP Critical Improvements

Today, Congress passed a bill that aims to address concerns over the structure of the federal Paycheck Protection Program (PPP). The program has been a bittersweet solution for cideries who have had to consider laying off staff due to state-mandated tasting room closures. Yes, it provided needed funds to pay employees. But the restrictions on using those funds without repayment didn’t quite make sense in our pandemic world. Here is how the reform bill headed to the President’s desk changes the program:

- The original PPP program required the loan funds to be spent within 8 weeks of receiving them. Today Congress expanded that period to 24 weeks.

- The original PPP program required that 75% of the funds be used for payroll. Today Congress reduced that requirement to 60%.

We thank our members for letting us know the challenges you faced with the PPP program. We’ve been able to share that feedback with congressional offices who in turn utilized your stories and others to fix the program.

Read more: Senate approves House-passed Paycheck Protection Program reform bill

American Cider Association Virtual Listening Tour

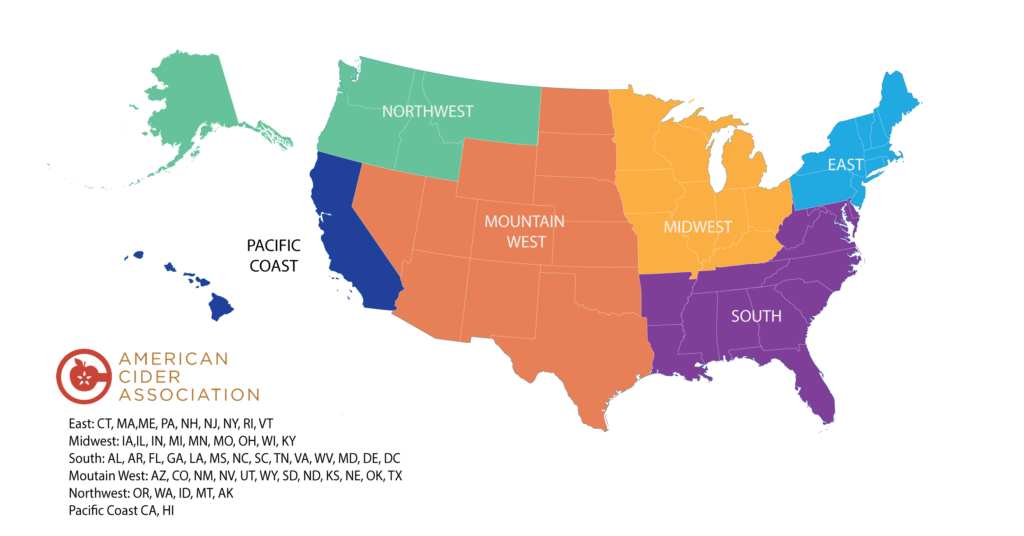

Virtual Listening Tour: May 12-15

We’re hitting the virtual road! Please join the board of the American Cider Association for a listening tour next month. What you can expect:

- Program & resource updates from Executive Director Michelle McGrath, including the legislative & compliance landscape for cider and COVID-19 pandemic updates

- Virtual Listening Session led by Michelle with your Regional Board Chair

- Informative Guest Speakers

We hope you’ll join us with your questions and comments on the national landscape for cider and the American Cider Association’s involvement. Please note that to keep this meeting productive, we are limiting the meeting to pre-registered participants and a password is required (received upon registration).

LINKS TO REGISTER CAN BE FOUND BELOW

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Eastern Region

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Midwest Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Southern Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Mountain West Region

–>Thursday, May 14: American Cider Association Virtual Listening Tour: Pacific Coast Region

–>Friday, May 15: American Cider Association Virtual Listening Tour: Northwest Region

P.S. Have questions you’d like to send in advance? We’d love to hear them! Let us know what you’re thinking.

Craft Beverage Coalition Calls for Day of Action 4/22

Urge Congress to Approve Economic Relief from COVID-19 for Craft Beverage Alcohol Producers

Members of the Craft Beverage Coalition representing the nation’s brewers, distillers, vintners, cidermakers and mead producers are hosting a “Call to Action” on Wednesday, April 22 to urge Congress to provide much needed economic support for the industry. As a result of “stay at home” orders issued by state officials, craft producers are struggling to stay afloat as they take innovative steps to keep the doors open, including curbside pickup and local delivery options as well as the production of hand sanitizers and disinfectant sprays. The CARES Act provided initial relief, but much more must be done. The coalition is asking Congress to provide more economic relief so that businesses can weather this crisis, return to normal operations once the crisis is over, and continue supporting jobs and state economies across the country while providing consumers with their favorite products to enjoy responsibly.

The Coalition is asking Congress to take the following actions:

- Suspend all federal excise tax obligations on domestic and imported alcohol products, effective January 1, 2020, through December 31, 2020 so producers can dedicate scarce resources to payroll and other operating costs.

- Enact a permanent extension of the Craft Beverage Modernization and Tax Reform Act (H.R. 1175/S. 362), which now has bipartisan support from 74 senators and 343 representatives and would provide certainty amidst economic instability.

- Approve additional funding to support no- and low-interest loan and grant programs administered by the Department of the Treasury and Small Business Administration, including the Paycheck Protection Program and Economic Injury Disaster Loans.

- Authorize the Department of the Treasury to create a Workforce Stabilization Fund for the hospitality and travel sectors that will allow distilleries, breweries, wineries, and cideries to keep workers employed, maintain operations, and meet financial obligations.

- Create temporary tax incentives that encourage consumers to return to on-premise dining and drinking establishments when public health officials determine it’s safe. Examples include reinstating the expanded business entertainment tax deduction and creating a new, temporary travel tax credit equal to 50% of any expense for meals, lodging, recreation, transportation, or entertainment while traveling away from home within the U.S.

- Encourage the Administration to work with our trading partners to simultaneously suspend tariffs on beer, wine, and distilled spirits products and our supply chain partners.

Join the Call to Action and help craft producers seek much needed economic relief.

5/9/20 Updates on SBA Resources

There’s a lot of information (and a lot of MISSING information) regarding stimulus funds currently. Here are a few new pieces of info to know:

+According to the SBA, lenders supporting PPP loans “must make the first disbursement of the loan no later than 10 calendar days after the loan is approved.” Read more

+The Treasury is expected to start dispersing stimulus checks by April 10 Read more

+The government is releasing informing guidelines on many of the SBA resources on what seems like a rolling basis. Although the good news is that “EIDL Loan advances will start to be distributed this week,” the SBA has released at least in some places that the advances are for “$1000 per employee up to $10,000 max.” This is different than what was previously said.

+Farmers do qualify for PPP loans, but as of today, they do not qualify for EIDL loans. We are advocating for farmers to qualify for EIDL loans and for specialty crop support in the USDA earmarked stimulus funds of the CARES ACt. To learn more about what resources are available to farm-based businesses, check out our webinar with Penn State Extension on Monday, April 13.

+Congress is struggling to find a path forward for a bipartisan proposal that would expand the Paycheck Protection Program (PPP). It is recognized by both parties that expanding the program is necessary.