Archive for October 2019

Stop Tax Increases

The Craft Beverage Modernization and Tax Reform Act EXPIRES at the end of 2019.

The Craft Beverage Modernization and Tax Reform Act created critical but temporary excise tax credits for beer, wine, spirit and cider producers. This cross-sector cooperation was unprecedented, and the results have been clear—our industries create jobs, support farms, and bolster community economies. Now we are working together again to prevent your taxes from going up come January 1. Congress needs to hear from the cider community that increasing federal excise taxes will cost. The resources that allowed you to invest in jobs, trees, equipment and innovations could go away overnight. Join us in telling Congress to stop these pending tax hikes and make the savings in the Craft Beverage Modernization and Tax Reform Act permanent.

From coast to coast, producers are making their voices heard. Our industries have two things in common—the vast majority of the businesses in our sectors are small, family-owned businesses, and our fermented products create added value for farms. These facts have led to overwhelming bipartisan support for the Craft Beverage Modernization and Tax Reform Act. But we need to hammer this message home: The loss of these credits will hurt local economies. Congress must act to make them permanent before it’s too late.

Want to learn more about how this bill impacts your cidery? Read our recent blog.

The Gravensteins of Sonoma County

“What can I get for you?” I ask the next customer at the bar. “I don’t know. Do you have any cider made with Gravenstein apples?”, comes the reply. “All the ciders on our menu have some Gravenstein in them. What sort of cider do you like?”

That’s a typical beginning conversation at the Craft Cider Tent of the Gravenstein Apple Fair, an annual fundraising event benefiting the local agricultural non-profit Sonoma County Farm Trails. Most of our customers are not regular cider drinkers, and have generally just tried one or another of the large nationally distributed brands. Confronted with a menu of 18 local ciders, from almost as many producers, they are understandably a bit flummoxed. We talk about what they typically drink, do a little sampling, and eventually find something they love.

When most people hear “Sonoma County, CA” they think wine, but apples have been a part of the commercial landscape there since northern Europeans arrived in the mid-19th century. Chief among them was, and is, the Gravenstein, an apple whose 18th century origins (said to be Italy, Denmark, or Germany) are shrouded in mystery. It’s an apple that expresses itself marvelously in the area’s loamy soils, warm, dry days, and cool summer nights. Nineteenth century pomologists had it right when they described the Gravenstein as having “that refreshing admixture of sweet and acid which characterize our most esteemed apples” and declaring it good for cider.

Cider makers in the area take full advantage of everything the Gravenstein has to offer making ciders that cover all possible flavor and texture bases – wild and tart native-ferments (Old World Winery and Coturri Winery); dry and fruit forward (Sawhorse Cider and Horse & Plow Winery); clean and crisp (Goat Rock and Ethic Ciders); semi-dry single varietals (California Cider Company and Golden State Cider), and complex blends (tannic from Tilted Shed Ciderworks, aromatic from Dutton Estates). The 10-fold increase in local cider companies over the last seven years has been a boon to local farmers, too, allowing them to resist the economic pressure to grub up their orchards in favor of wine grapes.

While the range of flavor possibilities seems almost endless, what these ciders all have in common is their use of local fruit, typically dry-farmed and organic, harvested and pressed in season. They also rarely make it outside of Northern California, and most can only be found within Sonoma County itself and the handful of counties that surround it. To experience all this place has to offer, you have to go there.

The American Cider Association is making it easy for the attendees of CiderCon 2020 in nearby Oakland to do just that with a pre-conference orchard and tasting tour. For cider lovers, it’s an opportunity that shouldn’t be missed.

American Cider Association Note: Registration for CiderCon 2020 and associated tours will open soon! Darlene Hayes will be the guide for the Sonoma Country tour.

Are You Overpaying Your Taxes?

Every week I speak with a producer that is unknowingly overpaying their taxes. Last week a quick email resulted in one of our smallest members getting a $700 tax refund. It’s understandable that people are confused about their taxes. In particular, I find there a misunderstanding that because the cider tax rate was expanded with the CIDER Act in 2017, small producers are not benefitting from the Craft Beverage Modernization and Tax Reform Act.

The Craft Beverage Modernization and Tax Reform Act went into effect on January 1, 2018. It was passed for a 2-year period. It benefits the cider industry in a number of ways:

- It increases the amount of Small Producer Tax Credits for the first 30,000 gallons of product. This benefits small producers.

- It makes sparkling cider producers eligible for the Small Producer Tax Credit for the first time. For the smallest producers it is a $1 credit!

- It removes the barrier to growth cideries were facing by slowly phasing out the Small Producer Tax Credit up to 750,000 gallons.

Please check your taxes for 2018 and 2019 to make sure you are receiving the proper credits. We talk to producers everyday—small and large—that are sometimes owed hundreds or thousands of dollars in refunds.

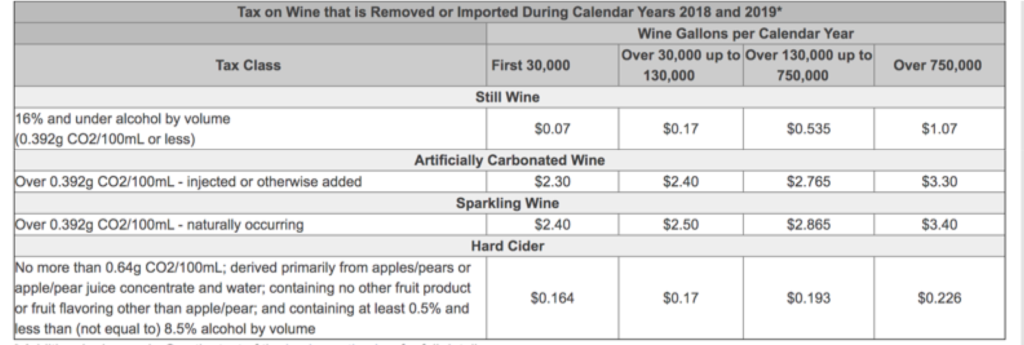

This below chart is of the EFFECTIVE rate after the credit has been applied. Download our flier to print this chart.

Your Membership Dollars at Work: We are working with a coalition of other alcohol associations to ensure these credits stick around. As of now, they are set to expire. Recently the American Cider Association Board of Directors and members met with 16 congressional offices to educate them on cider and its importance for local economies and agriculture. We encouraged support of the Craft Beverage Modernization and Tax Reform Act, asking for Congress to make the federal excise tax credits permanent.

Stay tuned for opportunities to get involved in grassroots actions supporting the Craft Beverage Modernization and Tax Reform Act.