Market Data

Q2 Nielsen Reports Ready For Download

One of the perks of combining our buying power as an association is that we can share valuable insights from Nielsen with you, our members.

You can now download our custom Q2 reports. In this data packet you will be able to access:

- Off-Premise Micro-Reports broken down for packaging type, flavor, and region–14 states and 6 regional outlooks. Available in both a 12-week and a 52-week outlook.

- Off-Premise Macro-Reports for Beer, FMBs and Cider. Available in both a 12-week and a 52-week outlook.

- On-Premise Reports for 6 metro markets.

- Nielsen PPT slide decks with charts, data visualization and insights on the cider category’s recent performance in both On- and Off-Premise.

- Bonus this quarter: Hard Seltzer off-premise report.

Here is an excerpt from a recent Nielsen survey about current overall consumer sentiment:

CONSUMER SENTIMENT REPORT SUMMARY BY NIELSEN

“Here are some high-level findings from a Nielsen survey of 18K+ consumers, fielded July 1-8, 2020.

- Since June, we have started to see some consistent trends not only for off premise alcohol, but also across many consumer good categories. That comes to life in consumer sentiment as well. 60% of households expect their routines to remain altered for at least the next 4 months

- Nielsen has shared insights in the past in several forms about how premiumization within off premise alcohol isn’t slowing down, and has in fact accelerated during COVID weeks. However, when it comes to total consumer goods, we are starting to see more cautious consumer sentiment in relation to spending. Approximately 4 in 10 (42%) of households say they are watching what they spend as a result of COVID.

- The homebody economy continues. When asked what % of time households eat meals or snacks at home versus outside of home, 39% of households said they ate 100% of their meals and snacks at home. An equal amount (39%) said they ate outside of their home only 10% of the time. As a comparison, when asked what their habits were prior to COVID, only 12% said they ate all of their meals at home.

- When asked what their plans are for the coming months, close to 1 in 3 households (28%) said they plan to eat all of their meals at home. That of course was lower for younger consumers age 21-34, and much higher for consumers age 65+.

- What about consumer plans if economic conditions get worse (recession and/or inflation)? When asked about things they would do to save money when shopping for beer or wine, 39% said they won’t change how they shop for it. However, nearly ¼ said they would buy less. That’s a slightly different story for households with lower income (<$30K), which said they would be more likely to stop buying it all together.”

Q2 2020 Nielsen Reports for Our Members

This content is for members only.

If you were a member and are now seeing this message, please Renew your membership to continue.

Cider: The Road Ahead

Every year around this time, we review the trends, changes, growth and challenges our industry faced in the prior twelve months. It’s a time to learn and respond. As your association, we do this to understand how U.S. companies are faring and to identify ways we can support the cider industry and its diverse members in the year ahead. No doubt, 2019 was challenging, but there is plenty of reason for optimism as we enter 2020.

YEAR IN REVIEW Despite strong head winds from growth in adjacent categories, the cider industry held ground in 2019.

2017 was the year we saw explosive growth for regional cider brands. 2018 was defined by the rosé trend. 2019 was a year of resilience. If you look at how fast the flavored malt beverage sector grew this past year, it’s quite impressive that cider performed as it did.

Over a two-year view from Q3 2017 to Q3 2019, off premise cider sales grew 6%. The rosé success of 2018 was an anomaly, and the come down from the trend is minor noise in the big picture. The cider category marches upward–sustainably. Many in the media may try to focus on pockets of decline in the market, but the fact is the wins outnumber the losses. Regional brands continue to see double-digit growth for off-premise sales across all flavor categories except pear. Stories of growth, success and rebounds are also found within national brands.

THE FUTURE 2020 is forecast to continue the beverage trends of 2019. Threats to our market share right now are fueled by a consumer desire for a drink that is refreshing, healthful, and light. Those three characters describe cider to a T. Somewhere cider lost that as part of our messaging, so this is an opportunity to remind people that cider is just that, and even better, it’s made from apples.

To help kickstart this messaging in the new year, we are highlighting 0g residual sugar ciders in our outward social media messaging for the month of January. We’re calling it Dry Cider January and we will be promoting the hashtag #pickdrycider. Our goal is to gain the attention of health-oriented consumers. Do you make a 0g residual sugar cider? Please tell us so we can include it on our list.

We’re developing additional campaigns to promote the diversity of cider and its relevance throughout the year. Cider is not a seasonal beverage, and there are many styles to enjoy.

THE DETAILS We’re proud to offer complimentary detailed quarterly market reports to our active members in partnership with Nielsen. The flavor, format and subsector comparisons are helpful for conversations with wholesalers and buyers. But the value of these reports shouldn’t overshadow the half of the equation unilluminated by them. Direct to consumer sales and indie retailers are not found in these reports, leaving many brands and success stories out of the Nielsen data. Our annual membership survey will be deployed in January. Please take a dozen or so minutes to complete it when you see our request. Cider data is hard to come by, and we are taking serious efforts to continue growing what data and information is available about the industry. Our membership survey is an important part of that.

So, what are the details for cider’s growth in 2019? We don’t have Q4 data yet, but here is what we do know for off-premise sales measured by Nielsen for 52-week period ending on 11/30/19. Total cider sales declined -3.9% in the channels measured by Nielsen, led by declines in some of the leading national brands. But also:

- Regional brand off-premise sales grew 15%

- Regional brand off-premise market share of the cider category grew from 29.4% for 2018 to 34% as of 11/30/19. (Dollar share)

What else do we know? This year we saw cidery acquisitions after not seeing any for some time. We also know that online sales through the vendor VinoShipper increased 9% in 2019. These changes represent different sides of the cider spectrum and demonstrate how intricate the cider ecosystem truly is.

Share your growth story with us. We want to know how you measured success in 2019. There will be many opportunities to reflect on 2019’s trends in our Marketing & Trends track at CiderCon® 2020. Meet us there!

RELEVANT Today, gluten-free is a common lifestyle, and cider continues to benefit from it. But cider is not just gluten-free. It’s light, crisp, refreshing, often low in or sugar free, and versatile. Low-ABV is a growing trend, and cider serves to benefit from this trend both with low-ABV ciders and with low-ABV cider cocktails. Both beer drinkers and wine drinkers are looking for lighter in flavor, lighter in body choices and our diverse category is greeting these drinkers with welcome arms.

I was at a party last week where there was no alcohol. It was a very 2019 moment, as we know more and more people are drinking less. But much to my glee, we spent about half the party discussing cider—how much people loved it, where to drink it, and exploring styles. Most people explained to me that they discovered cider due to health choices. I regretted not bringing cider to that party!

My point is that cider meets the criteria of today’s health-oriented consumer. This fact should be in all of our talking points next year, no matter what style of cider we make.

ROAD AHEAD Cider maintained its gains in a year of challenges. With the projections that we’re seeing for flavored malt beverages in 2020, it will be harder to do so next year. In light of these pressures, increasing direct-to-consumer sales is good for category and company health. If you don’t already vend online, make that your New Year’s resolution and attend ‘Clicks & Cliques: Tactics for direct-to-consumer channels’ at CiderCon®.

It may be tempting to feel competitive with our peers in the industry right now. If we stick together, celebrate our differences and diversity, and work united to share a message of category versality, healthfulness and cider pairing beautifully with food, we will surprise ourselves and our doubters. Good things come from working together.

The board and I look forward to working with our members in 2020. Let’s do this thing called cider!

Modified image Liz West by courtesy of CC license.

The Cider Rebound: Now, Let’s Keep It Going!

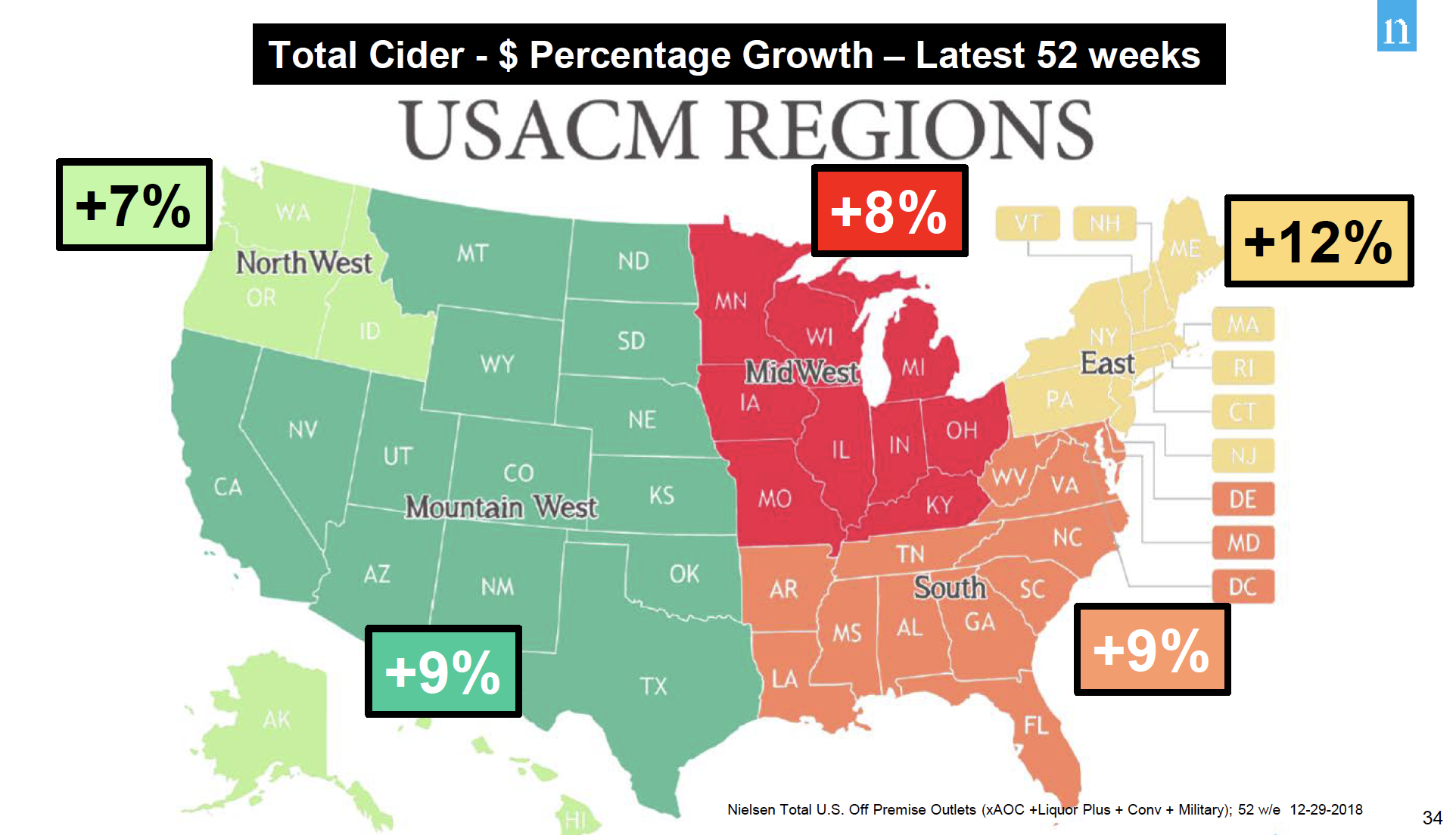

A recap of Nielsen’s keynote presentation at CiderCon 2019 in Chicago.

For the last three years we’ve been honored to have our partners at Nielsen present on the state of the cider industry during CiderCon’s opening session. They offer many of our members individual services, but we work with Nielsen to bring our members broad analysis that can help you with business pursuits and decisions. We are grateful for our partnership with Nielsen, and we hope that you will make sure you’ve sent them your labels and UPCs to enhance the value of this partnership.

We wanted to give you a quick recap of the points they delivered a week ago today. You can download their slides here: Nielsen Pres’n at CiderCon 2019_2-7-2019.

- Total off-premise (aka retail) sales were up 8.4% for the cider category in 2018.

- The category did over $500 million in off-premise sales last year.

- Cider retail sales dollars are 10x bigger today than 10 years ago.

- 40% of cider drinkers are between the ages of 21 and 29.

- Cider is the most gender balanced alcohol category, with 51% of drinkers being male and 49% of drinkers being female.

- Cider grew faster than beer, wine or spirits last year. Cider was edged out by Flavored Malt Beverage (FMB) growth, however.

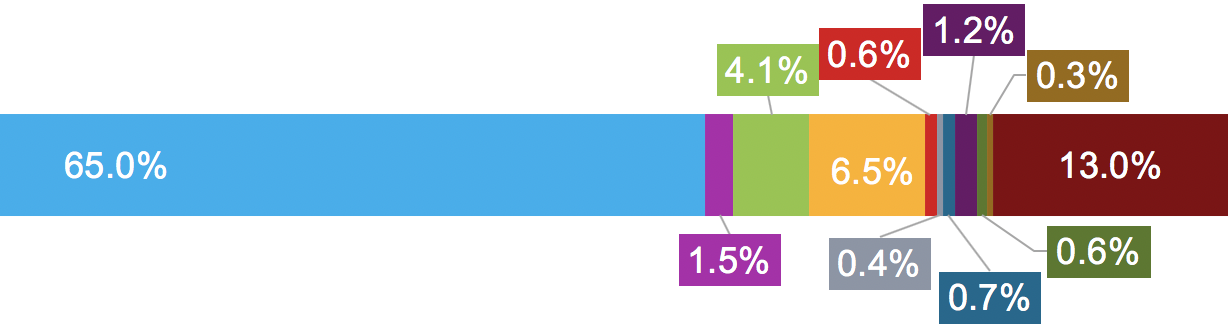

- Cider is growing, but is still less that 1% of alcoholic beverage market share.

- The National Beer Wholesaler Association’s “Beer Purchasing Index” survey shows cider is an expanding segment with respect to distributor purchasing orders.

- Cider conversations online grew 11%–more than craft beer and alcoholic beverage category as a whole.

- Cider’s growth was led by nationally distributed rosé ciders (chiefly Angry Orchard and Crispin) and by regional/local brands.

- All 5 of American Cider Association’s geographical regions experienced positive growth in cider sales for 2018 (off-premise).

- Regional and local cider retail sales increased 23% in 2018 (local craft beer increased 9.3% in 2018).

- 23 brands exceed the $1MM retail sales mark AND had double digit gains in 2018.

- Regional/local cider is now 1/3 of cider retail sales.

- Off the top 25 cider brands, 17 of them are regional or local brands.

- Cider’s total sales rely more heavily on on-premise sales that the other sectors, which are all about 50/50 on/off-premise.

- On-Premise retail sales were down across the board for cider: draft/packaged, national/regional.

- Some growth was seen for citrus, stone fruit and fruit-combo flavored ciders.

- Cider sales are 4.5X larger than FMB sales in on-premise

- Cider drinkers visit on-premise establishments more often than beer drinkers, and cider drinkers spend more money.

- Nearly a quarter of cocktail drinkers age 21-34 report drinking cider cocktails.

- Cider share of Beer/FMB/Cider today (Off plus On Premise) is 1.6%today (dollars)

Nielsen closed with this challenge: What If Cider’s Share of Beer in U.S. increases by 1 point? U.S. Cider sales would increase +65%, (over $800MM more than today).

Contact speaker Danny Brager (danny.brager@nielsen.com) with your questions or to submit your labels for their database.

As a American Cider Association membership benefit, detailed Q1-Q3 on- and off-premise reports are available for just $50 per quarter. Contact Ellen@ciderassociation.org if you’d like to purchase any of these today. Q4 will be available shortly, to be followed by our annual report on the cider market.