Are You Overpaying Your Taxes?

Every week I speak with a producer that is unknowingly overpaying their taxes. Last week a quick email resulted in one of our smallest members getting a $700 tax refund. It’s understandable that people are confused about their taxes. In particular, I find there a misunderstanding that because the cider tax rate was expanded with the CIDER Act in 2017, small producers are not benefitting from the Craft Beverage Modernization and Tax Reform Act.

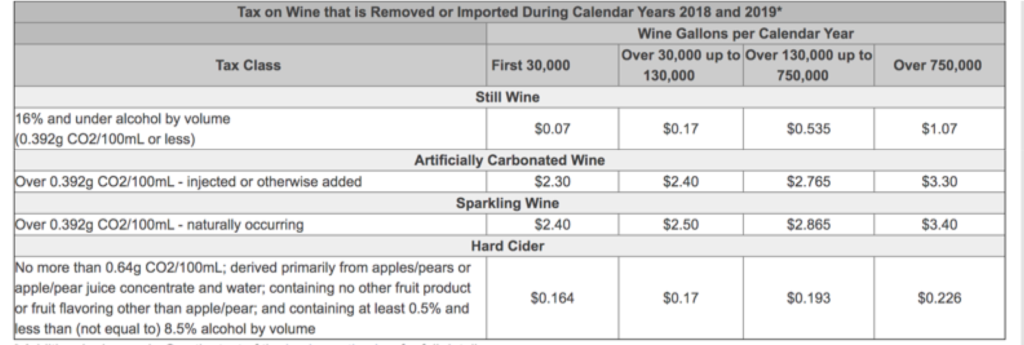

The Craft Beverage Modernization and Tax Reform Act went into effect on January 1, 2018. It was passed for a 2-year period. It benefits the cider industry in a number of ways:

- It increases the amount of Small Producer Tax Credits for the first 30,000 gallons of product. This benefits small producers.

- It makes sparkling cider producers eligible for the Small Producer Tax Credit for the first time. For the smallest producers it is a $1 credit!

- It removes the barrier to growth cideries were facing by slowly phasing out the Small Producer Tax Credit up to 750,000 gallons.

Please check your taxes for 2018 and 2019 to make sure you are receiving the proper credits. We talk to producers everyday—small and large—that are sometimes owed hundreds or thousands of dollars in refunds.

This below chart is of the EFFECTIVE rate after the credit has been applied. Download our flier to print this chart.

Your Membership Dollars at Work: We are working with a coalition of other alcohol associations to ensure these credits stick around. As of now, they are set to expire. Recently the American Cider Association Board of Directors and members met with 16 congressional offices to educate them on cider and its importance for local economies and agriculture. We encouraged support of the Craft Beverage Modernization and Tax Reform Act, asking for Congress to make the federal excise tax credits permanent.

Stay tuned for opportunities to get involved in grassroots actions supporting the Craft Beverage Modernization and Tax Reform Act.

Hello, my name is Valerie Scott, I’m part owner of Duluth Cider and also on the board of the MN Cider Guild. Please let us know what we can do to support your actions on this as soon as possible, as the end of the year is fast approaching.

Thank you!