Archive for April 2020

American Cider Association Virtual Listening Tour

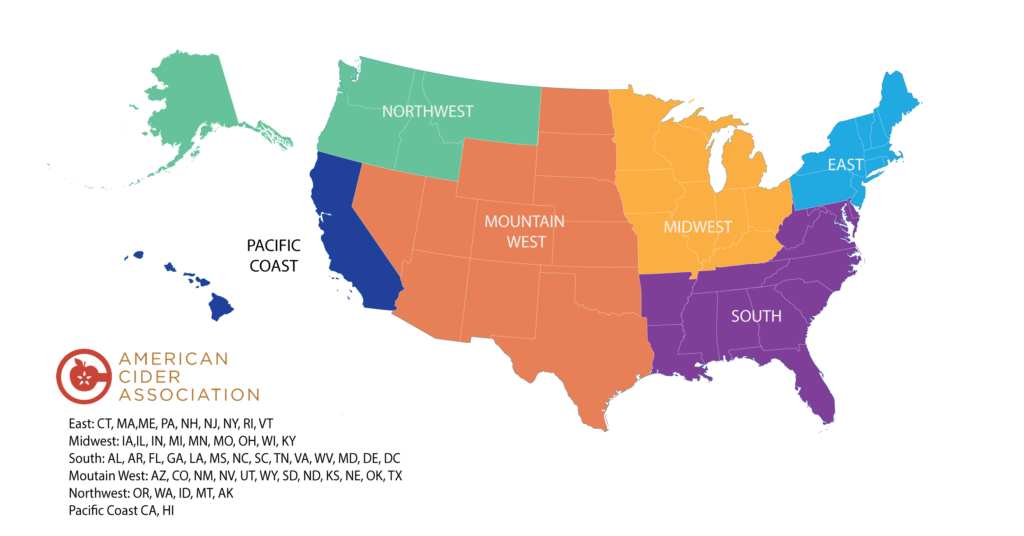

Virtual Listening Tour: May 12-15

We’re hitting the virtual road! Please join the board of the American Cider Association for a listening tour next month. What you can expect:

- Program & resource updates from Executive Director Michelle McGrath, including the legislative & compliance landscape for cider and COVID-19 pandemic updates

- Virtual Listening Session led by Michelle with your Regional Board Chair

- Informative Guest Speakers

We hope you’ll join us with your questions and comments on the national landscape for cider and the American Cider Association’s involvement. Please note that to keep this meeting productive, we are limiting the meeting to pre-registered participants and a password is required (received upon registration).

LINKS TO REGISTER CAN BE FOUND BELOW

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Eastern Region

–>Tuesday, May 12: American Cider Association Virtual Listening Tour: Midwest Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Southern Region

–>Wednesday, May 13: American Cider Association Virtual Listening Tour: Mountain West Region

–>Thursday, May 14: American Cider Association Virtual Listening Tour: Pacific Coast Region

–>Friday, May 15: American Cider Association Virtual Listening Tour: Northwest Region

P.S. Have questions you’d like to send in advance? We’d love to hear them! Let us know what you’re thinking.

Craft Beverage Coalition Calls for Day of Action 4/22

Urge Congress to Approve Economic Relief from COVID-19 for Craft Beverage Alcohol Producers

Members of the Craft Beverage Coalition representing the nation’s brewers, distillers, vintners, cidermakers and mead producers are hosting a “Call to Action” on Wednesday, April 22 to urge Congress to provide much needed economic support for the industry. As a result of “stay at home” orders issued by state officials, craft producers are struggling to stay afloat as they take innovative steps to keep the doors open, including curbside pickup and local delivery options as well as the production of hand sanitizers and disinfectant sprays. The CARES Act provided initial relief, but much more must be done. The coalition is asking Congress to provide more economic relief so that businesses can weather this crisis, return to normal operations once the crisis is over, and continue supporting jobs and state economies across the country while providing consumers with their favorite products to enjoy responsibly.

The Coalition is asking Congress to take the following actions:

- Suspend all federal excise tax obligations on domestic and imported alcohol products, effective January 1, 2020, through December 31, 2020 so producers can dedicate scarce resources to payroll and other operating costs.

- Enact a permanent extension of the Craft Beverage Modernization and Tax Reform Act (H.R. 1175/S. 362), which now has bipartisan support from 74 senators and 343 representatives and would provide certainty amidst economic instability.

- Approve additional funding to support no- and low-interest loan and grant programs administered by the Department of the Treasury and Small Business Administration, including the Paycheck Protection Program and Economic Injury Disaster Loans.

- Authorize the Department of the Treasury to create a Workforce Stabilization Fund for the hospitality and travel sectors that will allow distilleries, breweries, wineries, and cideries to keep workers employed, maintain operations, and meet financial obligations.

- Create temporary tax incentives that encourage consumers to return to on-premise dining and drinking establishments when public health officials determine it’s safe. Examples include reinstating the expanded business entertainment tax deduction and creating a new, temporary travel tax credit equal to 50% of any expense for meals, lodging, recreation, transportation, or entertainment while traveling away from home within the U.S.

- Encourage the Administration to work with our trading partners to simultaneously suspend tariffs on beer, wine, and distilled spirits products and our supply chain partners.

Join the Call to Action and help craft producers seek much needed economic relief.

5/9/20 Updates on SBA Resources

There’s a lot of information (and a lot of MISSING information) regarding stimulus funds currently. Here are a few new pieces of info to know:

+According to the SBA, lenders supporting PPP loans “must make the first disbursement of the loan no later than 10 calendar days after the loan is approved.” Read more

+The Treasury is expected to start dispersing stimulus checks by April 10 Read more

+The government is releasing informing guidelines on many of the SBA resources on what seems like a rolling basis. Although the good news is that “EIDL Loan advances will start to be distributed this week,” the SBA has released at least in some places that the advances are for “$1000 per employee up to $10,000 max.” This is different than what was previously said.

+Farmers do qualify for PPP loans, but as of today, they do not qualify for EIDL loans. We are advocating for farmers to qualify for EIDL loans and for specialty crop support in the USDA earmarked stimulus funds of the CARES ACt. To learn more about what resources are available to farm-based businesses, check out our webinar with Penn State Extension on Monday, April 13.

+Congress is struggling to find a path forward for a bipartisan proposal that would expand the Paycheck Protection Program (PPP). It is recognized by both parties that expanding the program is necessary.

TTB Postpones Excise Tax Due Dates

The TTB announced on March 31 that they will postpone excise tax filing and payment due dates for 90 days. The full announcement and details of their plan can be read in their newsletter.

The craft beverage coalition, which the American Cider Association is proud to support, asked for excise tax relief in a joint letter on March 19.

In the announcement, the TTB acknowledged that the alcohol industry is hurting due to the COVID-19 pandemic.

“The Alcohol and Tobacco Tax and Trade Bureau (TTB) recognizes that businesses that we regulate are being severely impacted by COVID-19. To assist these businesses during this period, we are postponing several filing and payment due dates for 90-days where the original due date falls on or after March 1, 2020, through July 1, 2020.”

The American Cider Association applauds the TTB for responding to the needs of the industry during this time.